Question: answer all questions please Y=[a(1+g)P]+g If Y= 20, a=4, and P=65, what is g? Time left 1 O a 1304 Ob. 112 OC. 1022 od

![answer all questions please Y=[a(1+g)P]+g If Y= 20, a=4, and P=65, what](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f20215c8683_27766f20215674d0.jpg)

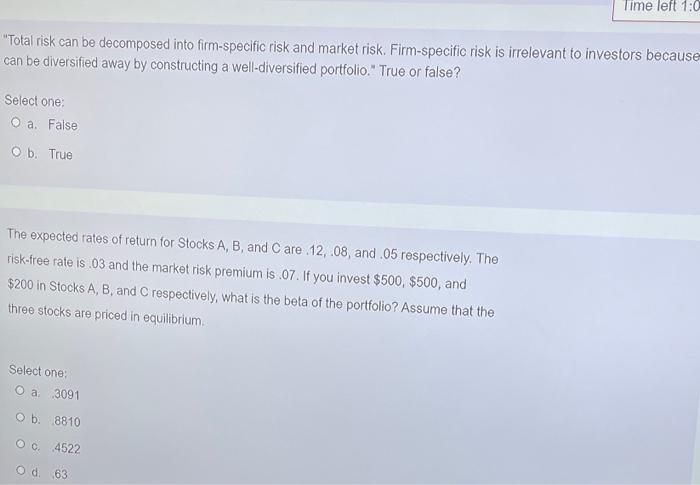

Y=[a(1+g)P]+g If Y= 20, a=4, and P=65, what is g? Time left 1 O a 1304 Ob. 112 OC. 1022 od 1210 What is the beta of the Ford stock implied by the following numbers? Assume the Ford stock is priced in equilibrium. Expected rate of return for the stock: 20 Risk-free rate: 04 Market risk premium: 09 Select one: O a. 1.600 O b. 0.775 Oc. 1.778 Time left 1:0 "Total risk can be decomposed into firm-specific risk and market risk. Firm-specific risk is irrelevant to investors because can be diversified away by constructing a well-diversified portfolio." True or false? Select one: O a. False O b. True The expected rates of return for Stocks A, B, and Care 12,08, and .05 respectively. The risk-free rate is .03 and the market risk premium is .07. If you invest $500, $500, and $200 in Stocks A, B, and respectively, what is the beta of the portfolio? Assume that the three stocks are priced in equilibrium Select one: O a 3091 b. 8810 O c. 4522 Od 63

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts