Question: ANSWER ALL QUESTIONS RELATED TO THE PROBLEM TO FULLY SOLVE!! When High Horizon LLC was formed, Maude contributed the following assets in exchange for a

ANSWER ALL QUESTIONS RELATED TO THE PROBLEM TO FULLY SOLVE!!

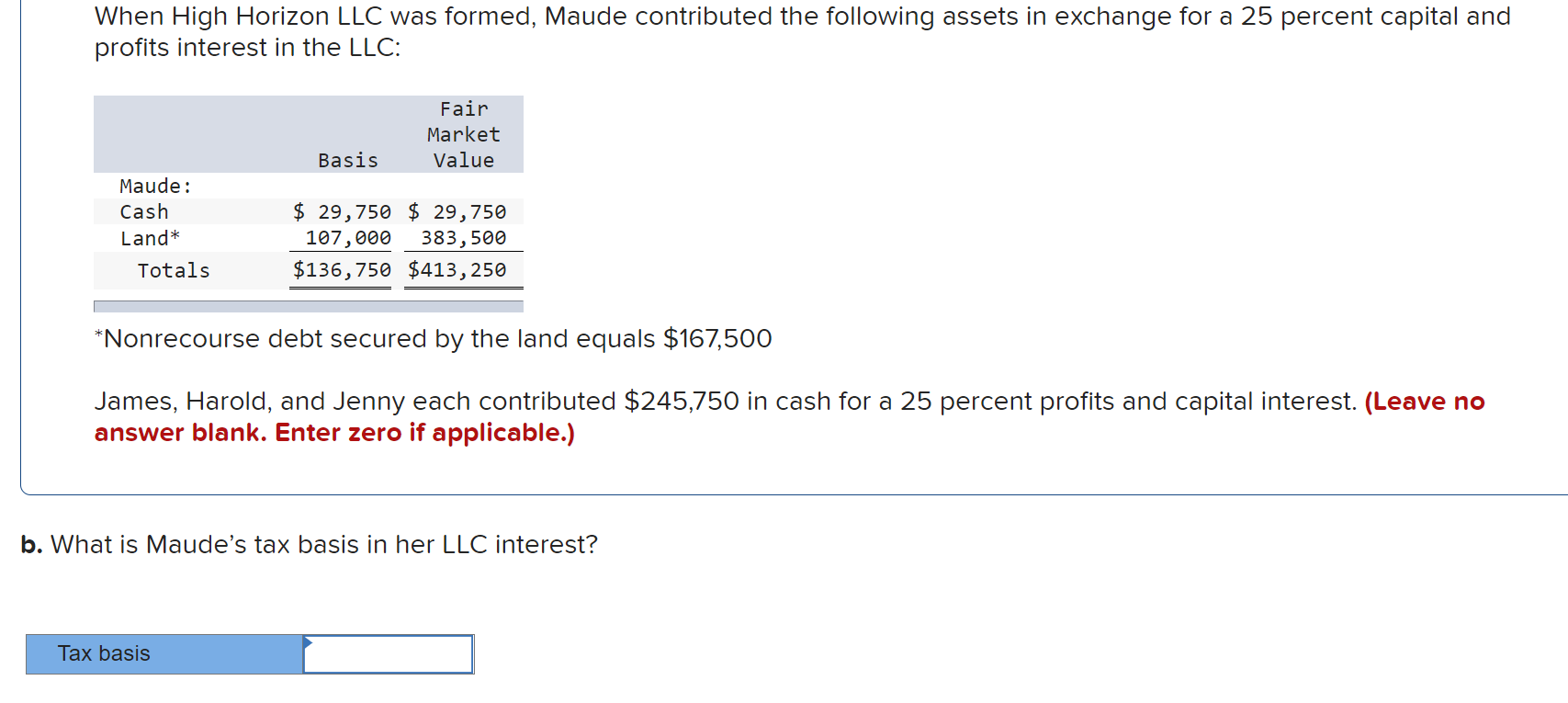

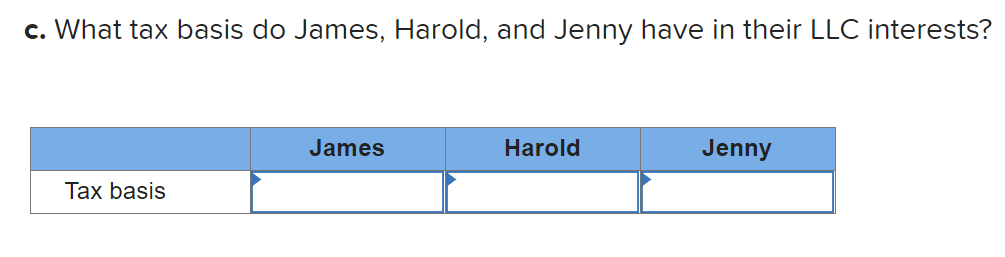

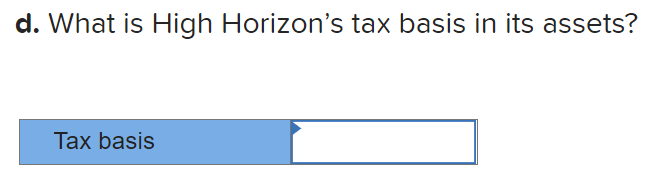

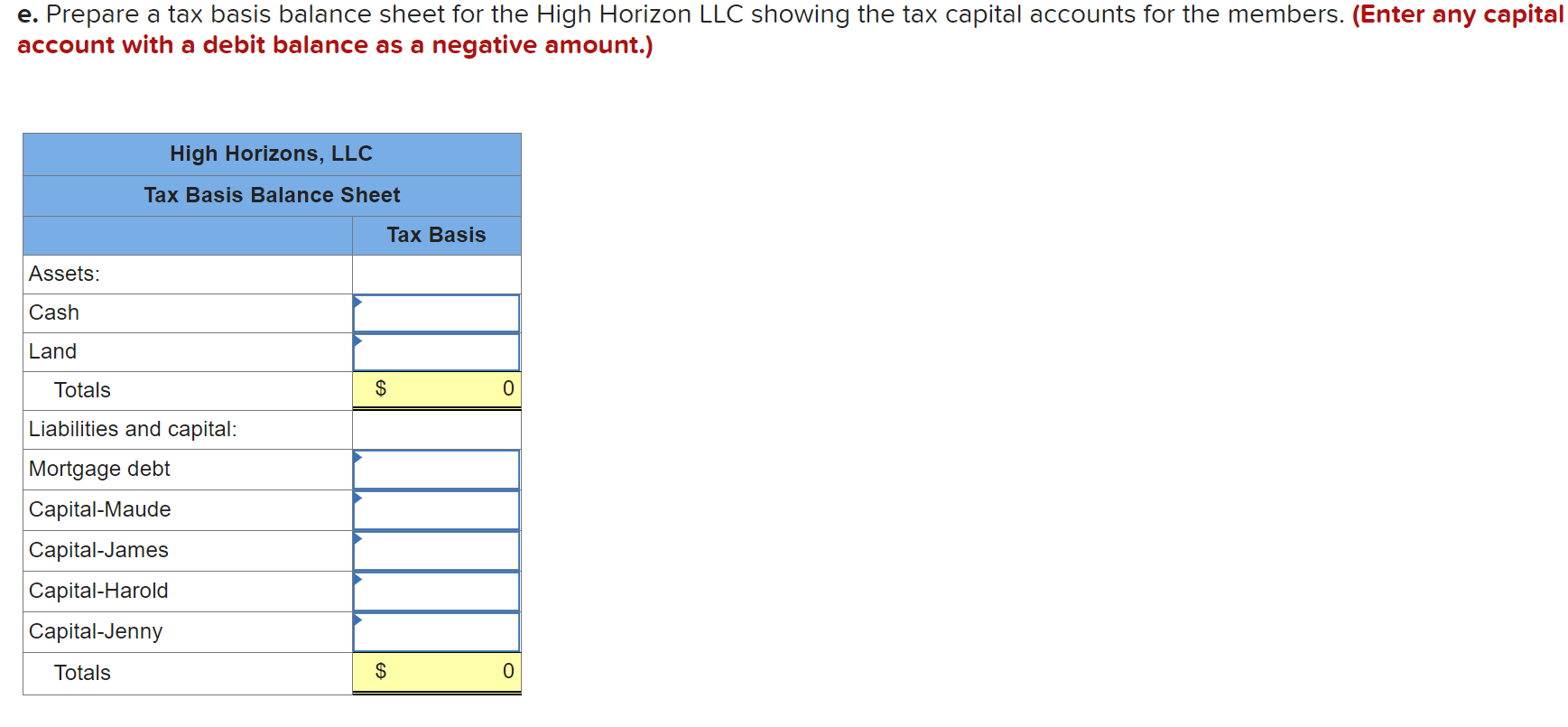

When High Horizon LLC was formed, Maude contributed the following assets in exchange for a 25 percent capital and profits interest in the LLC: Fair Market Value Basis Maude: Cash Land* Totals $ 29,750 $ 29,750 107,000 383,500 $136,750 $413,250 *Nonrecourse debt secured by the land equals $167,500 James, Harold, and Jenny each contributed $245,750 in cash for a 25 percent profits and capital interest. (Leave no answer blank. Enter zero if applicable.) b. What is Maude's tax basis in her LLC interest? Tax basis c. What tax basis do James, Harold, and Jenny have in their LLC interests? James Harold Jenny Tax basis d. What is High Horizon's tax basis in its assets? Tax basis e. Prepare a tax basis balance sheet for the High Horizon LLC showing the tax capital accounts for the members. (Enter any capital account with a debit balance as negative amount.) High Horizons, LLC Tax Basis Balance Sheet Tax Basis Assets: Cash Land Totals $ 0 Liabilities and capital: Mortgage debt Capital-Maude Capital-James Capital-Harold Capital-Jenny Totals $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts