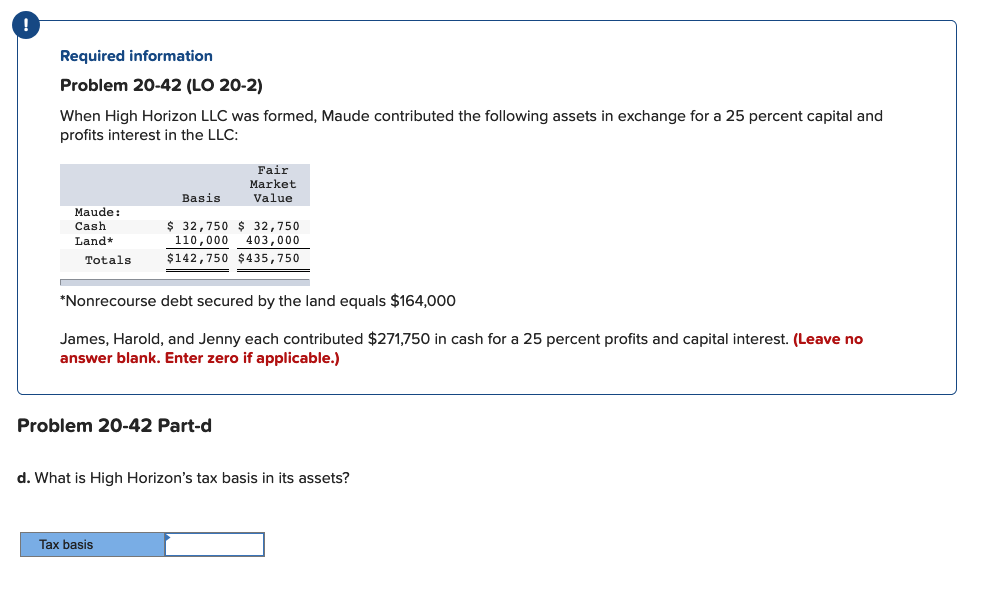

Question: Required information Problem 20-42 (LO 20-2) When High Horizon LLC was formed, Maude contributed the following assets in exchange for a 25 percent capital and

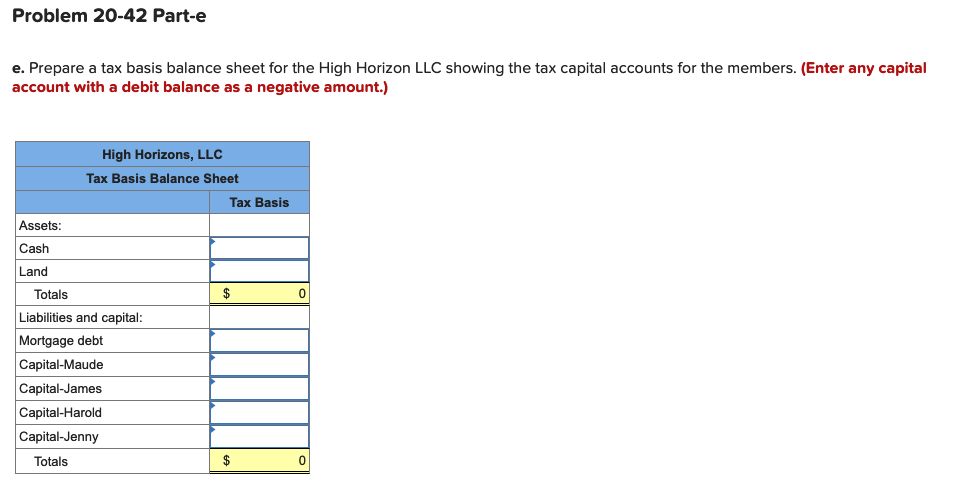

Required information Problem 20-42 (LO 20-2) When High Horizon LLC was formed, Maude contributed the following assets in exchange for a 25 percent capital and profits interest in the LLC: Fair Market Value Basis Maude: Cash Land* Totals $ 32, 750 $ 32,750 110,000 403,000 $142,750 $435,750 *Nonrecourse debt secured by the land equals $164,000 James, Harold, and Jenny each contributed $271,750 in cash for a 25 percent profits and capital interest. (Leave no answer blank. Enter zero if applicable.) Problem 20-42 Part-d d. What is High Horizon's tax basis in its assets? Tax basis Problem 20-42 Part-e e. Prepare a tax basis balance sheet for the High Horizon LLC showing the tax capital accounts for the members. (Enter any capital account with a debit balance as a negative amount.) High Horizons, LLC Tax Basis Balance Sheet Tax Basis Assets: Cash Land Totals $ 0 Liabilities and capital: Mortgage debt Capital-Maude Capital-James Capital-Harold Capital-Jenny Totals $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts