Question: Answer ALL Questions. This section is worth 30 Marks. Question 1 (24 Marks) As a fixed income Portfolio Manager, you are well aware that your

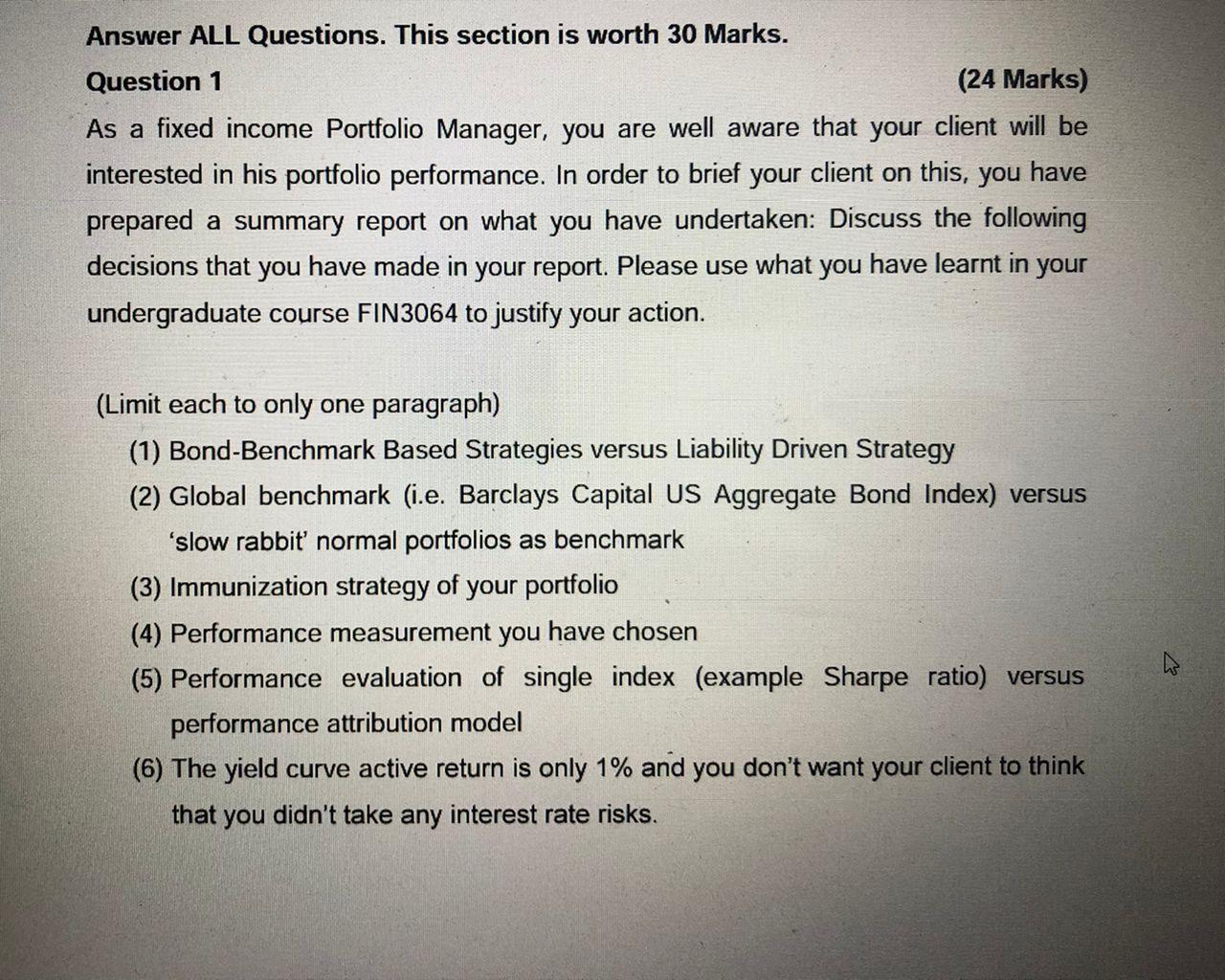

Answer ALL Questions. This section is worth 30 Marks. Question 1 (24 Marks) As a fixed income Portfolio Manager, you are well aware that your client will be interested in his portfolio performance. In order to brief your client on this, you have prepared a summary report on what you have undertaken: Discuss the following decisions that you have made in your report. Please use what you have learnt in your undergraduate course FIN3064 to justify your action. (Limit each to only one paragraph) (1) Bond-Benchmark Based Strategies versus Liability Driven Strategy (2) Global benchmark (i.e. Barclays Capital US Aggregate Bond Index) versus 'slow rabbit' normal portfolios as benchmark (3) Immunization strategy of your portfolio (4) Performance measurement you have chosen (5) Performance evaluation of single index (example Sharpe ratio) versus performance attribution model (6) The yield curve active return is only 1% and you don't want your client to think that you didn't take any interest rate risks. Answer ALL Questions. This section is worth 30 Marks. Question 1 (24 Marks) As a fixed income Portfolio Manager, you are well aware that your client will be interested in his portfolio performance. In order to brief your client on this, you have prepared a summary report on what you have undertaken: Discuss the following decisions that you have made in your report. Please use what you have learnt in your undergraduate course FIN3064 to justify your action. (Limit each to only one paragraph) (1) Bond-Benchmark Based Strategies versus Liability Driven Strategy (2) Global benchmark (i.e. Barclays Capital US Aggregate Bond Index) versus 'slow rabbit' normal portfolios as benchmark (3) Immunization strategy of your portfolio (4) Performance measurement you have chosen (5) Performance evaluation of single index (example Sharpe ratio) versus performance attribution model (6) The yield curve active return is only 1% and you don't want your client to think that you didn't take any interest rate risks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts