Question: Answer ALL questions. Total marks for this paper are 50. Write your answers in the Pre-printed Answer Book. Question 1 (20 marks) PR Company Limited

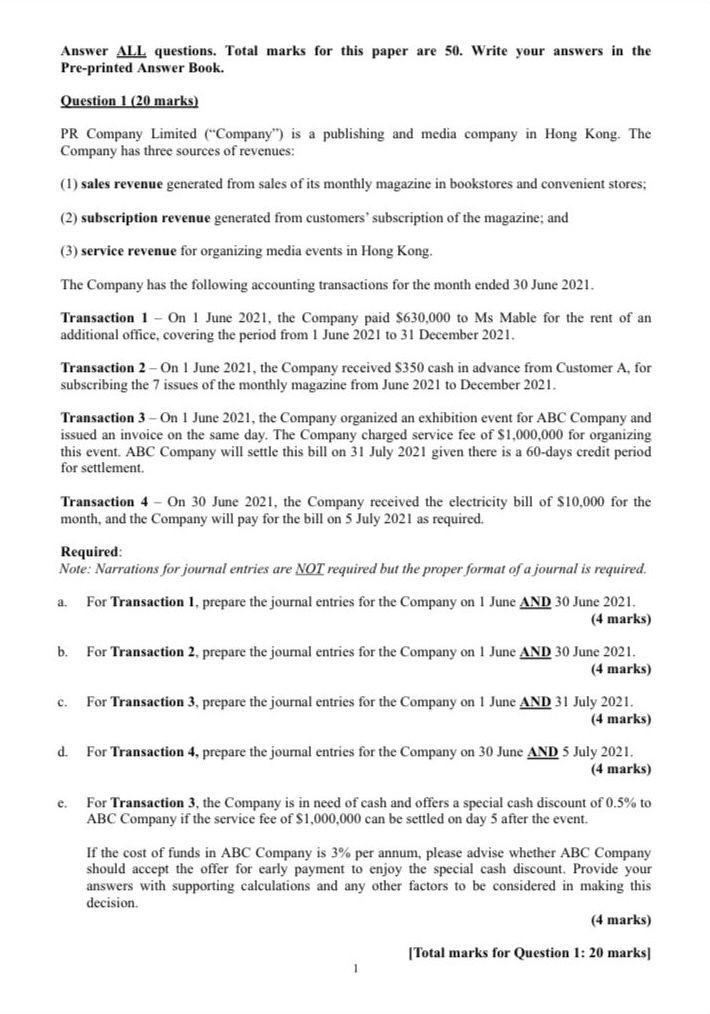

Answer ALL questions. Total marks for this paper are 50. Write your answers in the Pre-printed Answer Book. Question 1 (20 marks) PR Company Limited ("Company") is a publishing and media company in Hong Kong. The Company has three sources of revenues: (1) sales revenue generated from sales of its monthly magazine in bookstores and convenient stores; (2) subscription revenue generated from customers' subscription of the magazine; and (3) service revenue for organizing media events in Hong Kong. The Company has the following accounting transactions for the month ended 30 June 2021. Transaction 1 - On 1 June 2021, the Company paid $630,000 to Ms Mable for the rent of an additional office, covering the period from 1 June 2021 to 31 December 2021. Transaction 2 - On 1 June 2021, the Company received $350 cash in advance from Customer A, for subscribing the 7 issues of the monthly magazine from June 2021 to December 2021. Transaction 3-On 1 June 2021, the Company organized an exhibition event for ABC Company and issued an invoice on the same day. The Company charged service fee of $1,000,000 for organizing this event. ABC Company will settle this bill on 31 July 2021 given there is a 60 -days credit period for settlement. Transaction 4 - On 30 June 2021 , the Company received the electricity bill of $10,000 for the month, and the Company will pay for the bill on 5 July 2021 as required. Required: Note: Narrations for journal entries are NOT required but the proper format of a journal is required. a. For Transaction 1, prepare the journal entries for the Company on 1 June A ND 30 June 2021 . (4 marks) b. For Transaction 2, prepare the journal entries for the Company on 1 June AND 30 June 2021 . (4 marks) c. For Transaction 3, prepare the journal entries for the Company on 1 June AND 31 July 2021. (4 marks) d. For Transaction 4, prepare the journal entries for the Company on 30 June AND5 July 2021. (4 marks) e. For Transaction 3, the Company is in need of cash and offers a special cash discount of 0.5% to ABC Company if the service fee of $1,000,000 can be settled on day 5 after the event. If the cost of funds in ABC Company is 3% per annum, please advise whether ABC Company should accept the offer for early payment to enjoy the special cash discount. Provide your answers with supporting calculations and any other factors to be considered in making this decision. (4 marks) [Total marks for Question 1: 20 marks] Answer ALL questions. Total marks for this paper are 50. Write your answers in the Pre-printed Answer Book. Question 1 (20 marks) PR Company Limited ("Company") is a publishing and media company in Hong Kong. The Company has three sources of revenues: (1) sales revenue generated from sales of its monthly magazine in bookstores and convenient stores; (2) subscription revenue generated from customers' subscription of the magazine; and (3) service revenue for organizing media events in Hong Kong. The Company has the following accounting transactions for the month ended 30 June 2021. Transaction 1 - On 1 June 2021, the Company paid $630,000 to Ms Mable for the rent of an additional office, covering the period from 1 June 2021 to 31 December 2021. Transaction 2 - On 1 June 2021, the Company received $350 cash in advance from Customer A, for subscribing the 7 issues of the monthly magazine from June 2021 to December 2021. Transaction 3-On 1 June 2021, the Company organized an exhibition event for ABC Company and issued an invoice on the same day. The Company charged service fee of $1,000,000 for organizing this event. ABC Company will settle this bill on 31 July 2021 given there is a 60 -days credit period for settlement. Transaction 4 - On 30 June 2021 , the Company received the electricity bill of $10,000 for the month, and the Company will pay for the bill on 5 July 2021 as required. Required: Note: Narrations for journal entries are NOT required but the proper format of a journal is required. a. For Transaction 1, prepare the journal entries for the Company on 1 June A ND 30 June 2021 . (4 marks) b. For Transaction 2, prepare the journal entries for the Company on 1 June AND 30 June 2021 . (4 marks) c. For Transaction 3, prepare the journal entries for the Company on 1 June AND 31 July 2021. (4 marks) d. For Transaction 4, prepare the journal entries for the Company on 30 June AND5 July 2021. (4 marks) e. For Transaction 3, the Company is in need of cash and offers a special cash discount of 0.5% to ABC Company if the service fee of $1,000,000 can be settled on day 5 after the event. If the cost of funds in ABC Company is 3% per annum, please advise whether ABC Company should accept the offer for early payment to enjoy the special cash discount. Provide your answers with supporting calculations and any other factors to be considered in making this decision. (4 marks) [Total marks for Question 1: 20 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts