Question: answer all quetsions in excel please with formula text. Decker Tires' free cash flow was just FC =$1.32 bn. Analysts expect the company's free cash

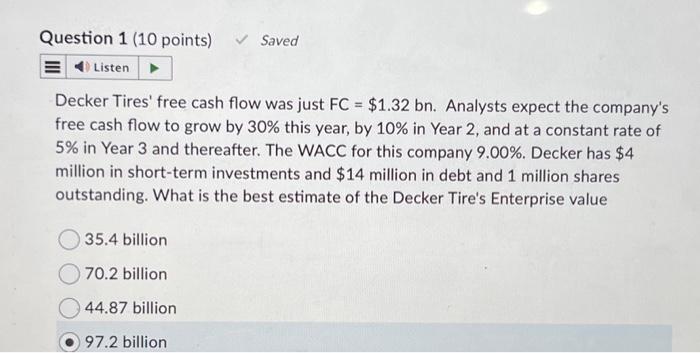

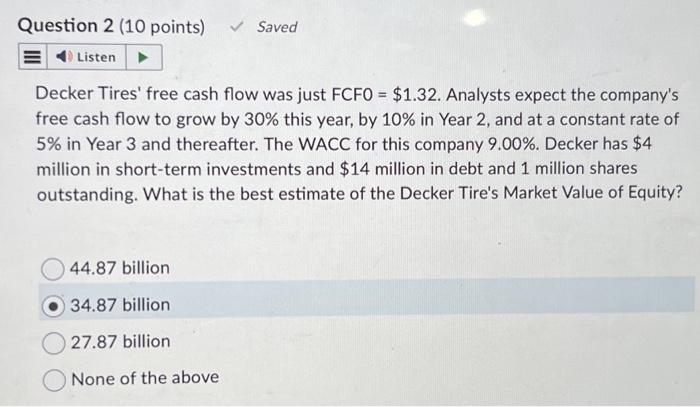

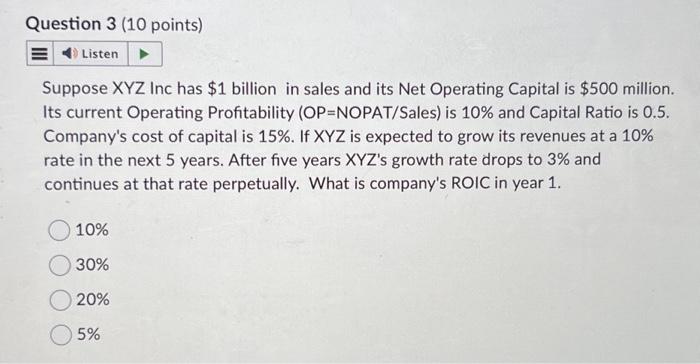

Decker Tires' free cash flow was just FC =$1.32 bn. Analysts expect the company's free cash flow to grow by 30% this year, by 10% in Year 2, and at a constant rate of 5% in Year 3 and thereafter. The WACC for this company 9.00%. Decker has $4 million in short-term investments and $14 million in debt and 1 million shares outstanding. What is the best estimate of the Decker Tire's Enterprise value 35.4 billion 70.2 billion 44.87 billion 97.2 billion Decker Tires' free cash flow was just FCF0 =$1.32. Analysts expect the company's free cash flow to grow by 30% this year, by 10% in Year 2, and at a constant rate of 5% in Year 3 and thereafter. The WACC for this company 9.00%. Decker has $4 million in short-term investments and $14 million in debt and 1 million shares outstanding. What is the best estimate of the Decker Tire's Market Value of Equity? 44.87 billion 34.87 billion 27.87 billion None of the above Suppose XYZ Inc has $1 billion in sales and its Net Operating Capital is $500 million. Its current Operating Profitability (OP=NOPAT/Sales) is 10% and Capital Ratio is 0.5 . Company's cost of capital is 15%. If XYZ is expected to grow its revenues at a 10% rate in the next 5 years. After five years XYZ's growth rate drops to 3% and continues at that rate perpetually. What is company's ROIC in year 1. 10% 30% 20% 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts