Question: Answer ALL quickly and recieve a like! Leaming Co. reported the following data for the month of June. 0 Units in beginning inventory Units produced

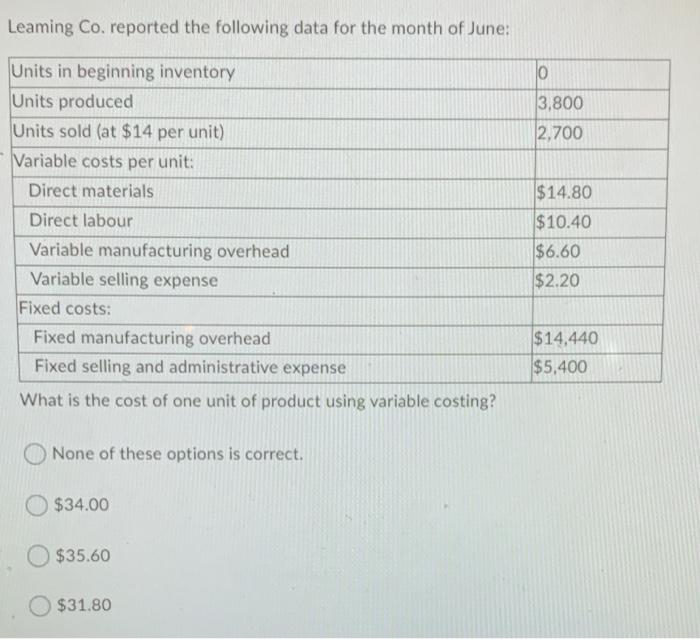

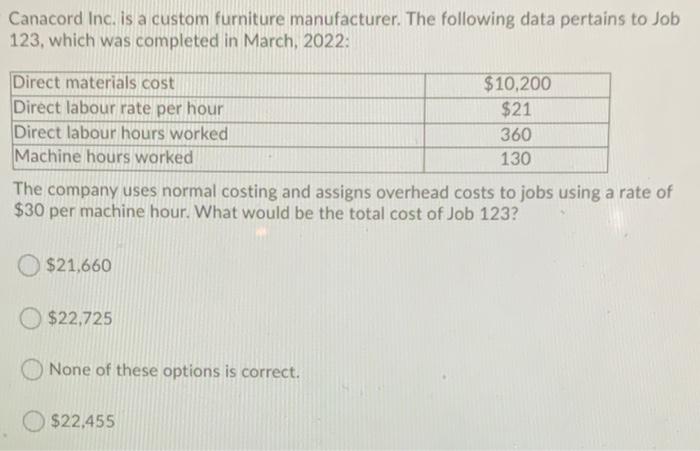

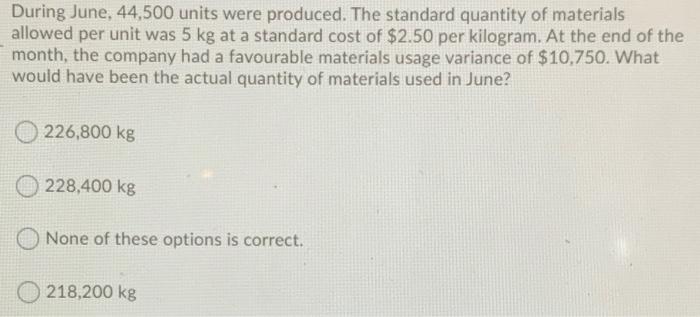

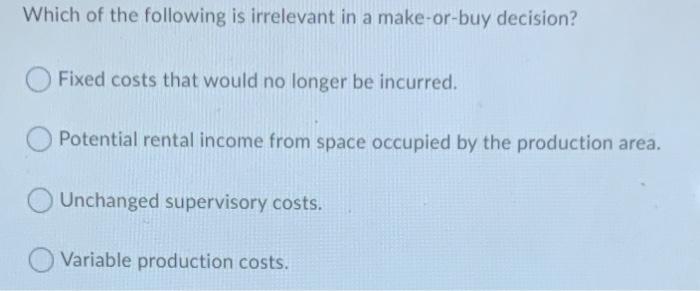

Leaming Co. reported the following data for the month of June. 0 Units in beginning inventory Units produced Units sold (at $14 per unit) Variable costs per unit: 3,800 2,700 Direct materials $14.80 $10.40 $6.60 $2.20 Direct labour Variable manufacturing overhead Variable selling expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense What is the cost of one unit of product using variable costing? $14,440 $5,400 None of these options is correct. $34.00 $35.60 $31.80 Canacord Inc. is a custom furniture manufacturer. The following data pertains to Job 123, which was completed March, 2022: Direct materials cost Direct labour rate per hour Direct labour hours worked Machine hours worked $10,200 $21 360 130 The company uses normal costing and assigns overhead costs to jobs using a rate of $30 per machine hour. What would be the total cost of Job 123? O $21,660 $22,725 None of these options is correct. $22,455 During June, 44,500 units were produced. The standard quantity of materials allowed per unit was 5 kg at a standard cost of $2.50 per kilogram. At the end of the month, the company had a favourable materials usage variance of $10,750. What would have been the actual quantity of materials used in June? 226,800 kg 228,400 kg None of these options is correct. 218,200 kg Which of the following is irrelevant in a make-or-buy decision? Fixed costs that would no longer be incurred. Potential rental income from space occupied by the production area. Unchanged supervisory costs. Variable production costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts