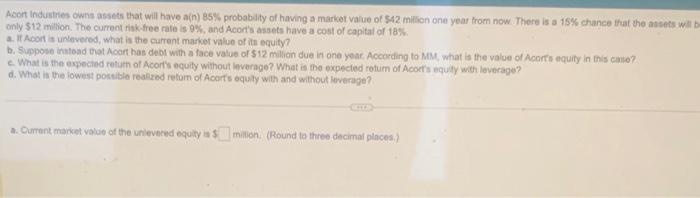

Question: answer all sections Aeort industries owns assets that will have a(n) 85% probabdity of having a market value of S42 million one yoar trom now.

Aeort industries owns assets that will have a(n) 85% probabdity of having a market value of S42 million one yoar trom now. There is a 15% chance ituat the assets will b only $12 milion. The current risktree rate is 9%, and Acorts assets have a cosf of capital of 18% a. If Acoit is unieverod, what is the current market value of its equity? b. Suppose instead that Aoar has debt with a face value of $12 milion due in one yoar According to MM, what is the value of Acorfs equity in Inis calle? c. What is the expected returh of Acorts equily without lewerage? What is the expected rotum of Acocra equity with leverage? d. What is the lowest postible realired retorn of Acorts equaty with and without leverage? a. Current market valun of the unievered equity is 3 milien. (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts