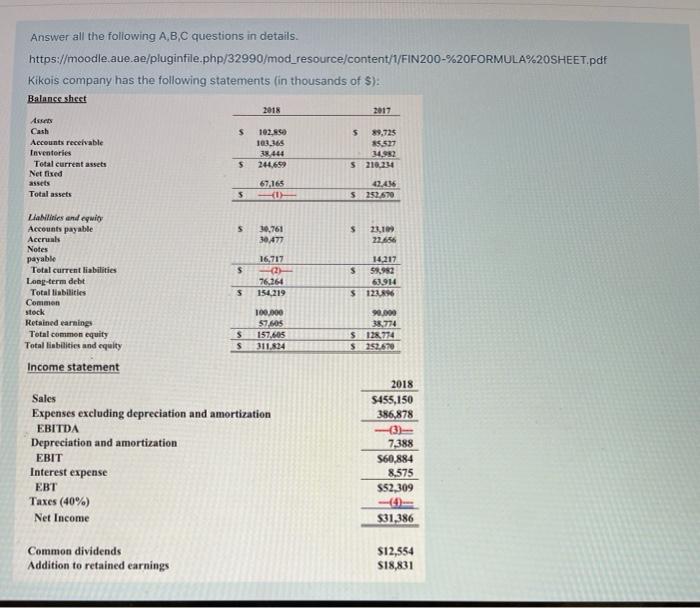

Question: Answer all the following A,B,C questions in details. https://moodle.aue.ae/pluginfile.php/32990/mod_resource/content/1/FIN200-%20FORMULA%20SHEET.pdf Kikois company has the following statements in thousands of $): Balance sheet 2018 2017 5 89,725

Answer all the following A,B,C questions in details. https://moodle.aue.ae/pluginfile.php/32990/mod_resource/content/1/FIN200-%20FORMULA%20SHEET.pdf Kikois company has the following statements in thousands of $): Balance sheet 2018 2017 5 89,725 Cash Accounts receivable Inventories Total current assets Net fixed assets Total assets 102.850 103.365 35.444 246,699 5 14.92 $ 210,214 67.165 5 5252.670 5 $ 30,761 30.477 23.10 22656 $ $ La lines and equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity Income statement 16,717 (2) 76.264 154.219 14,217 53,982 63.914 120 5 5 90.000 100,000 57.605 157.605 311.824 $ $ 128 774 S 252.670 Sales Expenses excluding depreciation and amortization EBITDA Depreciation and amortization EBIT Interest expense EBT Taxes (40%) Net Income 2018 5455,150 386,878 -(3) 7,388 S60,884 8.575 $52,309 $31,386 Common dividends Addition to retained earnings $12,554 S18,831 1. Complete the blank numbers in statements (1,2,3,4), (show calculations if needed). (2 points) 2. Calculate the Net Operating Working Capital (NOWC) for years 2017 and 2018, assuming no excech point 3. Calculate the following ratios and judge the company financial situation (trend analysis and industry bench pintu 1. Quick ratio: Compare if the industry average is 2.8 2. Days of sales outstanding DSO; Compare if industry average is 72 days 3. Profit Margin: Compare if industry average is 6% Paragraph BI SE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts