Question: answer all the question if you cant answer them all no need to answer skip my question post 6-1 (Future value of an ordinary annuity)

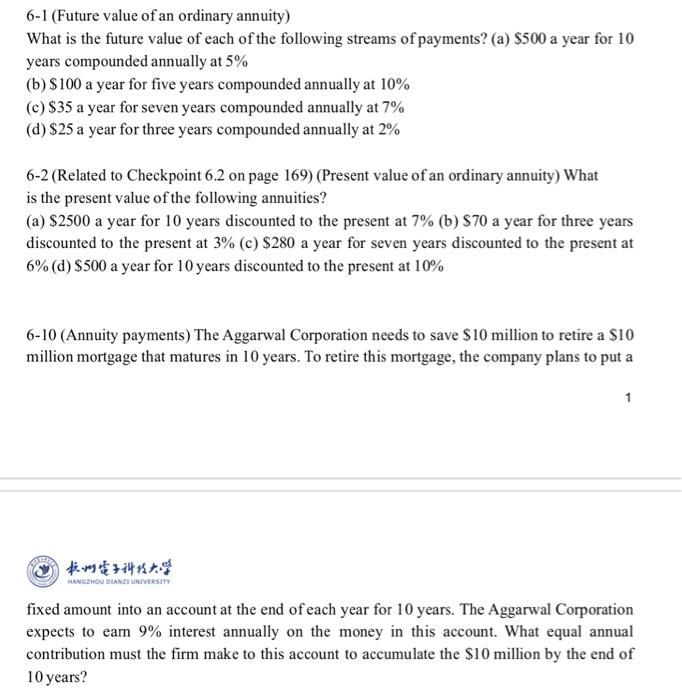

6-1 (Future value of an ordinary annuity) What is the future value of each of the following streams of payments? (a) $500 a year for 10 years compounded annually at 5% (b) $100 a year for five years compounded annually at 10% (c) $35 a year for seven years compounded annually at 7% (d) $25 a year for three years compounded annually at 2% 6-2 (Related to Checkpoint 6.2 on page 169) (Present value of an ordinary annuity) What is the present value of the following annuities? (a) $2500 a year for 10 years discounted to the present at 7% (b) $70 a year for three years discounted to the present at 3% (c) $280 a year for seven years discounted to the present at 6% (d) $500 a year for 10 years discounted to the present at 10% 6-10 (Annuity payments) The Aggarwal Corporation needs to save $10 million to retire a $10 million mortgage that matures in 10 years. To retire this mortgage, the company plans to put a 1 firm 14 15 #74 HANGZHOU DIAN UNIVERSITY fixed amount into an account at the end of each year for 10 years. The Aggarwal Corporation expects to earn 9% interest annually on the money in this account. What equal annual contribution must the firm make to this account to accumulate the $10 million by the end of 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts