Question: Answer All The Questions: (5 points each) 1. Many MNCs have established foreign exchange risk management policies that mandate hedging most exposures. Explain the logic

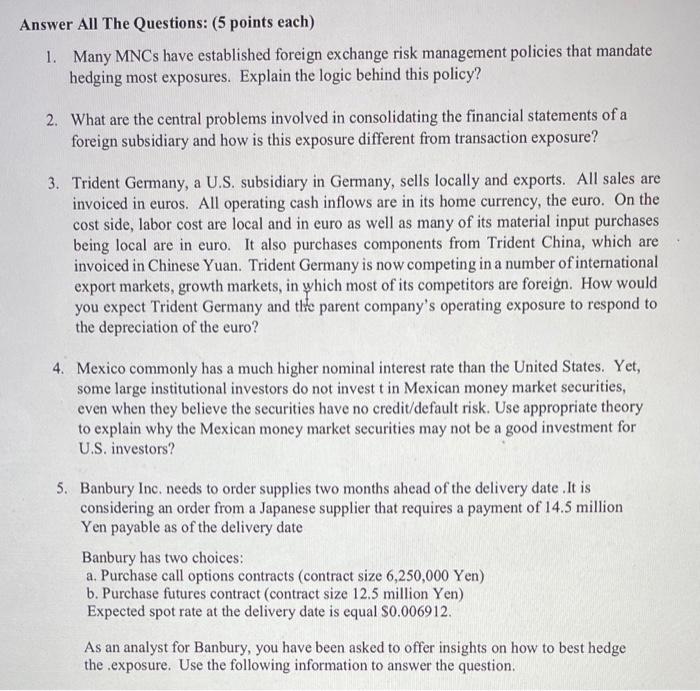

Answer All The Questions: (5 points each) 1. Many MNCs have established foreign exchange risk management policies that mandate hedging most exposures. Explain the logic behind this policy? 2. What are the central problems involved in consolidating the financial statements of a foreign subsidiary and how is this exposure different from transaction exposure? 3. Trident Germany, a U.S. subsidiary in Germany, sells locally and exports. All sales are invoiced in euros. All operating cash inflows are in its home currency, the euro. On the cost side, labor cost are local and in euro as well as many of its material input purchases being local are in euro. It also purchases components from Trident China, which are invoiced in Chinese Yuan. Trident Germany is now competing in a number of international export markets, growth markets, in which most of its competitors are foreign. How would you expect Trident Germany and the parent company's operating exposure to respond to the depreciation of the euro? 4. Mexico commonly has a much higher nominal interest rate than the United States. Yet, some large institutional investors do not invest t in Mexican money market securities, even when they believe the securities have no credit/default risk. Use appropriate theory to explain why the Mexican money market securities may not be a good investment for U.S. investors? 5. Banbury Inc. needs to order supplies two months ahead of the delivery date. It is considering an order from a Japanese supplier that requires a payment of 14.5 million Yen payable as of the delivery date Banbury has two choices: a. Purchase call options contracts (contract size 6,250,000 Yen) b. Purchase futures contract (contract size 12.5 million Yen) Expected spot rate at the delivery date is equal $0.006912. As an analyst for Banbury, you have been asked to offer insights on how to best hedge the .exposure. Use the following information to answer the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts