Question: answer all the questions above please 34) Managers can generate abnormal performance beyond the market uy. A) investing in the same market index fund. B)

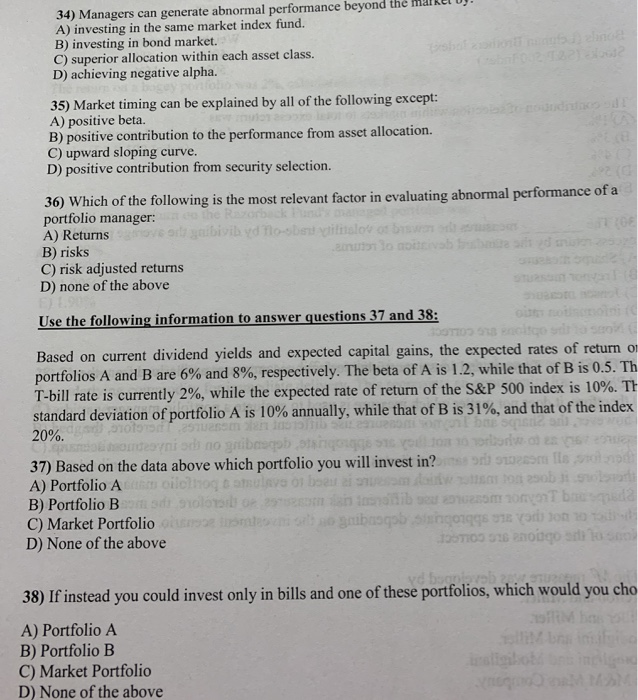

34) Managers can generate abnormal performance beyond the market uy. A) investing in the same market index fund. B) investing in bond market. C) superior allocation within each asset class. D) achieving negative alpha. 35) Market timing can be explained by all of the following except: A) positive beta. B) positive contribution to the performance from asset allocation. C) upward sloping curve. D) positive contribution from security selection. 36) Which of the following is the most relevant factor in evaluating abnormal performance of a portfolio manager: A) Returns or bivib yd to- b itslos os bens B) risks C) risk adjusted returns D) none of the above OBD Use the following information to answer questions 37 and 38: Based on current dividend yields and expected capital gains, the expected rates of return on portfolios A and B are 6% and 8%, respectively. The beta of A is 1.2, while that of B is 0.5. Th T-bill rate is currently 2%, while the expected rate of return of the S&P 500 index is 10%. TH standard deviation of portfolio A is 10% annually, while that of B is 31%, and that of the index 20%. 37) Based on the data above which portfolio you will invest in? A) Portfolio A ilolog vs os batim o B) Portfolio B loom ninonib se C) Market Portfolio 2 mesnio gribasgob Singos D) None of the above 12 st 250b suo vant bra in vochon zoo 38) If instead you could invest only in bills and one of these portfolios, which would you cho A) Portfolio A B) Portfolio B C) Market Portfolio D) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts