Question: Answer All The Questions and Write on PAPER. Question 1 a) What is a cash dividend? Define and describe the process of declaring and paying

Answer All The Questions and Write on PAPER.

Question 1

a) What is a cash dividend? Define and describe the process of declaring and paying a cash dividend. In your description, define the following terms: the declaration date, the exdividend date, the record date, and the payment date. ( 11 Marks)

b) A firm has had the indicated earnings per share over the last three years:

Year EPS

2021 3

2020 2

2019 1

(i) If the firm's dividend policy was based on a constant payout ratio of 50 percent, determine the annual dividend for each year.

(ii) If the firm's dividend policy was based on a fixed dollar payout policy of 50 cents per share plus an extra dividend equal to 75 percent of earnings per share above $1.00, determine the annual dividend for each year. (9 marks)

Question 2

a) What is the relationship between the predictability of a firms cash inflows and its required level of net working capital? How are net working capital, liquidity, and risk of insolvency related? (10 marks)

b) Joe Manufacturing uses 2,400 units of a product per year on a continuous basis. The product carrying costs are $60 per year and ordering costs are $250 per order. It takes 20 days to receive a shipment after an order is placed and the firm requires a safety stock of 8 days of usage in inventory.

(i) Calculate the economic order quantity (round up to the nearest whole unit.)

ii) Calculate the total cost per year to order and carry this item.

(iii) Its supplier has notified Joe that if Joe increases its order quantity by 58 units they will give it a discount. Calculate the dollar discount that the suppliers will have to give Joe Manufacturing to result in a net benefit to the company. (10 marks)

Question 3

a) Supreme Company has an outstanding preferred issue of stock with a par value of $100 and an annual dividend of 10 percent (of par). Similar risk preferred stocks are yielding an 11.5 percent annual rate of return.

(i) What is the current value of the outstanding preferred stock?

(ii) What will happen to price if the risk-free rate increases? Explain. (5 marks)

b) Julie's X-Ray Company paid $2.00 per share in common stock dividends last year. The company will allow its dividend to grow at 5 percent for 4 years, and after that the rate of growth will be 3 percent forever. What is the value of the stock if the required rate of return is 8 percent? (15 marks)

Question 4

a) What are the net proceeds from the sale of a bond? What are flotation costs, and how do they affect a bonds net proceeds? (10 marks)

b) Identify and describe the shortcomings of the use of payback period (without discounting) to evaluate a proposed investment. (5 marks)

c) What are sunk costs and opportunity costs? Discuss whether sunk costs and opportunity costs are relevant for capital budgeting. (5 marks)

Question 5

a) New Gold Mining Company is considering investing in a new mining project. The firm's cost of capital is 12 percent and the project is expected to have an initial after-tax cost of $5,000,000. Furthermore, the project is expected to provide after-tax operating cash flows of $2,500,000 in year 1, $2,300,000 in year 2, $2,200,000 in year 3, and ($1,300,000) in year 4?

(i) Calculate the project's NPV.

(ii) Should the firm make the investment? (8 marks)

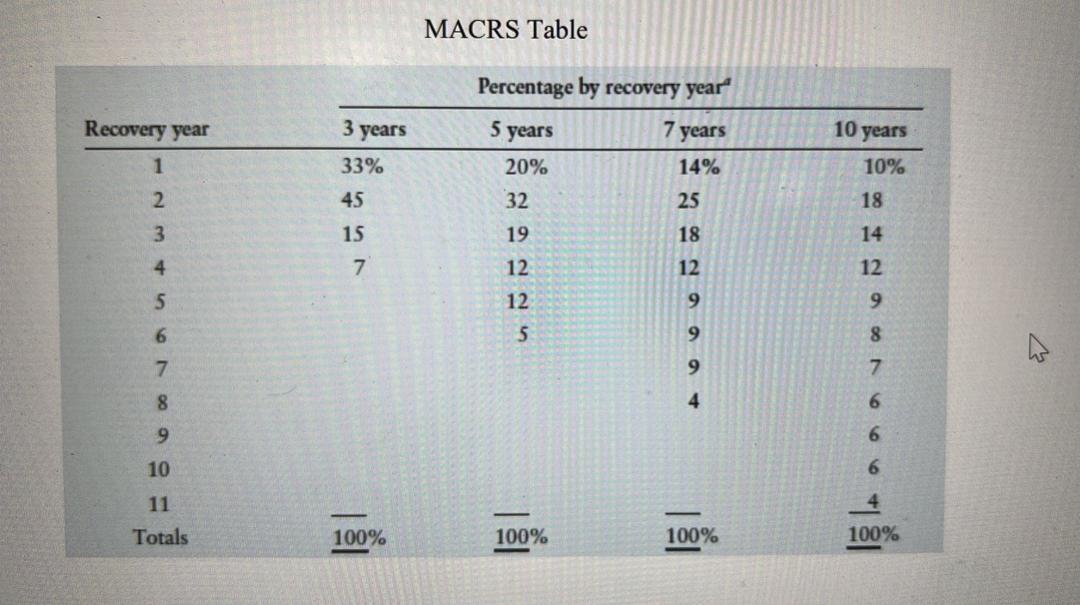

b) Summer Sdn Bhd, is considering replacing its existing machine which was originally purchased 2 years ago at a cost of $80,000. The machine is being depreciated under MACRS using a 5-year recovery period; it has 3 years of usable life remaining. The current machine can be sold today to net $22,000 after removal and cleanup costs. A new machine, using a 3-year MACRS recovery period, can be purchased at a price of $300,000. It requires $20,000 to install and has a 3-year usable life. If the new machine is acquired, the investment in accounts receivable will be expected to rise by $10,000, the inventory investment will increase by $25,000, and accounts payable will increase by $15,000. The firm is subject to a 40% tax rate.

(i) Calculates the current book value of the existing machine.

(ii) Calculates the capital gain/loss and the related taxes on the selling of the old machine.

(iii) Calculate the changes in net working capital.

iv) Determine the initial investment associated with the proposed replacement decision. (12 marks)

MACRS Table Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 1 33% 14% 20% 32 45 25 2 3 10% 18 14 15 19 18 4 7 12 12 12 5 12 9 9 6 5 9 8 7 9 7 8 6 9 10 11 Totals 100% 100% 100% 100% MACRS Table Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 1 33% 14% 20% 32 45 25 2 3 10% 18 14 15 19 18 4 7 12 12 12 5 12 9 9 6 5 9 8 7 9 7 8 6 9 10 11 Totals 100% 100% 100% 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts