Question: Answer ALL the questions. Please ensure all referencing and citations used in the answer submission are following APA format referencing. Otherwise, it is plagiarism and

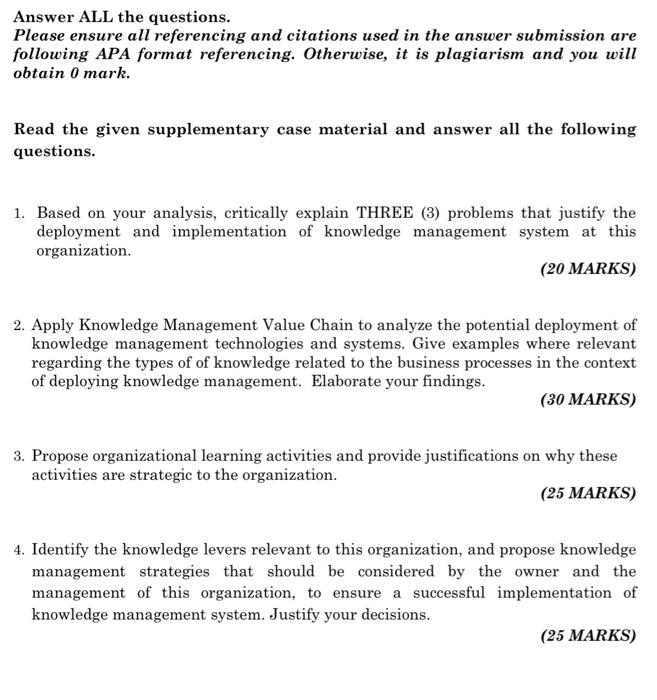

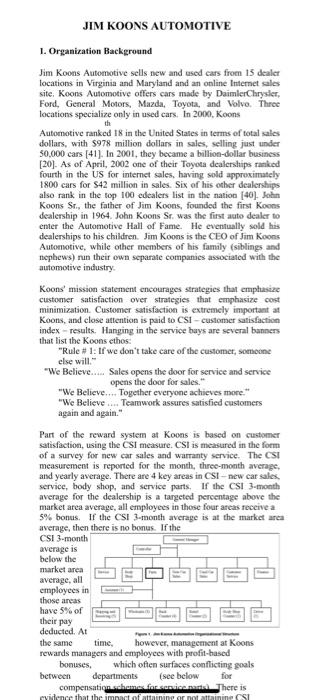

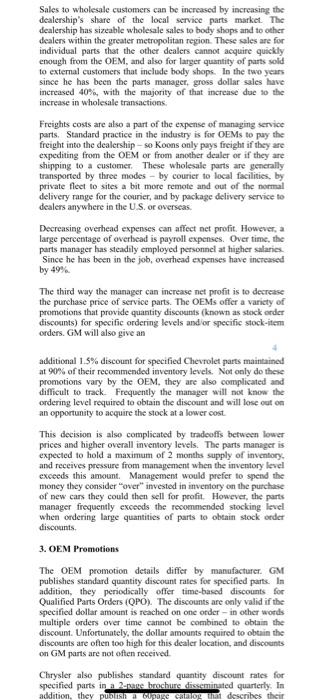

Answer ALL the questions. Please ensure all referencing and citations used in the answer submission are following APA format referencing. Otherwise, it is plagiarism and you will obtain 0 mark. Read the given supplementary case material and answer all the following questions. 1. Based on your analysis, critically explain THREE (3) problems that justify the deployment and implementation of knowledge management system at this organization. (20 MARKS) 2. Apply Knowledge Management Value Chain to analyze the potential deployment of knowledge management technologies and systems. Give examples where relevant regarding the types of of knowledge related to the business processes in the context of deploying knowledge management. Elaborate your findings. (30 MARKS) 3. Propose organizational learning activities and provide justifications on why these activities are strategic to the organization. (25 MARKS) 4. Identify the knowledge levers relevant to this organization, and propose knowledge management strategies that should be considered by the owner and the management of this organization, to ensure a successful implementation of knowledge management system. Justify your decisions. (25 MARKS) JIM KOONS AUTOMOTIVE 1. Organization Background Jim Koons Automotive sells new and used cars from 15 dealer locations in Virginia and Maryland and an online Internet sales site. Koons Automotive offers cars made by DaimlerChrysler, Ford, General Motors, Mazda, Toyota, and Volvo Three locations specialize only in used cars. In 2000, Koons th Automotive ranked 18 in the United States in terms of total sales dollars, with 5978 million dollars in sales, selling just under 50.000 cars [41]. In 2001, they became a billion-dollar business [20). As of April, 2002 one of their Toyota dealerships ranked fourth in the US for internet sales, having sold approximately 1800 cars for S42 million in sales. Six of his other dealerships also rank in the top 100 dealers list in the nation (40) John Koons Sr., the father of Jim Koons, founded the first koons dealership in 1964. John Koons Sr. was the first auto dealer to enter the Automotive Hall of Fame. He eventually sold his dealerships to his children. Jim Koons is the CEO of Jim Koons Automotive, while other members of his family (siblings and nephews) run their own separate companies associated with the automotive industry Koons' mission statement encourages strategies that emphasize customer satisfaction over strategies that emphasize cost minimization Customer satisfaction is extremely important at Koons, and close attention is paid to CSI - customer satisfaction index-results. Hanging in the service buys are several banners that list the Koons ethos: "Rule # 1: If we don't take care of the customer, someone else will." "We Believe..... Sales opens the door for service and service opens the door for sales." "We Believe... Together everyone achieves more." "We Believe.... Teamwork assures satisfied customers again and again." Part of the reward system at Koons is based on customer satisfaction, using the CSI measure. CSI is measured in the form of a survey for new car sales and warranty service. The CSI measurement is reported for the month, three-month average, and yearly average. There are 4 key areas in CSI-new car sales service, body shop, and service parts. If the CSI 3-month average for the dealership is a targeted percentage above the market area average, all employees in those four areas receive a 5% bonus. If the CSI 3-month average is at the market area average, then there is no bonus. If the CSI 3-month average is below the market area average, all employees in those areas have 5% of their pay deducted. At the same time, however, management at Koons rewards managers and employees with profit-based bonuses, which often surfaces conflicting goals between departments (see below for compensation schemefore. There is evidence that the impact of attainine or not attamine CSI the same time. however, management at Koons rewards managers and employees with protit-based bonuses, which often surfaces conflicting goals between departments (see below for compensation schemes for service parts). There is evidence that the impact of attaining or not attaining CSI benchmarks is real 2. Service Parts Management The parts department of Koons' flagship dealership at Tysons Comer is the focus of this case study. This dealership employs approximately 180 employees, with sales of $131 million in 2000 [41). The dealership sells new Chrysler car models (manufactured by the Daimler Chrylser Corporation), and new Chevrolet cars and trucks (manufactured by General Motors) as well as a variety of used cars through their used car department The parts department employs 20 employees, with sales of approximately S7 million a year. The organizational structure of the dealershin detailing the narts denartment is shown in Fiure SV Ya fo 1. aprIGICE Over time, he has held a variety of positions at different dealerships, to include service advisor and service manager. He has been in his current job for two years, which entails providing parts to both internal and external customers, and maintaining the inventory to support those sales. The internal customers include the service department, the body shop, and new and used car sales The external customers include walk-up retail customers individual consumers) and wholesale customers (other dealerships, tire shops, etc). He is responsible for a SI million dollar parts investory, and is expected to hold on average no more than two months supply at any time. On average, be normally holds 2.8 months supply, which has been a point of conflict with upper management. In addition, he is responsible for ordering and maintaining general MRO (maintenance, repair and operations supplies for the dealership. Tables 1 and 2 display inventory and ordering data as of the beginning of April 2002 Table 1. Inventory as of April 2002. Table 2. Outstanding orders as of April 2002. The parts and supplies are obtained from a varicty of sources. A majority of the parts are either shipped directly from the OEMS (GM and Chrysler) or from their distribution centers. Some parts are obtained from local parts vendors, and the MRO supplies are obtained from wholesale suppliers. Orders to the OEMs are placed through the Universal Computer System (UCS), the Dealer Management System used by Koons GM orders are placed daily, while Chrysler orders are weekly. Both OEMs will take promotion or rush orders anytime. Each day the UCS generates a list of stock numbers with inventory levels that have fallen below the recommended re- order point. The orders are then automatically generated with the quantities filled in that would bring the stock levels back to the recommended levels. The parts manager then manually scans each order for parts that may quanty tor quantity discounts Each day the UCS generates a list of stock numbers with inventory levels that have fallen below the recommended re- order point. The orders are then automatically generated with the quantities filled in that would bring the stock levels back to the recommended levels. The parts manager then manually scans cach order for parts that may qualify for quantity discounts (see OEM promotions below) and often times adjusts the quantities accordingly The service parts manager can check parts availability with Chrysler and other Chrysler dealers on a web-based system. Chrysler's parts distribution center (PDC) for this area is Newark, Delaware. The manager checks availability with GM using an automated phone inquiry system. In order to check availability of GM parts at other GM dealers, the manager must go through a third party web-based system maintained by Parts Voice. If the service parts manager locates a part he really needs at a dealer, he can call him directly and negotiate for markup The receiving dealer also pays freight charges. This doesn't always work well because some dealers do not update their records online regularly, and not all are willing to share their inventories with a competitor. Sometimes the OEM helps the service parts manager find parts, and arrange for shipping without a markup A pictorial representation of the supply chain for Jim Koons Automotive is illustrated in Figure 2 below. 810 Figure 2. The Supply Chain for Jim Koons Automotive The left half of the diagram illustrates the supply network to the automotive dealerships, and includes OEM's, outside part vendors and MRO suppliers, and transportation providers. The dealer organizations are identified in the central column. Note especially that there are a variety of "customers" for parts. Interally to the organization, parts are sold to the body shop. the service department, new car sales, and used car sales Externally to the organization, parts are sold to wholesale customers and other Koons dealers, and walk-in customers With the exception of the CSI bonus or reduction mentioned earlier, the manager is compensated strictly as a percentage of the amount of profit he can generate in his department at a rate of 8% of the net profit. Traditional overhead expenses such as employee salaries, training, and tools and equipment are taken off gross profit. His goal is to maximize the net profit in his department Net profit can be maximized through some combination of increasing total sales, reducing overhead expenses, or increasing stock order discounts on inventory. Figures for the parts department are incremers are disguised With the exception of the CSI bonus or reduction mentioned earlier, the manager is compensated strictly as a percentage of the amount of profit he can generate in his department at a rate of 8% of the net profit. Traditional overhead expenses such as employee salaries, training, and tools and equipment are taken off gross profit. His goal is to maximize the net profit in his department Net profit can be maximized through some combination of increasing total sales, reducing overhead expenses, or increasing stock order discounts on inventory Figures for the parts department are included in Table 3. (The numbers are disguiset however, the percentages are approximately correct. Note that the current parts manager arrived just after the December 1999 figures were posted) PREPARED BY ASSOC PROF DR ROHAYA MOHD NOR SUPPLEMENTARY CASE MATERIAL FOR E6333 KNOWLEDGE MANAGEMENT With the exception of the CSI bonus or reduction mentioned earlier, the manager is compensated strictly as a percentage of the amount of profit he can generate in his department at a rate of 8% of the net profit. Traditional overhead expenses such as employee salaries, training, and tools and equipment are taken off gross profit. His goal is to maximize the net profit in his department Net profit can be maximized through some combination of increasing total sales, reducing overhead expenses, or increasing stock order discounts on inventory Figures for the parts department are included in Table 3 below (The numbers are disguised; however, the percentages are approximately correct. Note that the current parts manager arrived just after the December 1999 figures were posted) The average markup for internal sales and walk-in Power 200 STO 3000 Table 3. Sales and Profit Figures retail customers is 42% while the average markup for wholesale customers is 10-15%. In general, sales to internal customers (body shop, service and new cars) cannot be affected by the parts manager. He has little control over how many cars come into the shop for service or repair. Demand by the different internal departments is also seasonal - higher in the winter due to bad weather and more accidents and more routine service maintenance in the summer. He also has little impact on sales to walk-in retail customers. While internal and retail sales carry a higher profit margin, increasing these sales is not a viable path to increasing net profit Sales to wholesale customers can be increased by increasing the dealership's share of the local service parts market. The dealership has sizeable wholesale sales to body shops and to other dealers within the greater metropolitan region. These sales are for individual parts that the other dealers cannot acquire quickly enough from the OEM, and also for larger quantity of parts sold to external customers that include body shops. In the two years since he has been the parts manager. gross dollar sales have increased 40%, with the majority of that increase due to the increase in wholesale transactions Sales to wholesale customers can be increased by increasing the dealership's share of the local service parts market. The dealership has sizeable wholesale sales to body shops and to other dealers within the greater metropolitan region. These sales are for individual parts that the other dealers cannot acquire quickly enough from the OEM, and also for larger quantity of parts sold to external customers that include body shops. In the two years since he has been the parts manager, gross dollar sales have increased 40%, with the majority of that increase due to the increase in wholesale transactions Freights costs are also a part of the expense of managing service parts. Standard practice in the industry is for OEMs to pay the freight into the dealership - so Koons only pays freight if they are expediting from the OEM or from another dealer or if they are shipping to a customer. These wholesale parts are generally transported by three modes - by courier to local facilities, by private fleet to sites a bit more remote and out of the normal delivery range for the courier, and by package delivery service to dealers anywhere in the U.S. or overseas. Decreasing overhead expenses can affect net profit. However, a large percentage of overhead is payroll expenses. Over time, the parts manager has steadily employed personnel at higher salaries Since he has been in the job, overhead expenses have increased by 49% The third way the manager can increase net profit is to decrease the purchase price of service parts. The OEMs offer a variety of promotions that provide quantity discounts (known as stock order discounts) for specific ordering levels and or specific stock-item orders. GM will also give an additional 1.5% discount for specified Chevrolet parts maintained at 90% of their recommended inventory levels. Not only do these promotions vary by the OEM. they are also complicated and difficult to track Frequently the manager will not know the ordering level required to obtain the discount and will lose out on an opportunity to acquire the stock at a lower cost This decision is also complicated by tradeoffs between lower prices and higher overall inventory levels. The parts manager is expected to hold a maximum of 2 months supply of inventory. and receives pressure from management when the inventory level exceeds this amount Management would prefer to spend the money they consider over invested in inventory on the purchase of new cars they could then sell for profit. However, the parts manager frequently exceeds the recommended stocking level when ordering large quantities of parts to obtain stock order discounts. 3. OEM Promotions The OEM promotion details differ by manufacturer. GM publishes standard quantity discount rates for specified parts. In addition, they periodically offer time-based discounts for Qualified Parts Orders (OPO). The discounts are only valid if the specified dollar amount is reached on one order in other words multiple orders over time cannot be combined to obtain the discount. Unfortunately, the dollar amounts required to obtain the discounts are often too high for this dealer location, and discounts on GM parts are not often received Chrysler also publishes standard quantity discount rates for specified parts in a 2.rare brochure disseminated quarterly. In addition, they publish a cupage catalog that describes their 3. OEM Promotions The OEM promotion details differ by manufacturer. GM publishes standard quantity discount rates for specified parts. In addition, they periodically offer time-based discounts for Qualified Parts Orders (OPO). The discounts are only valid if the specified dollar amount is reached on one order in other words multiple orders over time cannot be combined to obtain the discount. Unfortunately, the dollar amounts required to obtain the discounts are often too high for this dealer location, and discounts on GM parts are not often received Chrysler also publishes standard quantity discount rates for specified parts in a 2-page brochure disseminated quarterly. In addition, they publish a 60page catalog that describes their complex discount schemes. One example of a straightforward Chrysler promotion would be a 10% discount for an order valued between $3,000 and $6,499 for air conditioner compressors for the Chrysler Concorde. Orders valued greater than $6,500 would receive a 20% discount. Some Chrysler discount schemes are not so straightforward, however. An example of a complex discount scheme would be a 23% discount for ordering any mixture of air conditioning compressors and condensers that totals 30 units, with the same discount of 23% applied to refrigerant if you onder more than 5 units of Freon on the same order. As with the GM orders, in order to receive the discount the specified amounts must all be on one order. An additional complication with the Chrysler orders is that to receive the discount, the corresponding promotion code for the discount must be included on the order in a flag field. If the promotion code is not included, the dealer will not receive the discount Both GM and Chrysler orders are placed on line. However, neither system notifies the dealer that they are close to the threshold level for receiving a discount. The parts manager spends hours daily going through each order manually before it is placed looking for opportunities to receive discounts by increasing the order for certain parts. He often holds orders for parts until he reaches the threshold required for the discount allowing the stock on hand to deplete to very low levels. In order to achieve maximum efficiency in his job, the parts manager must keep track of several variables at the same time (eg current and projected inventory levels, specific quantity discount schemes, parts availability, etc.). While most of these variables are available to him in some manner, none of the information is integrated in a fashion that allows him to maximize the discount schemes available while holding inventory at a level that will both adequately service incoming customers and satisfy upper management Answer ALL the questions. Please ensure all referencing and citations used in the answer submission are following APA format referencing. Otherwise, it is plagiarism and you will obtain 0 mark. Read the given supplementary case material and answer all the following questions. 1. Based on your analysis, critically explain THREE (3) problems that justify the deployment and implementation of knowledge management system at this organization. (20 MARKS) 2. Apply Knowledge Management Value Chain to analyze the potential deployment of knowledge management technologies and systems. Give examples where relevant regarding the types of of knowledge related to the business processes in the context of deploying knowledge management. Elaborate your findings. (30 MARKS) 3. Propose organizational learning activities and provide justifications on why these activities are strategic to the organization. (25 MARKS) 4. Identify the knowledge levers relevant to this organization, and propose knowledge management strategies that should be considered by the owner and the management of this organization, to ensure a successful implementation of knowledge management system. Justify your decisions. (25 MARKS) JIM KOONS AUTOMOTIVE 1. Organization Background Jim Koons Automotive sells new and used cars from 15 dealer locations in Virginia and Maryland and an online Internet sales site. Koons Automotive offers cars made by DaimlerChrysler, Ford, General Motors, Mazda, Toyota, and Volvo Three locations specialize only in used cars. In 2000, Koons th Automotive ranked 18 in the United States in terms of total sales dollars, with 5978 million dollars in sales, selling just under 50.000 cars [41]. In 2001, they became a billion-dollar business [20). As of April, 2002 one of their Toyota dealerships ranked fourth in the US for internet sales, having sold approximately 1800 cars for S42 million in sales. Six of his other dealerships also rank in the top 100 dealers list in the nation (40) John Koons Sr., the father of Jim Koons, founded the first koons dealership in 1964. John Koons Sr. was the first auto dealer to enter the Automotive Hall of Fame. He eventually sold his dealerships to his children. Jim Koons is the CEO of Jim Koons Automotive, while other members of his family (siblings and nephews) run their own separate companies associated with the automotive industry Koons' mission statement encourages strategies that emphasize customer satisfaction over strategies that emphasize cost minimization Customer satisfaction is extremely important at Koons, and close attention is paid to CSI - customer satisfaction index-results. Hanging in the service buys are several banners that list the Koons ethos: "Rule # 1: If we don't take care of the customer, someone else will." "We Believe..... Sales opens the door for service and service opens the door for sales." "We Believe... Together everyone achieves more." "We Believe.... Teamwork assures satisfied customers again and again." Part of the reward system at Koons is based on customer satisfaction, using the CSI measure. CSI is measured in the form of a survey for new car sales and warranty service. The CSI measurement is reported for the month, three-month average, and yearly average. There are 4 key areas in CSI-new car sales service, body shop, and service parts. If the CSI 3-month average for the dealership is a targeted percentage above the market area average, all employees in those four areas receive a 5% bonus. If the CSI 3-month average is at the market area average, then there is no bonus. If the CSI 3-month average is below the market area average, all employees in those areas have 5% of their pay deducted. At the same time, however, management at Koons rewards managers and employees with profit-based bonuses, which often surfaces conflicting goals between departments (see below for compensation schemefore. There is evidence that the impact of attainine or not attamine CSI the same time. however, management at Koons rewards managers and employees with protit-based bonuses, which often surfaces conflicting goals between departments (see below for compensation schemes for service parts). There is evidence that the impact of attaining or not attaining CSI benchmarks is real 2. Service Parts Management The parts department of Koons' flagship dealership at Tysons Comer is the focus of this case study. This dealership employs approximately 180 employees, with sales of $131 million in 2000 [41). The dealership sells new Chrysler car models (manufactured by the Daimler Chrylser Corporation), and new Chevrolet cars and trucks (manufactured by General Motors) as well as a variety of used cars through their used car department The parts department employs 20 employees, with sales of approximately S7 million a year. The organizational structure of the dealershin detailing the narts denartment is shown in Fiure SV Ya fo 1. aprIGICE Over time, he has held a variety of positions at different dealerships, to include service advisor and service manager. He has been in his current job for two years, which entails providing parts to both internal and external customers, and maintaining the inventory to support those sales. The internal customers include the service department, the body shop, and new and used car sales The external customers include walk-up retail customers individual consumers) and wholesale customers (other dealerships, tire shops, etc). He is responsible for a SI million dollar parts investory, and is expected to hold on average no more than two months supply at any time. On average, be normally holds 2.8 months supply, which has been a point of conflict with upper management. In addition, he is responsible for ordering and maintaining general MRO (maintenance, repair and operations supplies for the dealership. Tables 1 and 2 display inventory and ordering data as of the beginning of April 2002 Table 1. Inventory as of April 2002. Table 2. Outstanding orders as of April 2002. The parts and supplies are obtained from a varicty of sources. A majority of the parts are either shipped directly from the OEMS (GM and Chrysler) or from their distribution centers. Some parts are obtained from local parts vendors, and the MRO supplies are obtained from wholesale suppliers. Orders to the OEMs are placed through the Universal Computer System (UCS), the Dealer Management System used by Koons GM orders are placed daily, while Chrysler orders are weekly. Both OEMs will take promotion or rush orders anytime. Each day the UCS generates a list of stock numbers with inventory levels that have fallen below the recommended re- order point. The orders are then automatically generated with the quantities filled in that would bring the stock levels back to the recommended levels. The parts manager then manually scans each order for parts that may quanty tor quantity discounts Each day the UCS generates a list of stock numbers with inventory levels that have fallen below the recommended re- order point. The orders are then automatically generated with the quantities filled in that would bring the stock levels back to the recommended levels. The parts manager then manually scans cach order for parts that may qualify for quantity discounts (see OEM promotions below) and often times adjusts the quantities accordingly The service parts manager can check parts availability with Chrysler and other Chrysler dealers on a web-based system. Chrysler's parts distribution center (PDC) for this area is Newark, Delaware. The manager checks availability with GM using an automated phone inquiry system. In order to check availability of GM parts at other GM dealers, the manager must go through a third party web-based system maintained by Parts Voice. If the service parts manager locates a part he really needs at a dealer, he can call him directly and negotiate for markup The receiving dealer also pays freight charges. This doesn't always work well because some dealers do not update their records online regularly, and not all are willing to share their inventories with a competitor. Sometimes the OEM helps the service parts manager find parts, and arrange for shipping without a markup A pictorial representation of the supply chain for Jim Koons Automotive is illustrated in Figure 2 below. 810 Figure 2. The Supply Chain for Jim Koons Automotive The left half of the diagram illustrates the supply network to the automotive dealerships, and includes OEM's, outside part vendors and MRO suppliers, and transportation providers. The dealer organizations are identified in the central column. Note especially that there are a variety of "customers" for parts. Interally to the organization, parts are sold to the body shop. the service department, new car sales, and used car sales Externally to the organization, parts are sold to wholesale customers and other Koons dealers, and walk-in customers With the exception of the CSI bonus or reduction mentioned earlier, the manager is compensated strictly as a percentage of the amount of profit he can generate in his department at a rate of 8% of the net profit. Traditional overhead expenses such as employee salaries, training, and tools and equipment are taken off gross profit. His goal is to maximize the net profit in his department Net profit can be maximized through some combination of increasing total sales, reducing overhead expenses, or increasing stock order discounts on inventory. Figures for the parts department are incremers are disguised With the exception of the CSI bonus or reduction mentioned earlier, the manager is compensated strictly as a percentage of the amount of profit he can generate in his department at a rate of 8% of the net profit. Traditional overhead expenses such as employee salaries, training, and tools and equipment are taken off gross profit. His goal is to maximize the net profit in his department Net profit can be maximized through some combination of increasing total sales, reducing overhead expenses, or increasing stock order discounts on inventory Figures for the parts department are included in Table 3. (The numbers are disguiset however, the percentages are approximately correct. Note that the current parts manager arrived just after the December 1999 figures were posted) PREPARED BY ASSOC PROF DR ROHAYA MOHD NOR SUPPLEMENTARY CASE MATERIAL FOR E6333 KNOWLEDGE MANAGEMENT With the exception of the CSI bonus or reduction mentioned earlier, the manager is compensated strictly as a percentage of the amount of profit he can generate in his department at a rate of 8% of the net profit. Traditional overhead expenses such as employee salaries, training, and tools and equipment are taken off gross profit. His goal is to maximize the net profit in his department Net profit can be maximized through some combination of increasing total sales, reducing overhead expenses, or increasing stock order discounts on inventory Figures for the parts department are included in Table 3 below (The numbers are disguised; however, the percentages are approximately correct. Note that the current parts manager arrived just after the December 1999 figures were posted) The average markup for internal sales and walk-in Power 200 STO 3000 Table 3. Sales and Profit Figures retail customers is 42% while the average markup for wholesale customers is 10-15%. In general, sales to internal customers (body shop, service and new cars) cannot be affected by the parts manager. He has little control over how many cars come into the shop for service or repair. Demand by the different internal departments is also seasonal - higher in the winter due to bad weather and more accidents and more routine service maintenance in the summer. He also has little impact on sales to walk-in retail customers. While internal and retail sales carry a higher profit margin, increasing these sales is not a viable path to increasing net profit Sales to wholesale customers can be increased by increasing the dealership's share of the local service parts market. The dealership has sizeable wholesale sales to body shops and to other dealers within the greater metropolitan region. These sales are for individual parts that the other dealers cannot acquire quickly enough from the OEM, and also for larger quantity of parts sold to external customers that include body shops. In the two years since he has been the parts manager. gross dollar sales have increased 40%, with the majority of that increase due to the increase in wholesale transactions Sales to wholesale customers can be increased by increasing the dealership's share of the local service parts market. The dealership has sizeable wholesale sales to body shops and to other dealers within the greater metropolitan region. These sales are for individual parts that the other dealers cannot acquire quickly enough from the OEM, and also for larger quantity of parts sold to external customers that include body shops. In the two years since he has been the parts manager, gross dollar sales have increased 40%, with the majority of that increase due to the increase in wholesale transactions Freights costs are also a part of the expense of managing service parts. Standard practice in the industry is for OEMs to pay the freight into the dealership - so Koons only pays freight if they are expediting from the OEM or from another dealer or if they are shipping to a customer. These wholesale parts are generally transported by three modes - by courier to local facilities, by private fleet to sites a bit more remote and out of the normal delivery range for the courier, and by package delivery service to dealers anywhere in the U.S. or overseas. Decreasing overhead expenses can affect net profit. However, a large percentage of overhead is payroll expenses. Over time, the parts manager has steadily employed personnel at higher salaries Since he has been in the job, overhead expenses have increased by 49% The third way the manager can increase net profit is to decrease the purchase price of service parts. The OEMs offer a variety of promotions that provide quantity discounts (known as stock order discounts) for specific ordering levels and or specific stock-item orders. GM will also give an additional 1.5% discount for specified Chevrolet parts maintained at 90% of their recommended inventory levels. Not only do these promotions vary by the OEM. they are also complicated and difficult to track Frequently the manager will not know the ordering level required to obtain the discount and will lose out on an opportunity to acquire the stock at a lower cost This decision is also complicated by tradeoffs between lower prices and higher overall inventory levels. The parts manager is expected to hold a maximum of 2 months supply of inventory. and receives pressure from management when the inventory level exceeds this amount Management would prefer to spend the money they consider over invested in inventory on the purchase of new cars they could then sell for profit. However, the parts manager frequently exceeds the recommended stocking level when ordering large quantities of parts to obtain stock order discounts. 3. OEM Promotions The OEM promotion details differ by manufacturer. GM publishes standard quantity discount rates for specified parts. In addition, they periodically offer time-based discounts for Qualified Parts Orders (OPO). The discounts are only valid if the specified dollar amount is reached on one order in other words multiple orders over time cannot be combined to obtain the discount. Unfortunately, the dollar amounts required to obtain the discounts are often too high for this dealer location, and discounts on GM parts are not often received Chrysler also publishes standard quantity discount rates for specified parts in a 2.rare brochure disseminated quarterly. In addition, they publish a cupage catalog that describes their 3. OEM Promotions The OEM promotion details differ by manufacturer. GM publishes standard quantity discount rates for specified parts. In addition, they periodically offer time-based discounts for Qualified Parts Orders (OPO). The discounts are only valid if the specified dollar amount is reached on one order in other words multiple orders over time cannot be combined to obtain the discount. Unfortunately, the dollar amounts required to obtain the discounts are often too high for this dealer location, and discounts on GM parts are not often received Chrysler also publishes standard quantity discount rates for specified parts in a 2-page brochure disseminated quarterly. In addition, they publish a 60page catalog that describes their complex discount schemes. One example of a straightforward Chrysler promotion would be a 10% discount for an order valued between $3,000 and $6,499 for air conditioner compressors for the Chrysler Concorde. Orders valued greater than $6,500 would receive a 20% discount. Some Chrysler discount schemes are not so straightforward, however. An example of a complex discount scheme would be a 23% discount for ordering any mixture of air conditioning compressors and condensers that totals 30 units, with the same discount of 23% applied to refrigerant if you onder more than 5 units of Freon on the same order. As with the GM orders, in order to receive the discount the specified amounts must all be on one order. An additional complication with the Chrysler orders is that to receive the discount, the corresponding promotion code for the discount must be included on the order in a flag field. If the promotion code is not included, the dealer will not receive the discount Both GM and Chrysler orders are placed on line. However, neither system notifies the dealer that they are close to the threshold level for receiving a discount. The parts manager spends hours daily going through each order manually before it is placed looking for opportunities to receive discounts by increasing the order for certain parts. He often holds orders for parts until he reaches the threshold required for the discount allowing the stock on hand to deplete to very low levels. In order to achieve maximum efficiency in his job, the parts manager must keep track of several variables at the same time (eg current and projected inventory levels, specific quantity discount schemes, parts availability, etc.). While most of these variables are available to him in some manner, none of the information is integrated in a fashion that allows him to maximize the discount schemes available while holding inventory at a level that will both adequately service incoming customers and satisfy upper management