Question: answer all them please and I will give you like for sure QUESTION 4 If you also spent an additional $500 on month 16, how

![how long will it take you to pay off the card? [m]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6717c047ccfe9_7996717c047583f0.jpg)

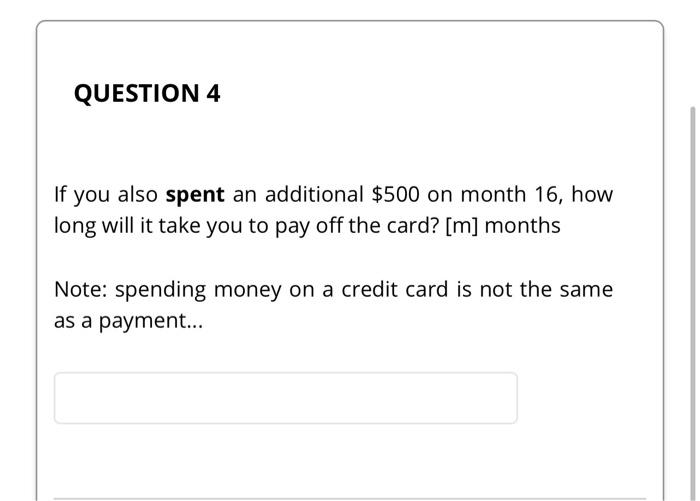

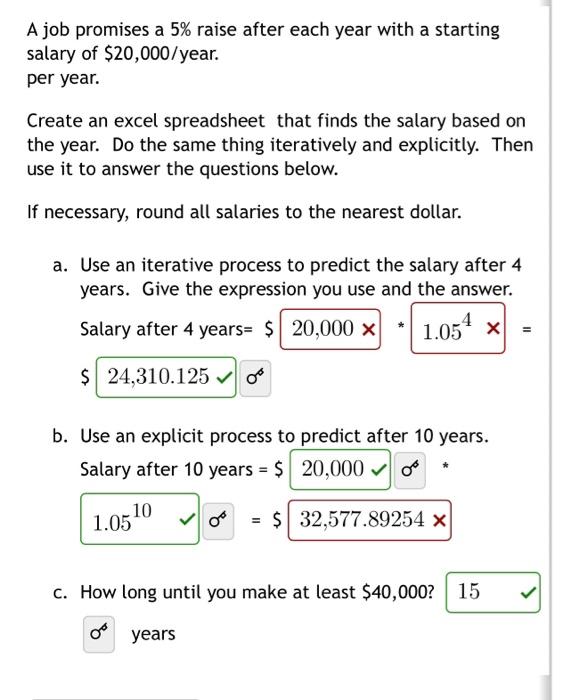

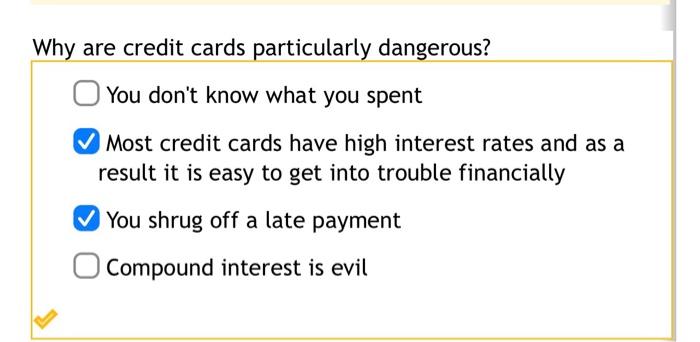

QUESTION 4 If you also spent an additional $500 on month 16, how long will it take you to pay off the card? [m] months Note: spending money on a credit card is not the same as a payment... A job promises a 5% raise after each year with a starting salary of $20,000/year. per year. Create an excel spreadsheet that finds the salary based on the year. Do the same thing iteratively and explicitly. Then use it to answer the questions below. If necessary, round all salaries to the nearest dollar. a. Use an iterative process to predict the salary after 4 years. Give the expression you use and the answer. Salary after 4 years= $ 20,000 X * 1.054 x X = $ 24,310.125 0 b. Use an explicit process to predict after 10 years. Salary after 10 years = $ 20,000 0 10 1.05 yo = $ 32,577.89254 x C. How long until you make at least $40,000? 15 years Question 5 3 pts 51 Details If you invested $9000 at 6.5% interest compounded monthly, how long in months would it take for your money to double? (Remember, you only get your statement once per month.) 12 months Question 6 4 pts 1 Details If you invested $3520 at 2.6% interest compounded monthly and added $30 each month, how much money would you have after 128 months? Round to the nearest cent. $ 9,033.46 Question 7 34 pts 1 Details If you invested $4040 at 4.7% interest compounded monthly and added $700 in months 21, 73, 93 and 127, how much would you have after 13 years? $ 11,268.23 Why are credit cards particularly dangerous? You don't know what you spent Most credit cards have high interest rates and as a result it is easy to get into trouble financially You shrug off a late payment Compound interest is evil QUESTION 4 If you also spent an additional $500 on month 16, how long will it take you to pay off the card? [m] months Note: spending money on a credit card is not the same as a payment... A job promises a 5% raise after each year with a starting salary of $20,000/year. per year. Create an excel spreadsheet that finds the salary based on the year. Do the same thing iteratively and explicitly. Then use it to answer the questions below. If necessary, round all salaries to the nearest dollar. a. Use an iterative process to predict the salary after 4 years. Give the expression you use and the answer. Salary after 4 years= $ 20,000 X * 1.054 x X = $ 24,310.125 0 b. Use an explicit process to predict after 10 years. Salary after 10 years = $ 20,000 0 10 1.05 yo = $ 32,577.89254 x C. How long until you make at least $40,000? 15 years Question 5 3 pts 51 Details If you invested $9000 at 6.5% interest compounded monthly, how long in months would it take for your money to double? (Remember, you only get your statement once per month.) 12 months Question 6 4 pts 1 Details If you invested $3520 at 2.6% interest compounded monthly and added $30 each month, how much money would you have after 128 months? Round to the nearest cent. $ 9,033.46 Question 7 34 pts 1 Details If you invested $4040 at 4.7% interest compounded monthly and added $700 in months 21, 73, 93 and 127, how much would you have after 13 years? $ 11,268.23 Why are credit cards particularly dangerous? You don't know what you spent Most credit cards have high interest rates and as a result it is easy to get into trouble financially You shrug off a late payment Compound interest is evil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts