Question: Please help! Will rate! I would also appreciate formulas on how to get the numbers! Lansing, Inc. provides the following information for one of its

Please help! Will rate! I would also appreciate formulas on how to get the numbers!

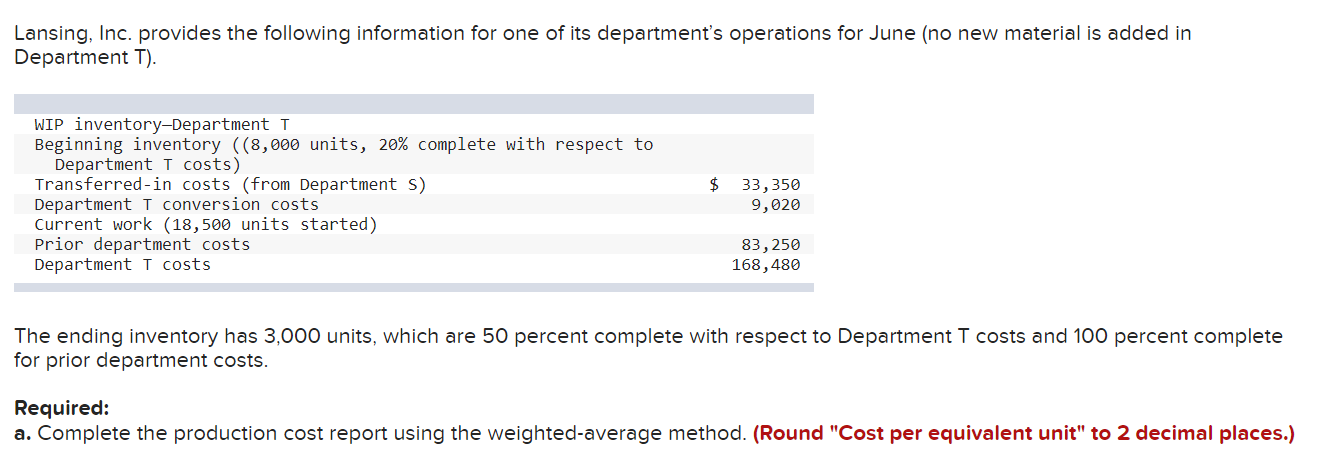

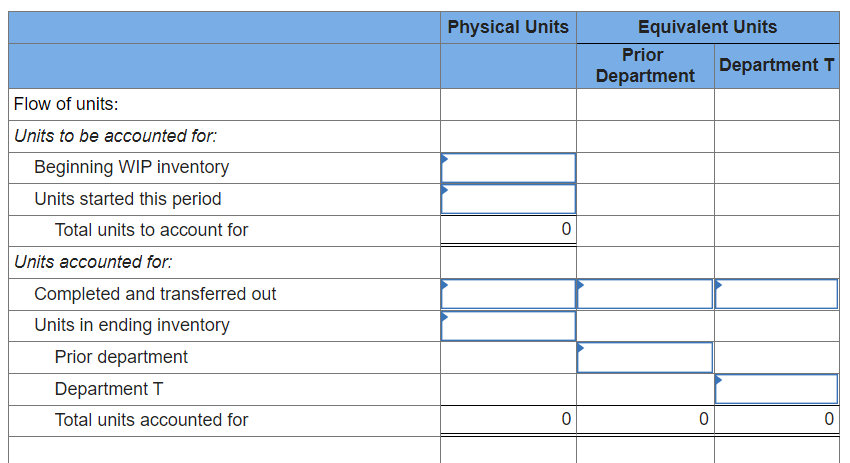

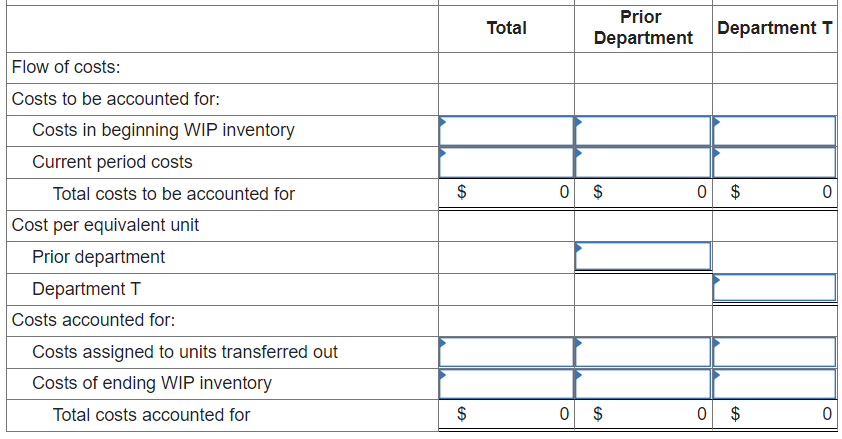

Lansing, Inc. provides the following information for one of its department's operations for June (no new material is added in Department T). WIP inventory-Department T Beginning inventory ((8,000 units, 20% complete with respect to Department T costs) Transferred-in costs (from Department S) $ 33,350 Department T conversion costs 9,020 Current work (18,500 units started) Prior department costs Department T costs 83, 250 168,480 The ending inventory has 3,000 units, which are 50 percent complete with respect to Department T costs and 100 percent complete for prior department costs. Required: a. Complete the production cost report using the weighted-average method. (Round "Cost per equivalent unit" to 2 decimal places.) Flow of units: Units to be accounted for: Beginning WIP inventory Units started this period Total units to account for Units accounted for: Completed and transferred out Units in ending inventory Prior department Department T Total units accounted for Physical Units 0 0 Equivalent Units Prior Department 0 Department T 0 Total Prior Department Department T $ 0 $ 0 $ 0 Flow of costs: Costs to be accounted for: Costs in beginning WIP inventory Current period costs Total costs to be accounted for Cost per equivalent unit Prior department Department T Costs accounted for: Costs assigned to units transferred out Costs of ending WIP inventory Total costs accounted for $ 0 $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts