Question: answer all three same info pls Question 15 2.5 pts Same facts as above: what is the average accounting return of this project if the

answer all three same info pls

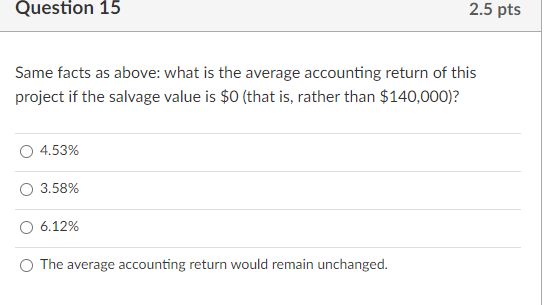

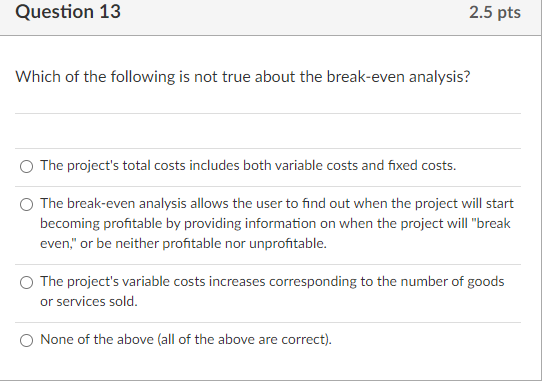

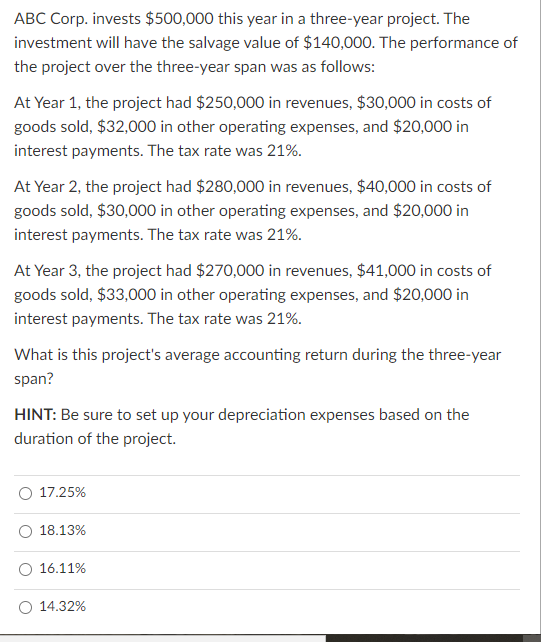

Question 15 2.5 pts Same facts as above: what is the average accounting return of this project if the salvage value is $0 (that is, rather than $140,000)? 4.53% 3.58% O 6.12% The average accounting return would remain unchanged. Question 13 2.5 pts Which of the following is not true about the break-even analysis? The project's total costs includes both variable costs and fixed costs. The break-even analysis allows the user to find out when the project will start becoming profitable by providing information on when the project will "break even," or be neither profitable nor unprofitable. The project's variable costs increases corresponding to the number of goods or services sold. None of the above all of the above are correct). ABC Corp. invests $500,000 this year in a three-year project. The investment will have the salvage value of $140,000. The performance of the project over the three-year span was as follows: At Year 1, the project had $250,000 in revenues, $30,000 in costs of goods sold, $32,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 21%. At Year 2, the project had $280,000 in revenues, $40,000 in costs of goods sold, $30,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 21%. At Year 3, the project had $270,000 in revenues, $41,000 in costs of goods sold, $33,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 21%. What is this project's average accounting return during the three-year span? HINT: Be sure to set up your depreciation expenses based on the duration of the project. 17.25% 18.13% 16.11% 14.32%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts