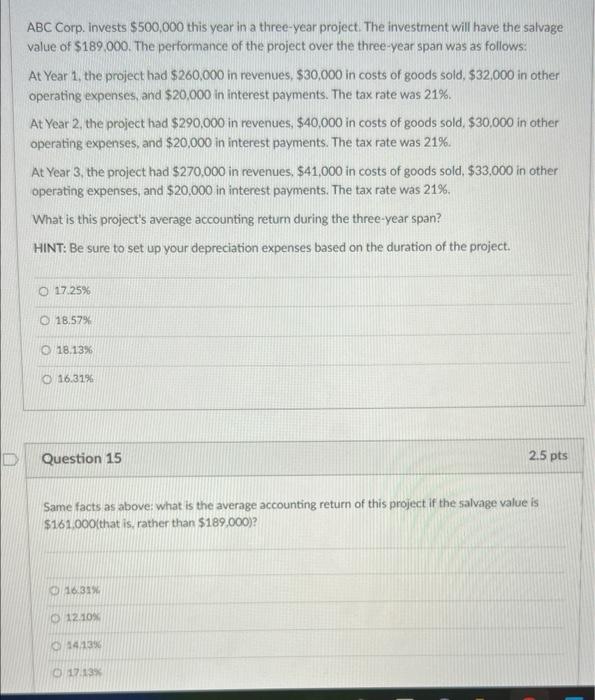

Question: please help with both!! ABC Corp. Invests $500,000 this year in a three-year project. The investment will have the salvage value of $189.000. The performance

ABC Corp. Invests $500,000 this year in a three-year project. The investment will have the salvage value of $189.000. The performance of the project over the three-year span was as follows: At Year 1, the project had $260,000 in revenues, $30,000 in costs of goods sold. $32,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 21%. At Year 2 the project had $290,000 in revenues, $40,000 in costs of goods sold, $30,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 21%. At Year 3, the project had $270,000 in revenues, $41,000 in costs of goods sold. $33,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 21%. What is this project's average accounting return during the three-year span? HINT: Be sure to set up your depreciation expenses based on the duration of the project. O 17.25% 18.57% 18.13% 16.3196 D Question 15 2.5 pts Same facts as above: what is the average accounting return of this project if the salvage value is $161.000(that is rather than $189.000)? 16.31% 12.10% 14:13 17.13%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts