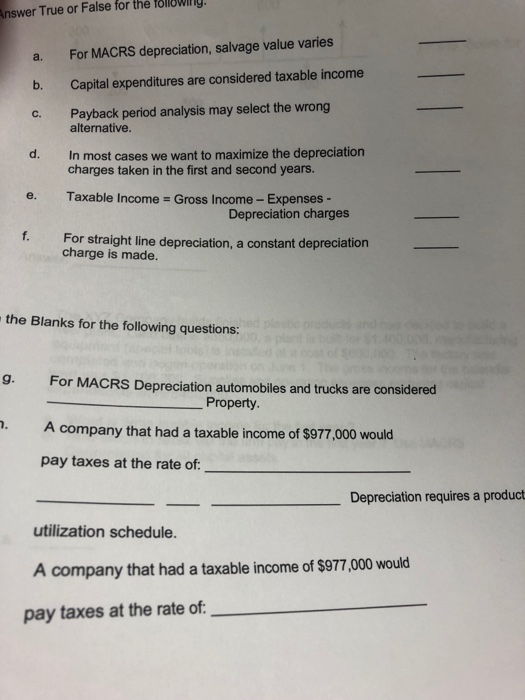

Question: Answer all tollowill nswer True or False for the a. For MACRS depreciation, salvage value varies b. Capital expenditures are considered taxable income c. Payback

tollowill nswer True or False for the a. For MACRS depreciation, salvage value varies b. Capital expenditures are considered taxable income c. Payback period analysis may select the wrong d. In most cases we want to maximize the depreciation alternative charges taken in the first and second years. Taxable Income = Gross Income-Expenses- Depreciation charges f. For straight line depreciation, a constant depreciation charge is made. the Blanks for the following questions: 9 For MACRS Depreciation automobiles and trucks are considered Property . A company that had a taxable income of $977,000 would pay taxes at the rate of Depreciation requires a product utilization schedule. A company that had a taxable income of $977,000 would pay taxes at the rate of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts