Question: ANSWER ALL WILL GIVE LIKE Problem 11-06 The risk-free rate of return is 3 percent, and the expected return on the market is 7.9 percent.

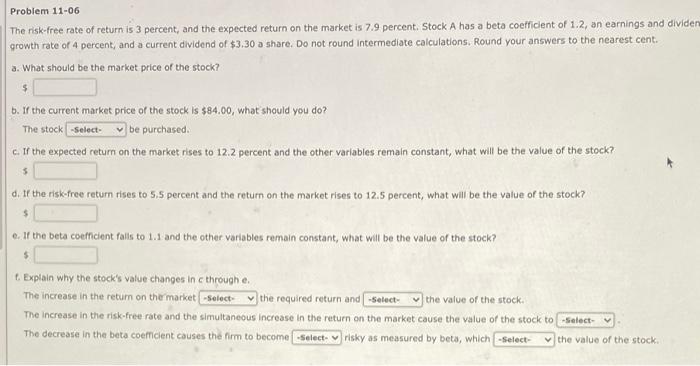

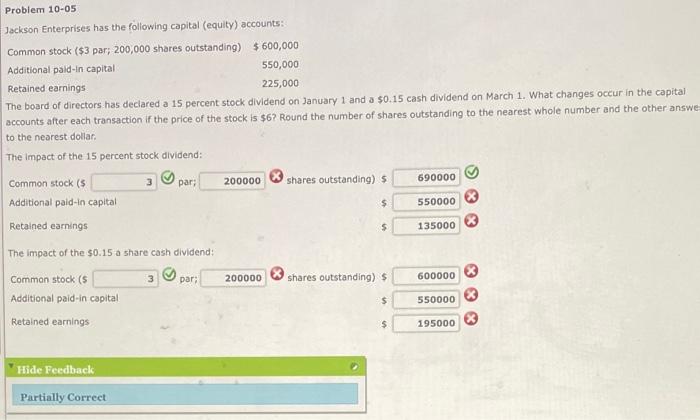

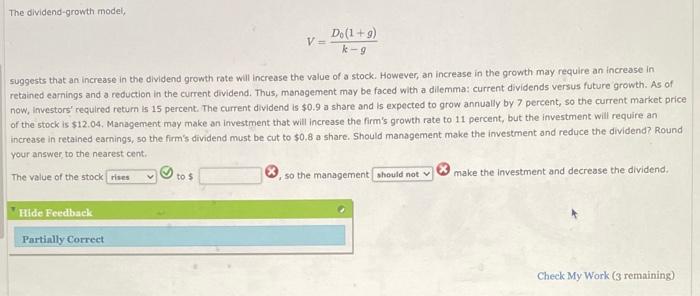

Problem 11-06 The risk-free rate of return is 3 percent, and the expected return on the market is 7.9 percent. Stock A has a beta coefficient of 1.2, an earnings and dividen growth rate of 4 percent, and a current dividend of $3.30 a share. Do not round Intermediate calculations. Round your answers to the nearest cent. a. What should be the market price of the stock? b. If the current market price of the stock is $84.00, what should you do? The stock -Select y be purchased. c. If the expected return on the market rises to 12.2 percent and the other variables remain constant, what will be the value of the stock? $ d. If the risk-free return rises to 5.5 percent and the return on the market rises to 12.5 percent, what will be the value of the stock? $ c. If the beta coefficient falls to 1.1 and the other variables remain constant, what will be the value of the stock? 5 t. Explain why the stock's value changes in c through e. The increase in the return on the market -Select- the required return and select the value of the stock. The increase in the risk-free rate and the simultaneous increase in the return on the market cause the value of the stock to -Select- The decrease in the beta coeficient causes the firm to become Select: risky as measured by beta, which -Select- the value of the stock Problem 10-05 Jackson Enterprises has the following capital (equity) accounts: Common stock ($3 par; 200,000 shares outstanding) $600,000 Additional paid-in capital 550,000 Retained earnings 225,000 The board of directors has declared a 15 percent stock dividend on January 1 and a $0.15 cash dividend on March 1. What changes occur in the capital accounts after each transaction if the price of the stock is $6? Round the number of shares outstanding to the nearest whole number and the other answer to the nearest dollar The impact of the 15 percent stock dividend: 3 par: 200000 shares outstanding) 5 690000 Common stock (s Additional pald-in capital $ 550000 Retained earnings $ 135000 The impact of the $0.15 a share cash dividend: 3 par; 200000 shares outstanding) $ 600000 Common stock (s Additional paid-in capital Retained earnings $ 550000 * * $ $ $ 195000 Hide Feedback Partially Correct The dividend-growth model, D. (1+9) VE k9 suggests that an increase in the dividend growth rate will increase the value of a stock. However, an increase in the growth may require an increase in retained earnings and a reduction in the current dividend. Thus, management may be faced with a dilemma: current dividends versus future growth. As of now, Investors' required return is 15 percent. The current dividend is $0.9 a share and is expected to grow annually by 7 percent, so the current market price of the stock is $12.04, Management may make an investment that will increase the firm's growth rate to 11 percent, but the investment will require an increase in retained earnings, so the firm's dividend must be cut to $0.8 a share. Should management make the investment and reduce the dividend? Round your answer to the nearest cent The value of the stock roes to $ so the management should not make the Investment and decrease the dividend. "Hide Feedback Partially Correct Check My Work (3 remaining)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts