Question: Select options are ''increase or decrease Problem 11-06 The risk-free rate of return is 3 percent, and the expected return on the market is 7

Select options are ''increase" or "decrease"

Select options are ''increase" or "decrease"

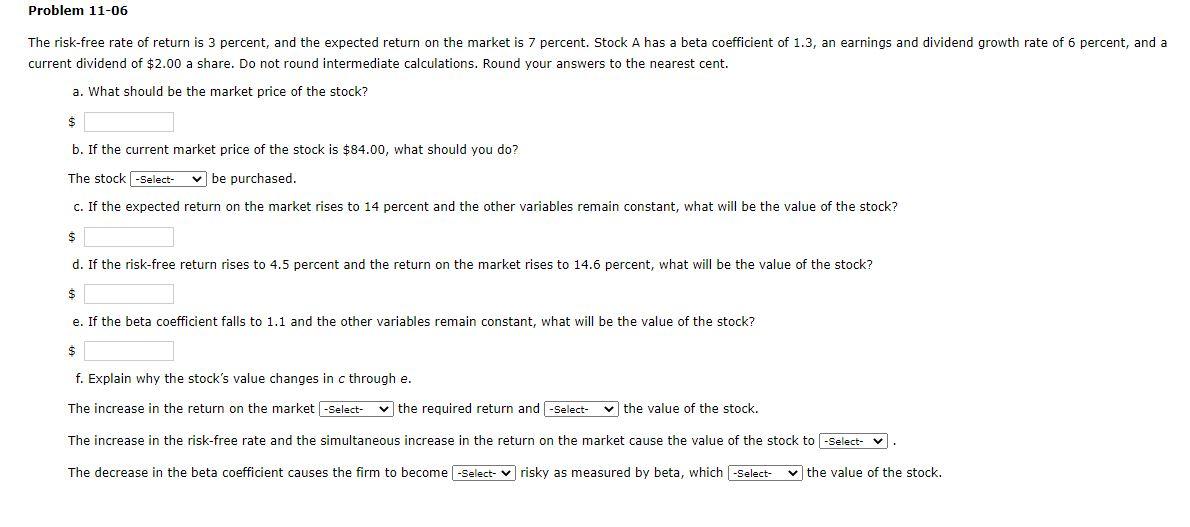

Problem 11-06 The risk-free rate of return is 3 percent, and the expected return on the market is 7 percent. Stock A has a beta coefficient of 1.3, an earnings and dividend growth rate of 6 percent, and a current dividend of $2.00 a share. Do not round intermediate calculations. Round your answers to the nearest cent. a. What should be the market price of the stock? $ b. If the current market price of the stock is $84.00, what should you do? The stock -Select- be purchased. c. If the expected return on the market rises to 14 percent and the other variables remain constant, what will be the value of the stock? $ d. If the risk-free return rises to 4.5 percent and the return on the market rises to 14.6 percent, what will be the value of the stock? $ e. If the beta coefficient falls to 1.1 and the other variables remain constant, what will be the value of the stock? $ f. Explain why the stock's value changes in c through e. The increase in the return on the market -Select- the required return and -Select- the value of the stock. The increase in the risk-free rate and the simultaneous increase in the return on the market cause the value of the stock to -Select- v. The decrease in the beta coefficient causes the firm to become -Select- risky as measured by beta, which -Select- the value of the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts