Question: answer and reason? Part 1. Multiple choice (1 point for each question) Question 1. Some financial measures can be used to hedge the transactional exposure,

answer and reason?

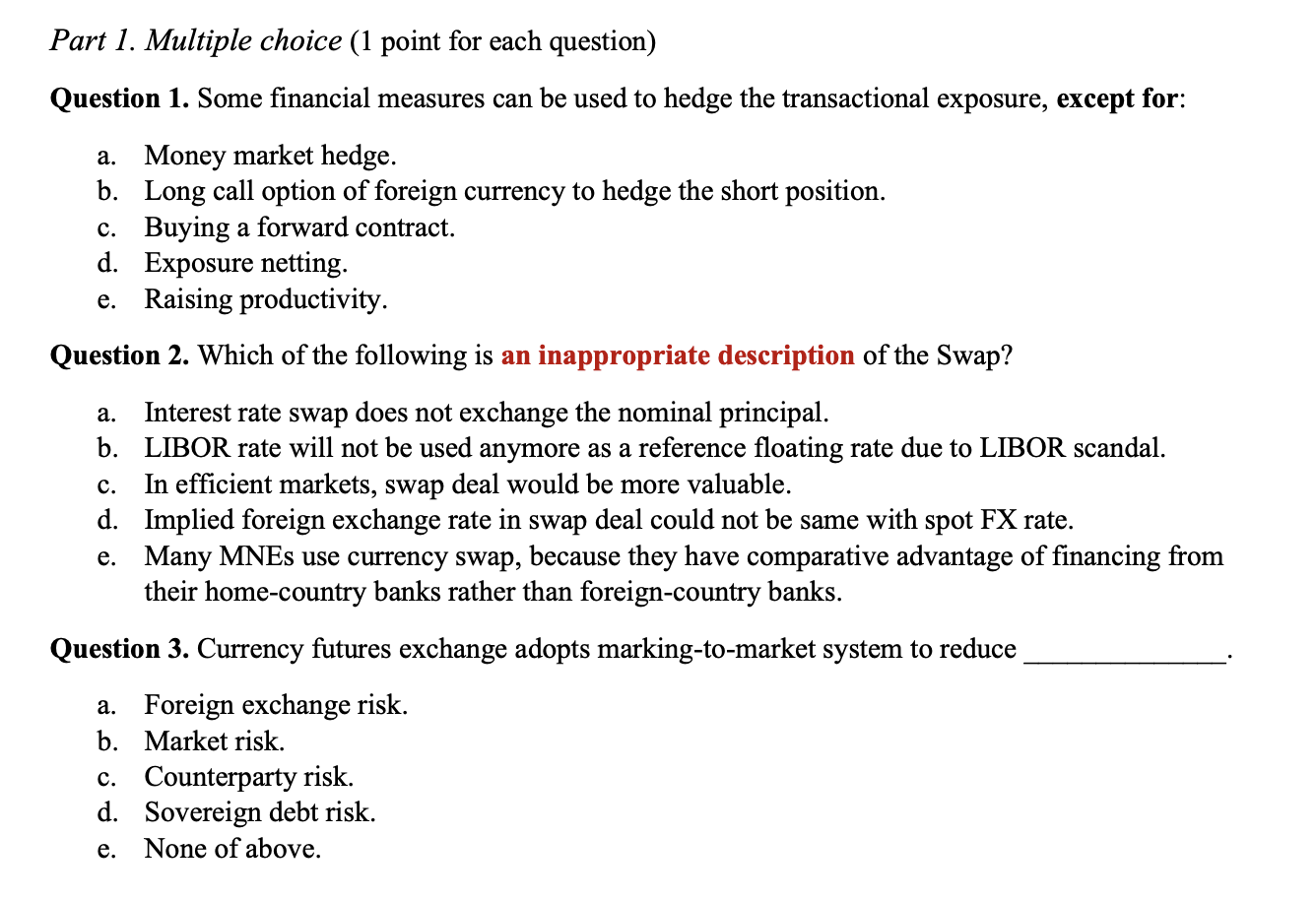

Part 1. Multiple choice (1 point for each question) Question 1. Some financial measures can be used to hedge the transactional exposure, except for: a. Money market hedge. b. Long call option of foreign currency to hedge the short position. c. Buying a forward contract. d. Exposure netting. e. Raising productivity. Question 2. Which of the following is an inappropriate description of the Swap? a. Interest rate swap does not exchange the nominal principal. b. LIBOR rate will not be used anymore as a reference floating rate due to LIBOR scandal. c. In efficient markets, swap deal would be more valuable. d. Implied foreign exchange rate in swap deal could not be same with spot FX rate. e. Many MNEs use currency swap, because they have comparative advantage of financing from their home-country banks rather than foreign-country banks. Question 3. Currency futures exchange adopts marking-to-market system to reduce a. Foreign exchange risk. b. Market risk. c. Counterparty risk. d. Sovereign debt risk. e. None of above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts