Question: answer and show your solution Problem 16-13 (AICPA Adapted) On January 1, 2019, Scoundrel Company purchased 100,000 ordinary shares at P80 per share to be

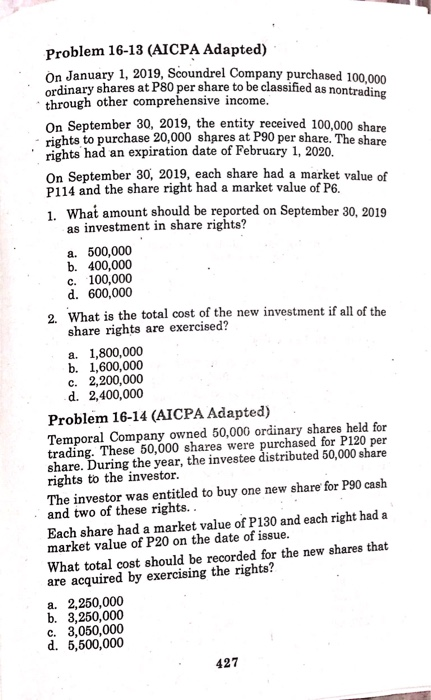

Problem 16-13 (AICPA Adapted) On January 1, 2019, Scoundrel Company purchased 100,000 ordinary shares at P80 per share to be classified as nontrading through other comprehensive income. On September 30, 2019, the entity received 100,000 share rights to purchase 20,000 shares at P90 per share. The share rights had an expiration date of February 1, 2020. On September 30, 2019, each share had a market value of P114 and the share right had a market value of P6 What a mount should be reported on September 30, 2019 1. as investment in share rights? a. 500,000 b. 400,000 100,000 d. 600,000 C. 2. What is the total cost of the share rights are exercised? investment if all of the new 1,800,000 b. 1,600,000 c. 2,200,000 d. 2,400,000 a. Problem 16-14 (AICPA Adapted) Temporal Company owned 50,000 ordinary shares held for trading. These 50,000 shares were purchased for P120 per share. During the year, the investee distributed 50,000 share rights to the investor. The investor was entitled to buy one new share for P90 cash and two of these rights.. Each share hada market value of P130 and each right had a market value of P20 on the date of issue. What total cost should be recorded for the new shares that acquired by exercising the rights? are 2,250,000 b. 3,250,000 c. 3,050,000 d. 5,500,000 a 427

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts