Question: Answer any TEN questions in this section. Each question carries THREE marks State 'true' or 'false', and briefly explain your answer. 1. A well-researched and

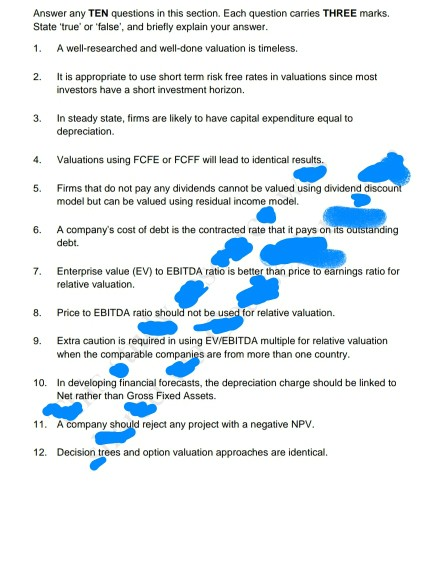

Answer any TEN questions in this section. Each question carries THREE marks State 'true' or 'false', and briefly explain your answer. 1. A well-researched and well-done valuation is timeless. 2. It is appropriate to use short term risk free rates in valuations since most investors have a short investment horizon. 3. In steady state, firms are likely to have capital expenditure equal to depreciation 4. Valuations using FCFE or FCFF will lead to identical results. 5. Firms that do not pay any dividends cannot be valued using dividend discount model but can be valued using residual income model. 6. A company's cost of debt is the contracted rate that it pays on its outstanding debt. 7. Enterprise value (EV) to EBITDA ratio is better than price to earnings ratio for relative valuation. 8. Price to EBITDA ratio should not be used for relative valuation. 9. Extra caution is required in using EV/EBITDA multiple for relative valuation when the comparable companies are from more than one country. 10. In developing financial forecasts, the depreciation charge should be linked to Net rather than Gross Fixed Assets. 11. A company should reject any project with a negative NPV. 12. Decision trees and option valuation approaches are identical

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts