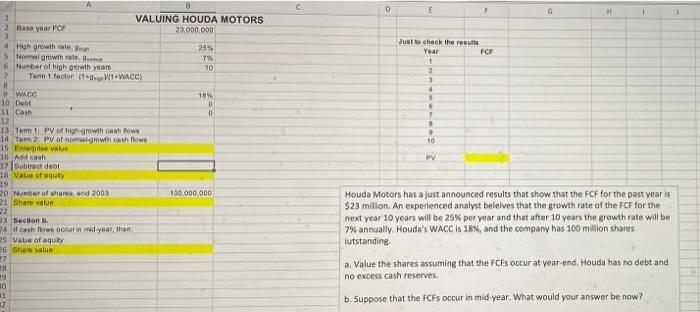

Question: answer asap and i will upvote D E F G H 1 1 2 Base year FCF VALUING HOUDA MOTORS 23.000.000 25% 4 High growth

D E F G H 1 1 2 Base year FCF VALUING HOUDA MOTORS 23.000.000 25% 4 High growth rate S Normal growth rated 6 Number of high growth years Tarm 1 Factor ( 1.1.WACC) 7% 10 Just to check the results Year FCF 1 2 3 5 16 0 0 7 10 PV 9 WACC 10 Det 11 Car 12 13 Tem PV of high growth anh 14 Tema pot nominalgrowincam dow 15 Enterprise value 10 Add cash 12 Subtract debt 18 Vale at aquly 19 20 Number of where, and 2003 21 Share value 22 Section 24 tahfws occur in dyear, then 25 Vale of equity 26 Share value 7 100.000.000 Houda Motors has a just announced results that show that the FCF for the past year is $23 milion. An experienced analyst belelves that the growth rate of the FCF for the next year 10 years will be 25% per year and that after 10 years the growth rate will be 7% annually. Houda's WACC Is 18%, and the company has 100 million shares lutstanding a. Value the shares assuming that the FCEs occur at year end Houda has no debt and no excess cash reserves b. Suppose that the FCFs occur in mid-year. What would your answer be now? 40 10 11 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts