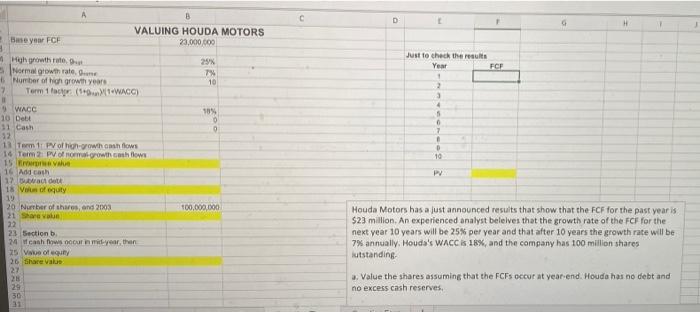

Question: answer asap & i will upvote please include formulas as well. thanks D H 1 VALUING HOUDA MOTORS 23,000,000 Base your FCF Just to check

D H 1 VALUING HOUDA MOTORS 23,000,000 Base your FCF Just to check the results Year FCF 25% T% 10 2 3 10% hgrowth rate 5 Normal growth rate. De Number of high growth years 2 Torm 1 acte (WACC) 9 WACC 10 Dett 11 Cash 32 13 Tom 1 PV of high-growth ashflows 16 Toim2 PV of rowth shows 15 16 Add cash 12. Da det 18 Vous of equity 5 0 7 D 10 PV 100,000,000 20 Number of shares and 2003 21 Savo 22 23 Section b 24 cash in milyear, then 25 Value of my 26 share Value 27 2 29 30 21 Houda Motors has a just announced results that show that the FCF for the past year is $23 million. An experienced analyst belelves that the growth rate of the FCF for the next year 10 years will be 25% per year and that after 10 years the growth rate will be 7% annually. Houda's WACC I 18%, and the company has 100 million shares utstanding a. Value the shares assuming that the FCFs occur at year-end. Houda has no debt and no excess cash reserves

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts