Question: ANSWER ASAP IT IS AN EXAM AND THE TIME IS LESS Cyberdyne systems creates robotic stuffed toys, remote controlled cars, and toy guns, which make

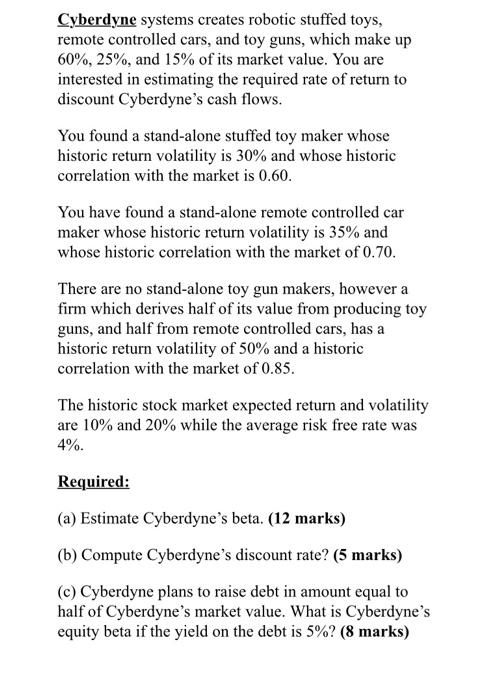

Cyberdyne systems creates robotic stuffed toys, remote controlled cars, and toy guns, which make up 60%, 25%, and 15% of its market value. You are interested in estimating the required rate of return to discount Cyberdyne's cash flows. You found a stand-alone stuffed toy maker whose historic return volatility is 30% and whose historic correlation with the market is 0.60. You have found a stand-alone remote controlled car maker whose historic return volatility is 35% and whose historic correlation with the market of 0.70. There are no stand-alone toy gun makers, however a firm which derives half of its value from producing toy guns, and half from remote controlled cars, has a historic return volatility of 50% and a historic correlation with the market of 0.85. The historic stock market expected return and volatility are 10% and 20% while the average risk free rate was 4%. Required: (a) Estimate Cyberdyne's beta. (12 marks) (b) Compute Cyberdyne's discount rate? (5 marks) (c) Cyberdyne plans to raise debt in amount equal to half of Cyberdyne's market value. What is Cyberdyne's equity beta if the yield on the debt is 5%? (8 marks) Cyberdyne systems creates robotic stuffed toys, remote controlled cars, and toy guns, which make up 60%, 25%, and 15% of its market value. You are interested in estimating the required rate of return to discount Cyberdyne's cash flows. You found a stand-alone stuffed toy maker whose historic return volatility is 30% and whose historic correlation with the market is 0.60. You have found a stand-alone remote controlled car maker whose historic return volatility is 35% and whose historic correlation with the market of 0.70. There are no stand-alone toy gun makers, however a firm which derives half of its value from producing toy guns, and half from remote controlled cars, has a historic return volatility of 50% and a historic correlation with the market of 0.85. The historic stock market expected return and volatility are 10% and 20% while the average risk free rate was 4%. Required: (a) Estimate Cyberdyne's beta. (12 marks) (b) Compute Cyberdyne's discount rate? (5 marks) (c) Cyberdyne plans to raise debt in amount equal to half of Cyberdyne's market value. What is Cyberdyne's equity beta if the yield on the debt is 5%? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts