Question: ANSWER ASAP IT IS AN EXAM AND THE TIME IS LESS Orio ple is an all equity company (worth 80 million) that operates in the

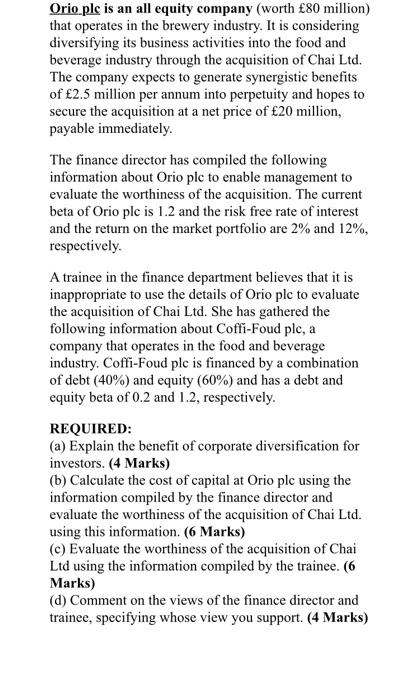

Orio ple is an all equity company (worth 80 million) that operates in the brewery industry. It is considering diversifying its business activities into the food and beverage industry through the acquisition of Chai Ltd. The company expects to generate synergistic benefits of 2.5 million per annum into perpetuity and hopes to secure the acquisition at a net price of 20 million, payable immediately. The finance director has compiled the following information about Orio plc to enable management to evaluate the worthiness of the acquisition. The current beta of Orio plc is 1.2 and the risk free rate of interest and the return on the market portfolio are 2% and 12%, respectively. A trainee in the finance department believes that it is inappropriate to use the details of Orio plc to evaluate the acquisition of Chai Ltd. She has gathered the following information about Coffi-Foud plc, a company that operates in the food and beverage industry. Coffi-Foud plc is financed by a combination of debt (40%) and equity (60%) and has a debt and equity beta of 0.2 and 1.2, respectively. REQUIRED: (a) Explain the benefit of corporate diversification for investors. (4 Marks) (b) Calculate the cost of capital at Orio plc using the information compiled by the finance director and evaluate the worthiness of the acquisition of Chai Ltd. using this information. (6 Marks) (c) Evaluate the worthiness of the acquisition of Chai Ltd using the information compiled by the trainee. (6 Marks) (d) Comment on the views of the finance director and trainee, specifying whose view you support. (4 Marks) Orio ple is an all equity company (worth 80 million) that operates in the brewery industry. It is considering diversifying its business activities into the food and beverage industry through the acquisition of Chai Ltd. The company expects to generate synergistic benefits of 2.5 million per annum into perpetuity and hopes to secure the acquisition at a net price of 20 million, payable immediately. The finance director has compiled the following information about Orio plc to enable management to evaluate the worthiness of the acquisition. The current beta of Orio plc is 1.2 and the risk free rate of interest and the return on the market portfolio are 2% and 12%, respectively. A trainee in the finance department believes that it is inappropriate to use the details of Orio plc to evaluate the acquisition of Chai Ltd. She has gathered the following information about Coffi-Foud plc, a company that operates in the food and beverage industry. Coffi-Foud plc is financed by a combination of debt (40%) and equity (60%) and has a debt and equity beta of 0.2 and 1.2, respectively. REQUIRED: (a) Explain the benefit of corporate diversification for investors. (4 Marks) (b) Calculate the cost of capital at Orio plc using the information compiled by the finance director and evaluate the worthiness of the acquisition of Chai Ltd. using this information. (6 Marks) (c) Evaluate the worthiness of the acquisition of Chai Ltd using the information compiled by the trainee. (6 Marks) (d) Comment on the views of the finance director and trainee, specifying whose view you support. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts