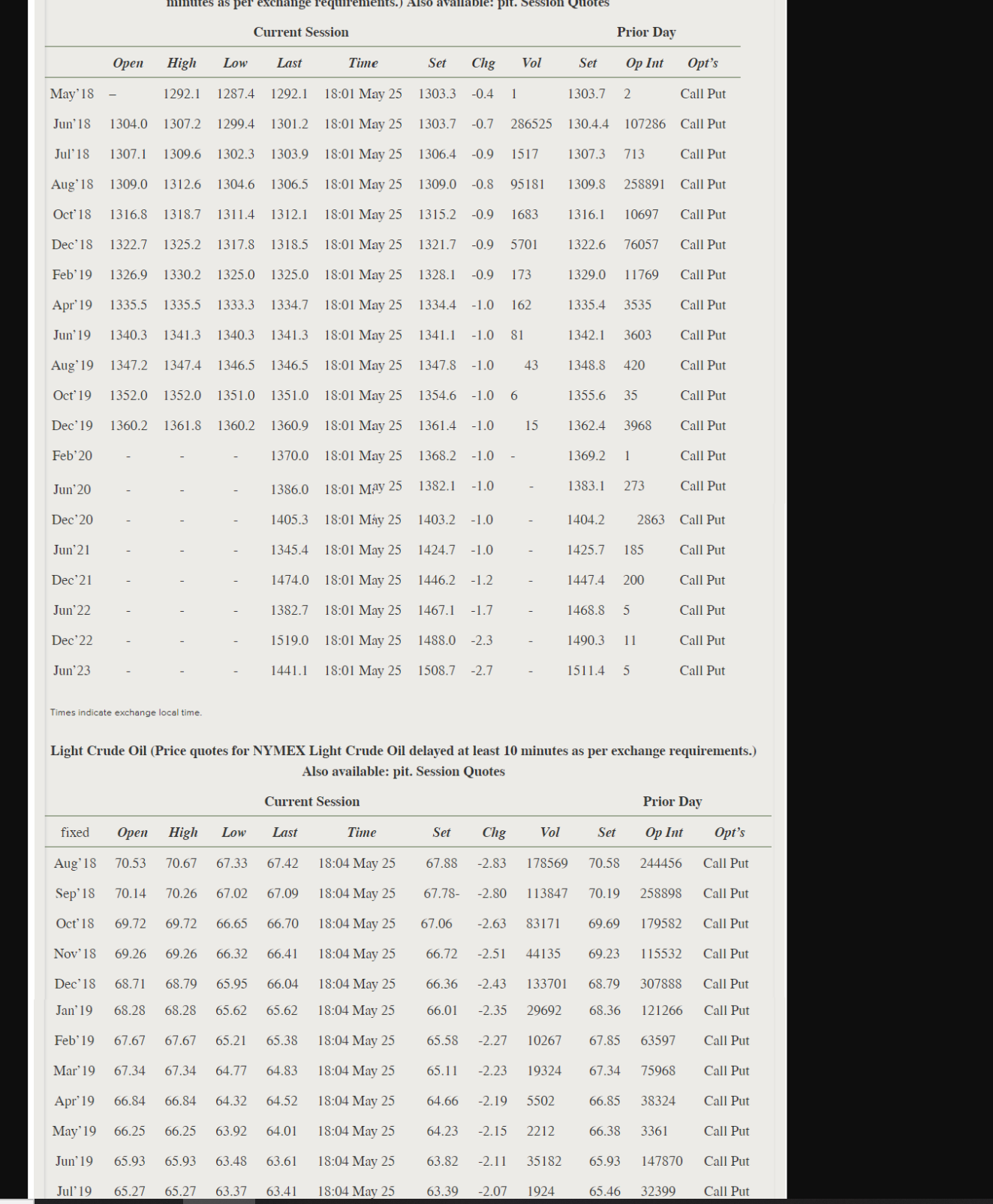

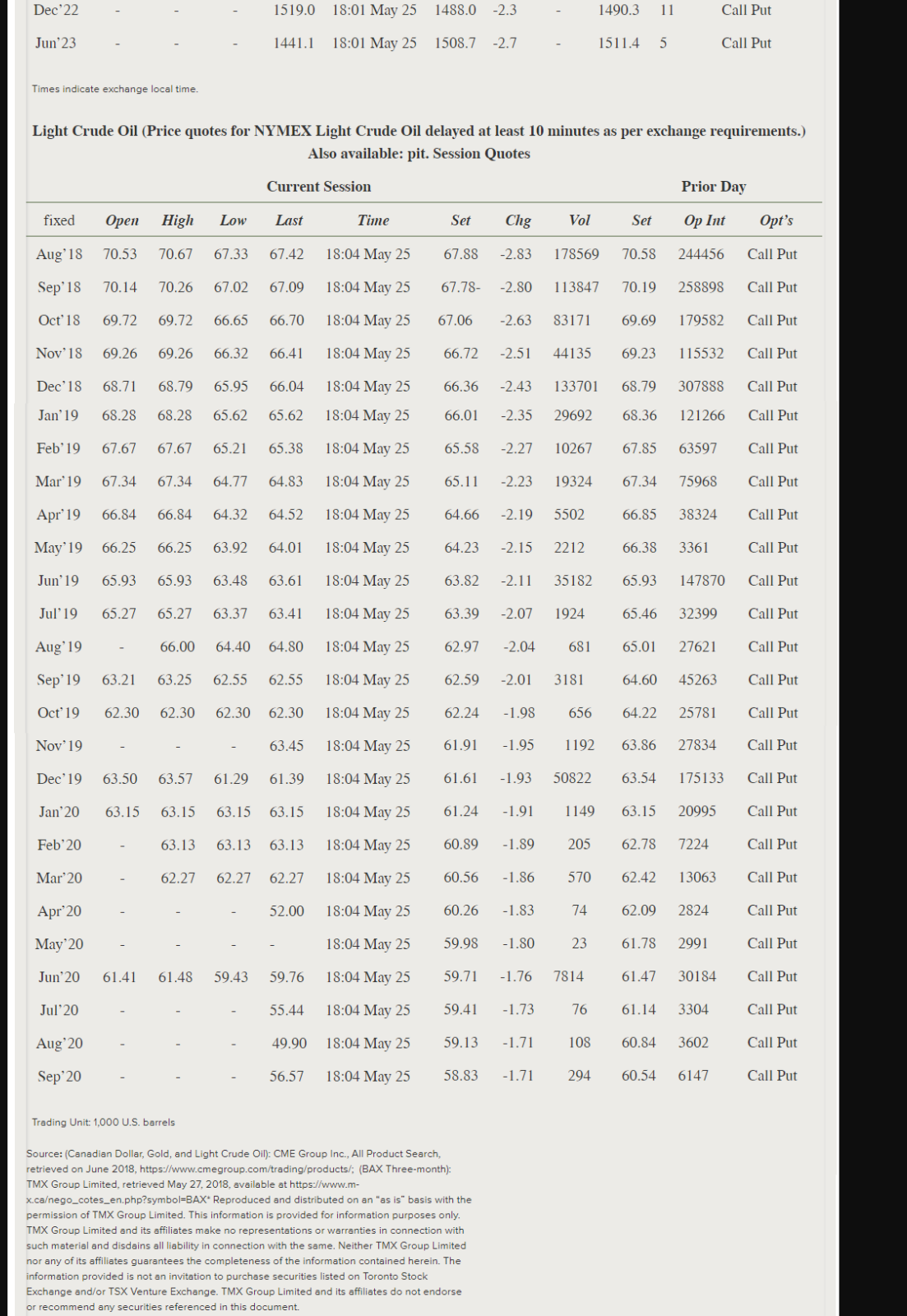

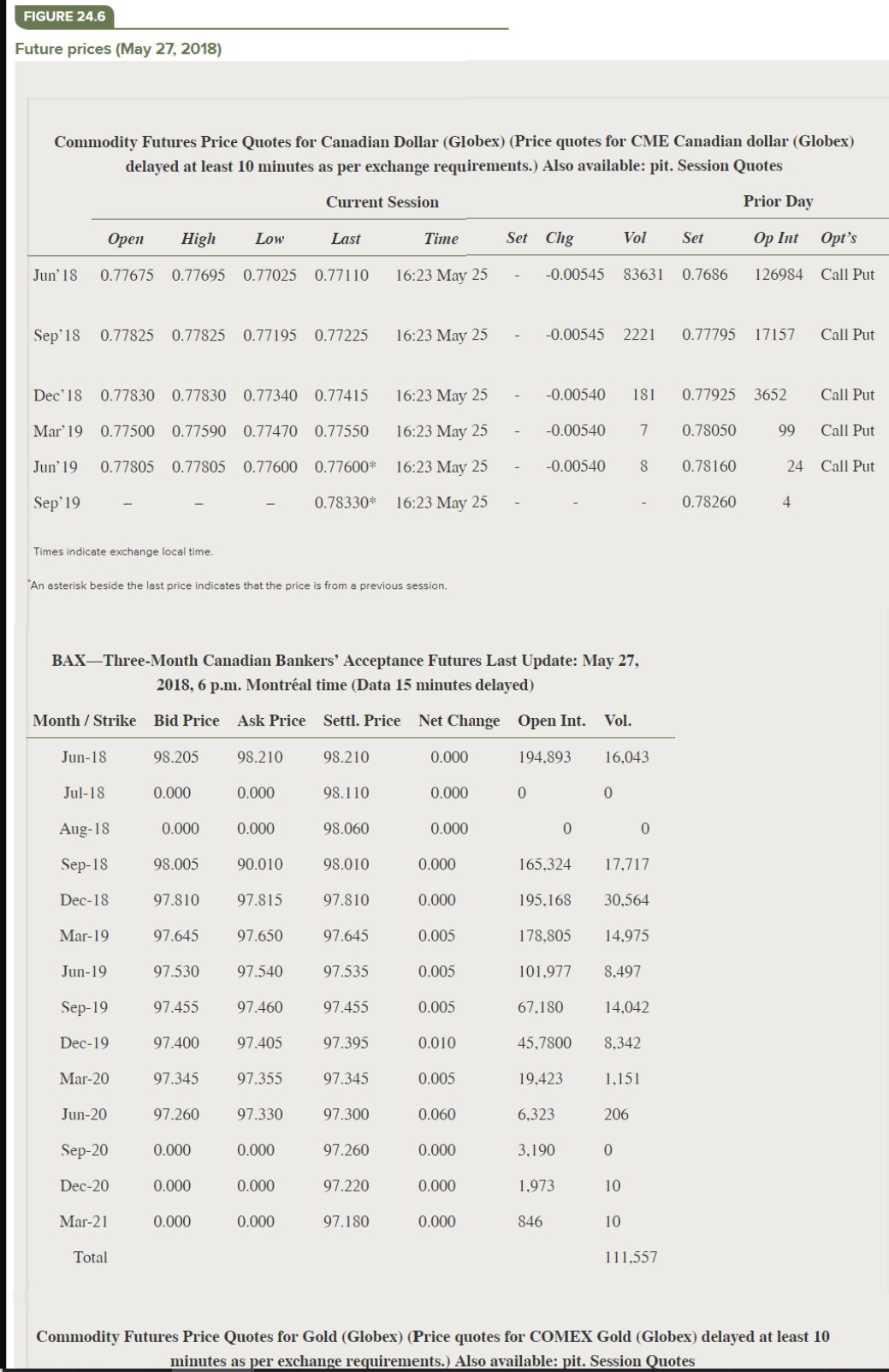

Question: ANSWER ASAP. REFERENCE FOR FIGURE ARE PROVIDED. COULDN'T TAKE ONE SCREENSHOT SO PROVIDED REFERENCES IN 3 SCREENSHOT. FIG - 1ST SCREENSHOT FIG 2 - 2SCREENSHOT

ANSWER ASAP. REFERENCE FOR FIGURE ARE PROVIDED. COULDN'T TAKE ONE SCREENSHOT SO PROVIDED REFERENCES IN 3 SCREENSHOT. FIG - 1ST SCREENSHOT FIG 2 - 2SCREENSHOT FIG 3 - 3 SCREENSHOT

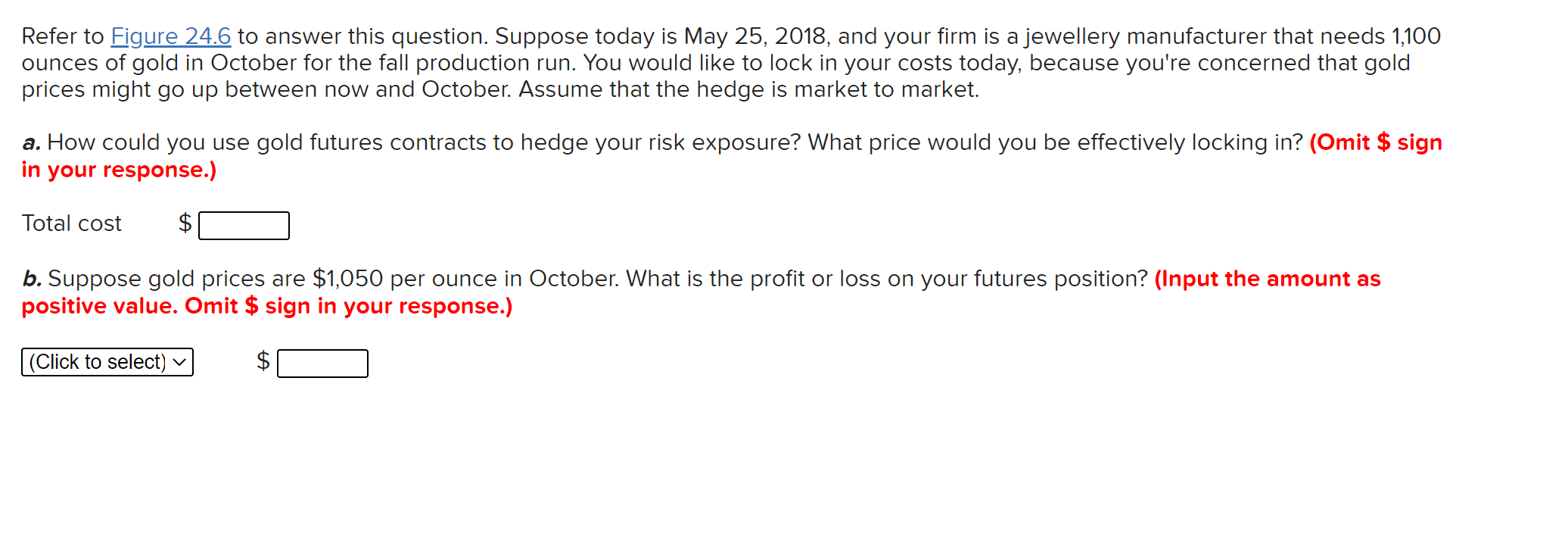

\f\f\fRefer to gure 24.6 to answer this question. Suppose today is May 25, 2018, and your firm is ajewellery manufacturer that needs 1,100 ounces of gold in October for the fall production run. You would like to lock in your costs today, because you're concerned that gold prices might go up between now and October. Assume that the hedge is market to market. a. How could you use gold futures contracts to hedge your risk exposure? What price would you be effectively locking in? (Omit $ sign in your response.) Total cost $ :] b. Suppose gold prices are $1,050 per ounce in October. What is the profit or loss on your futures position? (Input the amount as positive value. Omit $ sign in your response.) (Click to select) v $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts