Question: Answer B and C 10.A 30-year bond has a face value of $1,000 and a 9% coupon rate, paid semi-annually. a. You buy the bond

Answer B and C

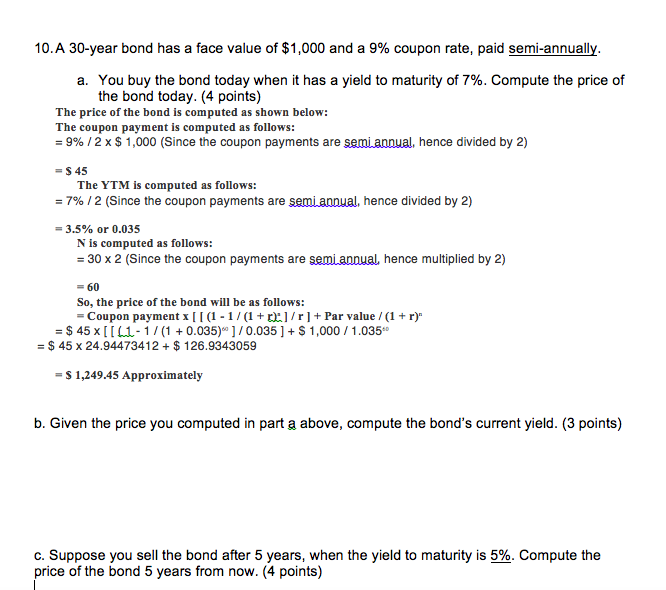

10.A 30-year bond has a face value of $1,000 and a 9% coupon rate, paid semi-annually. a. You buy the bond today when it has a yield to maturity of 7%. Compute the price of the bond today. (4 points) The price of the bond is computed as shown below: The coupon payment is computed as follows: = 9% / 2 x $1,000 (Since the coupon payments are semiannual, hence divided by 2) = S 45 The YTM is computed as follows: = 7% / 2 (Since the coupon payments are semi annual, hence divided by 2) = 3.5% or 0.035 N is computed as follows: = 30 x 2 (Since the coupon payments are semiannual, hence multiplied by 2) = 60 So, the price of the bond will be as follows: = Coupon payment x[[(1 - 1/(1+:]/r] + Par value /(1 + r)" = $ 45x[[41-1/(1 + 0.035)] / 0.035 ] +$ 1,000 / 1.035 = $ 45 x 24.94473412 + $126.9343059 =$ 1,249.45 Approximately b. Given the price you computed in part a above, compute the bond's current yield. (3 points) c. Suppose you sell the bond after 5 years, when the yield to maturity is 5%. Compute the price of the bond 5 years from now. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts