Question: Using the Exhibit 6 on page 44 in the first reading, consider another situation. Suppose we observe that AXE Electronics is worth $110 today, and

Using the Exhibit 6 on page 44 in the first reading, consider another situation. Suppose we observe that AXE Electronics is worth $110 today, and one period later will be worth either $154 or $64. The other stock, BYF Technology, is today worth $75 and one period later will be $102 or $42.5. Assume that the risk-free borrowing and lending rate is 5%. Also assume no dividends are paid on either stock during the period covered by this example. Design a trade(s) similar to Exhibit 7 and show is there an arbitrage opportunity under the new prices for the two stocks. Show all your work!

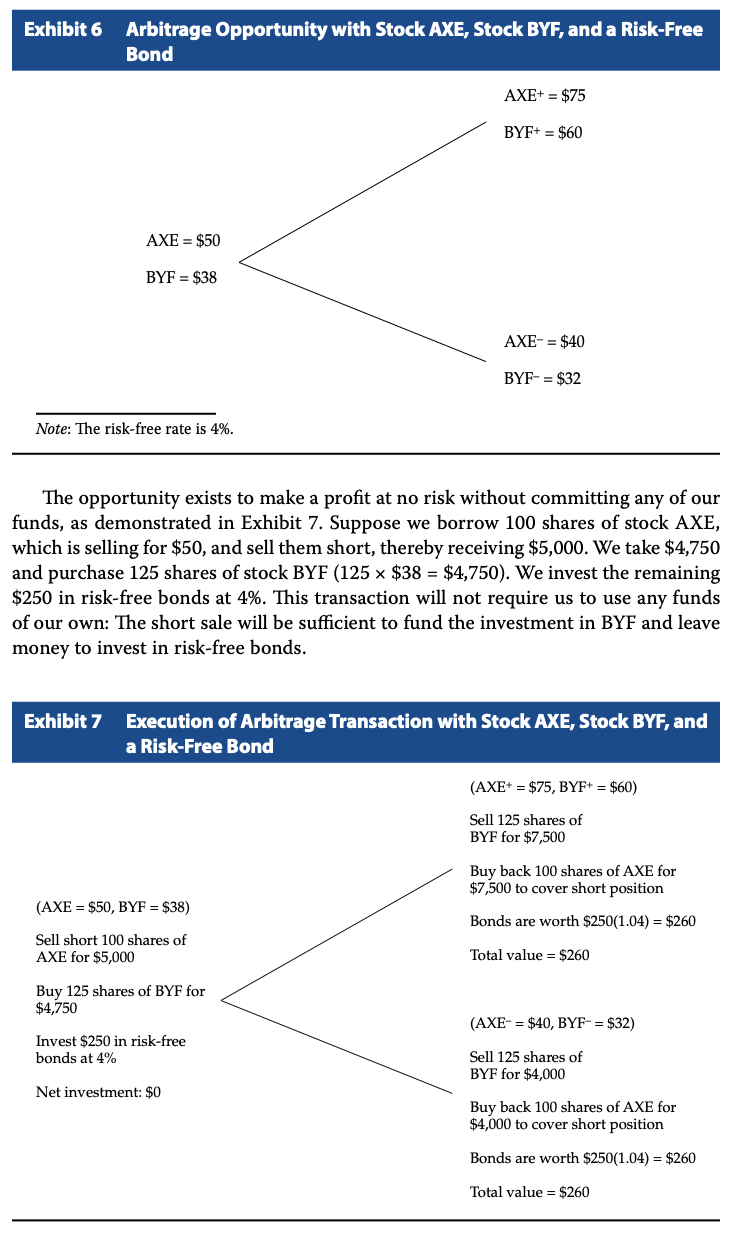

Exhibit 6 Arbitrage Opportunity with Stock AXE, Stock BYF, and a Risk-Free Bond AXE+ = $75 BYF+ = $60 AXE = $50 BYF = $38 AXE- = $40 BYF- = $32 Note: The risk-free rate is 4%. The opportunity exists to make a profit at no risk without committing any of our funds, as demonstrated in Exhibit 7. Suppose we borrow 100 shares of stock AXE, which is selling for $50, and sell them short, thereby receiving $5,000. We take $4,750 and purchase 125 shares of stock BYF (125 $38 = $4,750). We invest the remaining $250 in risk-free bonds at 4%. This transaction will not require us to use any funds of our own: The short sale will be sufficient to fund the investment in BYF and leave money to invest in risk-free bonds. Exhibit 7 Execution of Arbitrage Transaction with Stock AXE, Stock BYF, and a Risk-Free Bond (AXE+ = $75, BYF+ = $60) Sell 125 shares of BYF for $7,500 Buy back 100 shares of AXE for $7,500 to cover short position (AXE = $50, BYF = $38) Bonds are worth $250(1.04) = $260 Sell short 100 shares of AXE for $5,000 Total value = $260 Buy 125 shares of BYF for $4,750 (AXE = $40, BYF- = $32) Invest $250 in risk-free bonds at 4% Sell 125 shares of BYF for $4,000 Net investment: $0 Buy back 100 shares of AXE for $4,000 to cover short position Bonds are worth $250(1.04) = $260 Total value = $260

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts