Question: answer b les A company is considering two mutually exclusive expansion plans. Plan A requires a $39 million expenditure on a large-scale integrated plant that

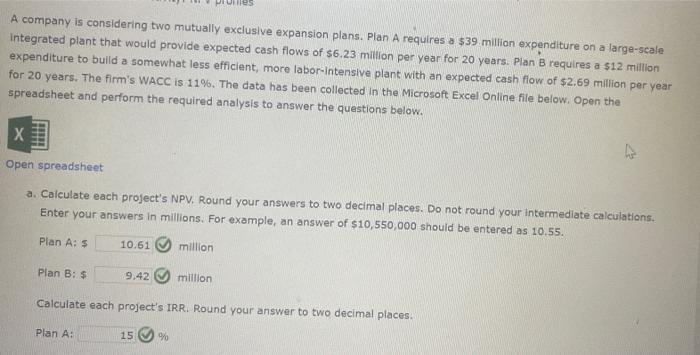

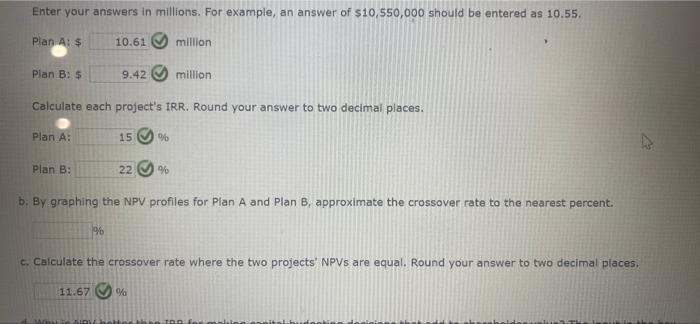

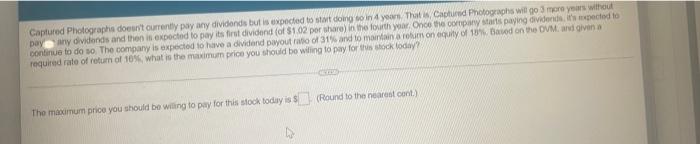

les A company is considering two mutually exclusive expansion plans. Plan A requires a $39 million expenditure on a large-scale integrated plant that would provide expected cash flows of $6.23 million per year for 20 years. Plan B requires a $12 million expenditure to build a somewhat less efficient, more labor-intensive plant with an expected cash flow of $2.69 million per year for 20 years. The firm's WACC is 11%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. X Open spreadsheet a. Calculate each project's NPV. Round your answers to two decimal places. Do not round your intermediate calculations. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Plan A: $ 10.61 million Plan B: $ 9.42 million Calculate each project's IRR. Round your answer to two decimal places. Plan A: 15 % Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Plan A: $ 10.61 million Plan B: $ 9.42 million Calculate each project's IRR. Round your answer to two decimal places. Plan A: 15 96 Plan B : 22 9% b. By graphing the NPV profiles for Plan A and Plan B, approximate the crossover rate to the nearest percent 96 c. Calculate the crossover rate where the two projects' NPVs are equal. Round your answer to two decimal places. 11.67 % IND TO Captured Photographe doesn't currently pay any dividends but is expected to start com coin 4 years. That Captured Photographs will go 3 more years without pay any dividends and then is expected to pay its first dividend (of 102 por share in the fourth year. Once the company starts paying videos pected to continue to do so. The company is expected to have a dividend payout ratio of 31% and to maintain a robum on equity of 10% Baved on the OVM and given required rate of return of 10% what is the maximum price you should be willing to pay for this stock today? Round to the nearest Cont) The marimum price you should be willing to pay for this stock today is 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts