Question: answer both please 2 An analyst notes that XYZ Corporation's 8% corporate bonds are coming due in 3 months. Interest rates for corporate bonds are

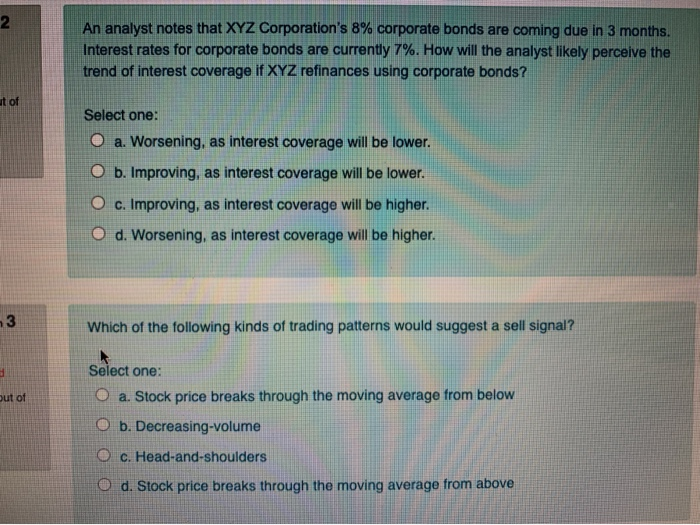

2 An analyst notes that XYZ Corporation's 8% corporate bonds are coming due in 3 months. Interest rates for corporate bonds are currently 7%. How will the analyst likely perceive the trend of interest coverage if XYZ refinances using corporate bonds? ut of Select one: a. Worsening, as interest coverage will be lower. O b. Improving, as interest coverage will be lower. O c. Improving, as interest coverage will be higher. O d. Worsening, as interest coverage will be higher. 3 Which of the following kinds of trading patterns would suggest a sell signal? out of Select one: O a. Stock price breaks through the moving average from below O b. Decreasing-volume O c. Head-and-shoulders O d. Stock price breaks through the moving average from above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts