Question: answer both please! Current Attempt in Progress Betty and Mark have successfully negotiated a house price and have been approved for a loan at an

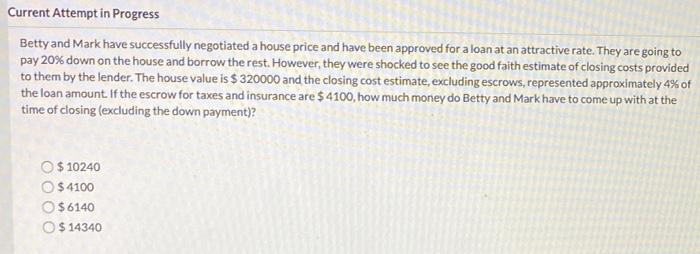

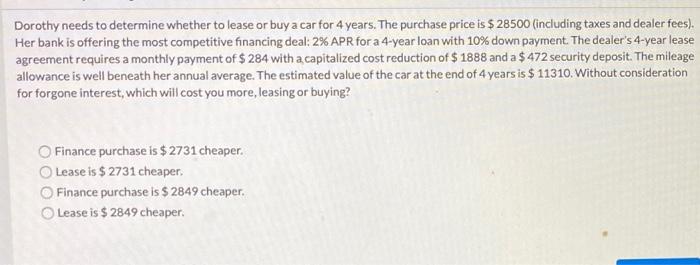

Current Attempt in Progress Betty and Mark have successfully negotiated a house price and have been approved for a loan at an attractive rate. They are going to pay 20% down on the house and borrow the rest. However, they were shocked to see the good faith estimate of closing costs provided to them by the lender. The house value is $320000 and the closing cost estimate, excluding escrows, represented approximately 4% of the loan amount. If the escrow for taxes and insurance are $4100, how much money do Betty and Mark have to come up with at the time of closing (excluding the down payment)? $ 10240 $ 4100 $6140 $14340 Dorothy needs to determine whether to lease or buy a car for 4 years. The purchase price is $28500 (including taxes and dealer fees). Her bank is offering the most competitive financing deal: 2% APR for a 4-year loan with 10% down payment. The dealer's 4-year lease agreement requires a monthly payment of $ 284 with a capitalized cost reduction of $ 1888 and a $ 472 security deposit. The mileage allowance is well beneath her annual average. The estimated value of the car at the end of 4 years is $ 11310. Without consideration for forgone interest, which will cost you more, leasing or buying? Finance purchase is $ 2731 cheaper. Lease is $ 2731 cheaper. Finance purchase is $ 2849 cheaper. Lease is $ 2849 cheaper

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts