Question: ANSWER BOTH QUESTIONS FAST PLEASE. ROUND YOUR ANSWER TO TWO DECIMAL PLACES. Question 18 5 pts Arco Industries has a bond outstanding with 15 years

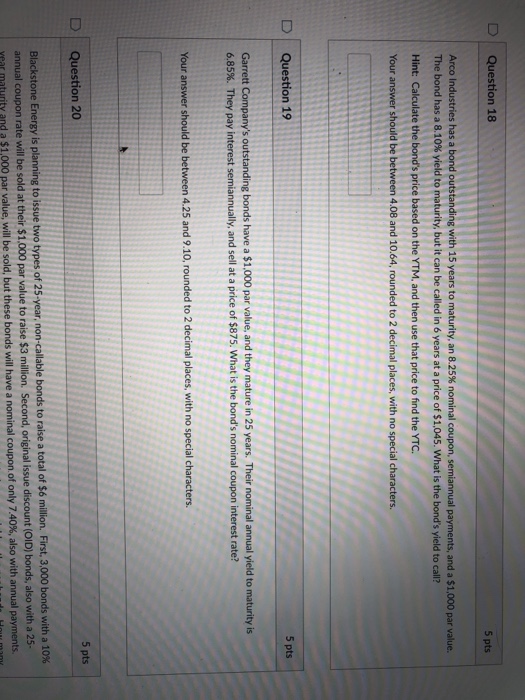

Question 18 5 pts Arco Industries has a bond outstanding with 15 years to maturity, an 8.25% nominal coupon, semiannual payments and a $1,000 par value. The bond has a 8.10% yield to maturity, but it can be called in 6 years at a price of $1,045, what is the bond's yield to call? Hint: Calculate the bond's price based on the YTM, and then use that price to find the YTC. our D Question 19 5 pts Garrett Company's outstanding bonds have a $1,000 par value, and they mature in 25 years. Their nominal annual yield to maturity is 6.85%. They pay interest semiannually, and sell at a price of $875, what is the bond's nominal coupon interest rate? Your answer should be between 4.25 an 5 pts D Question 20 bonds with a 10% Blackstone Energy annual coupon rate will be sold at their $1,000 par value to raise $3 million. Second, original issue ear maturity and a $1,000 par value, will be sold, but these bonds will have a nominal coupon of only 7.40%, also with annual payments. is planning to issue two types of 25-year, non-callable bonds to raise a total of $6 million. First, 3. discount (OID) bonds, also with a 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts