Question: Answer by showing all necessary computations in good accounting format. Round-off the figures to the nearest peso and the percentages to the nearest two decimal

Answer by showing all necessary computations in good accounting format.

Round-off the figures to the nearest peso and the percentages to the nearest two decimal places.

Use tax rate prior to CREATE law. Country: Philippines

Required:

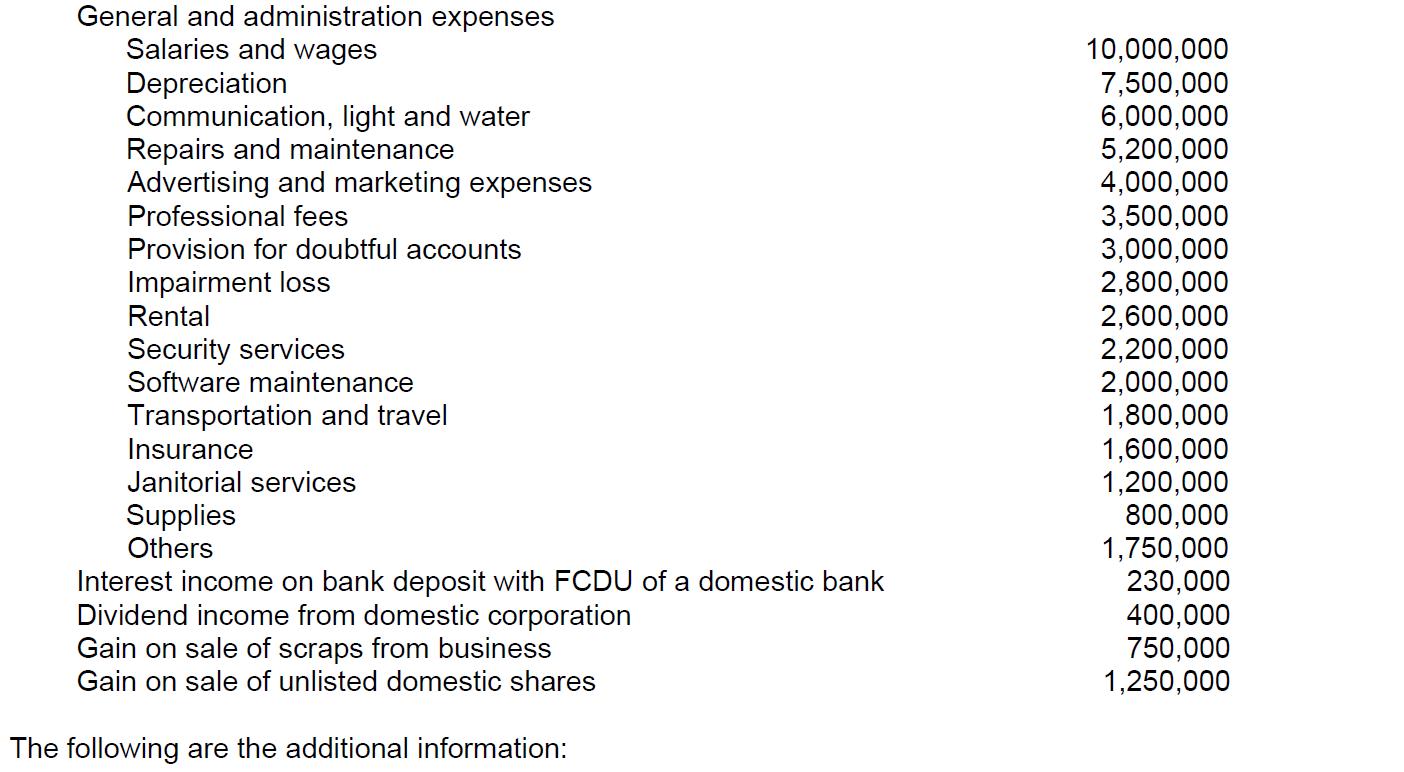

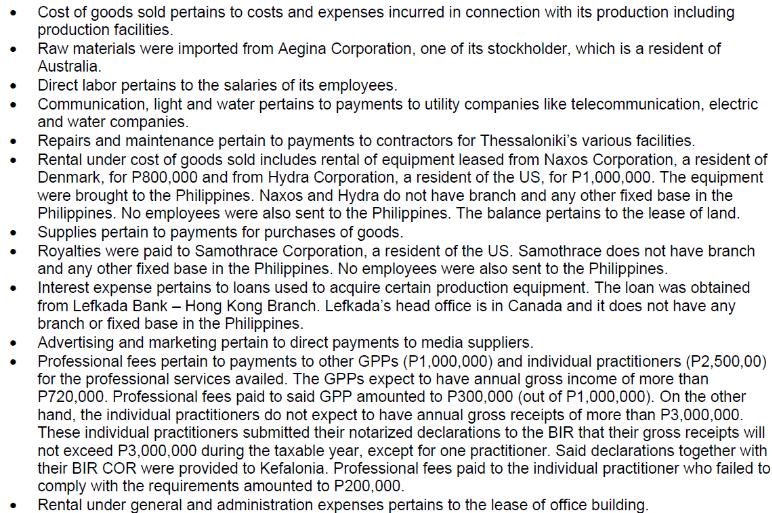

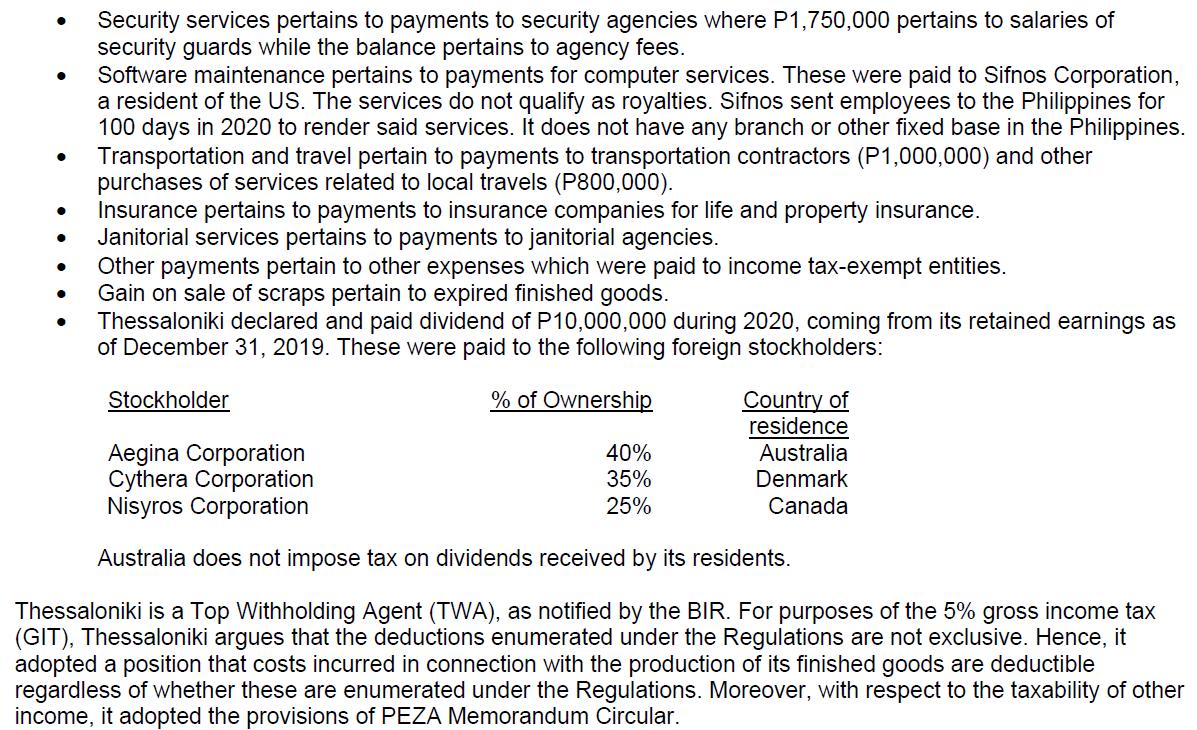

1. Determine the gross income subject to 5% GIT, 5% GIT and other income tax liability of Thessaloniki for the year ended December 31, 2020. Indicate the amount payable to the BIR and LGU.

2. Determine the total FWT on income payments of Thessaloniki to other parties for the year ended December 31, 2020. List down all the payments to non-residents including those that are not subject to FWT.

3. Determine the EWT liability of Thessaloniki for the year ended December 31, 2020. Enumerate the income payments in the same sequence as presented in the problem and the corresponding EWT. Separate the items comprising the cost of goods and sold, and general and administration expenses.

4. Assuming Thessaloniki is a BOI-registered entity enjoying income tax holiday (ITH), determine its taxable income covered by its registered activity for the year ended December 31, 2020.

5. Assuming Thessaloniki is a BOI-registered entity but no longer entitled to the ITH, determine its income tax liability, if any, for the year ended December 31, 2020.

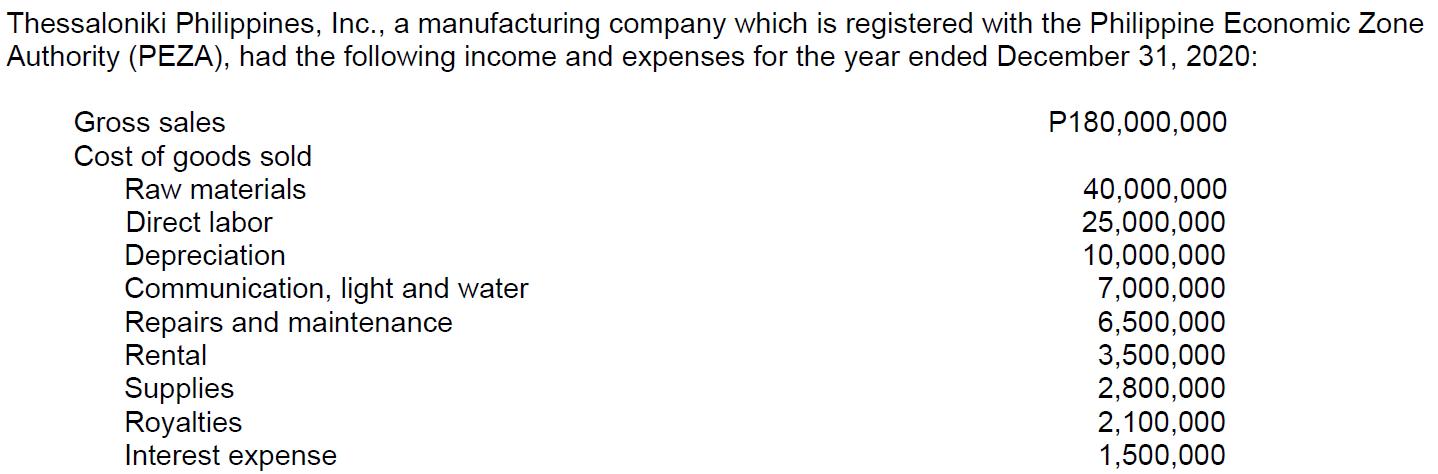

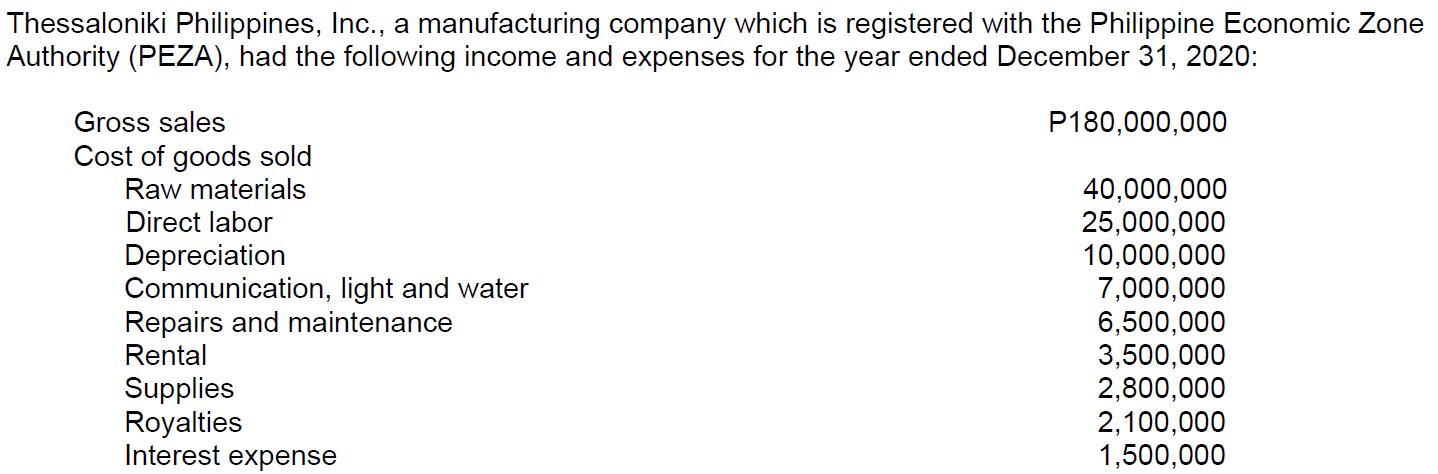

Thessaloniki Philippines, Inc., a manufacturing company which is registered with the Philippine Economic Zone Authority (PEZA), had the following income and expenses for the year ended December 31, 2020: P180,000,000 Gross sales Cost of goods sold Raw materials Direct labor Depreciation Communication, light and water Repairs and maintenance Rental Supplies Royalties Interest expense 40,000,000 25,000,000 10,000,000 7,000,000 6,500,000 3,500,000 2,800,000 2,100,000 1,500,000

Step by Step Solution

There are 3 Steps involved in it

Requirement 1 gross income 82350000 GIT 4117500 BIR 2470500 LGU 1647000 CGT 187500 FWT 34500 Requirement 2 Total FWT 1820000 Requirement 3 Total EWT 1... View full answer

Get step-by-step solutions from verified subject matter experts