Question: Answer correctly! Fast! 6. This question will use our knowledge of put options, call options and the value of zero-coupon bonds to evaluate the payoffs

Answer correctly! Fast!

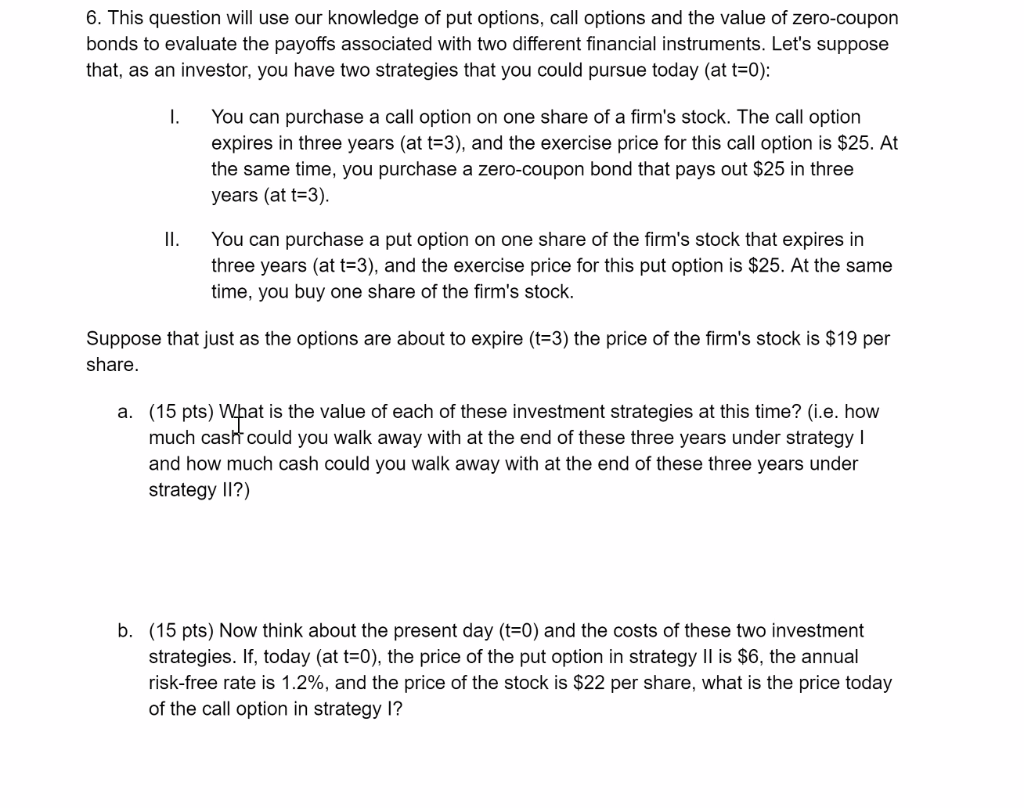

6. This question will use our knowledge of put options, call options and the value of zero-coupon bonds to evaluate the payoffs associated with two different financial instruments. Let's suppose that, as an investor, you have two strategies that you could pursue today (at t=0): You can purchase a call option on one share of a firm's stock. The call option expires in three years (at t=3), and the exercise price for this call option is $25. At the same time, you purchase a zero-coupon bond that pays out $25 in three years (at t=3). II. You can purchase a put option on one share of the firm's stock that expires in three years (at t=3), and the exercise price for this put option is $25. At the same time, you buy one share of the firm's stock. Suppose that just as the options are about to expire (t=3) the price of the firm's stock is $19 per share. a. (15 pts) What is the value of each of these investment strategies at this time? (i.e. how much cash could you walk away with at the end of these three years under strategy and how much cash could you walk away with at the end of these three years under strategy 11?) b. (15 pts) Now think about the present day (t=0) and the costs of these two investment strategies. If, today (at t=0), the price of the put option in strategy II is $6, the annual risk-free rate is 1.2%, and the price of the stock is $22 per share, what is the price today of the call option in strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts