Question: answer d pls i meant to put answer b and c (asap) ignor d. just b and c pls d) Which project would you choose?

answer d pls

i meant to put answer b and c (asap)

ignor d. just b and c pls

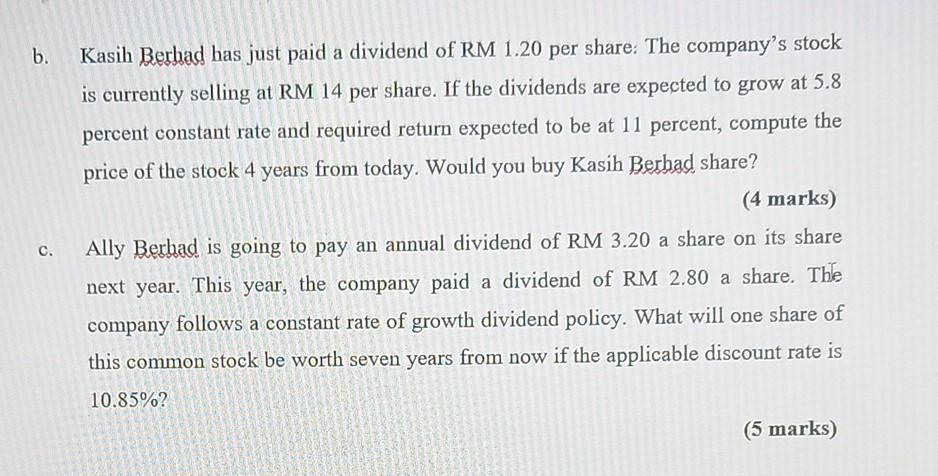

d) Which project would you choose? Why? (2 marks) (Total: 20 marks) 3 Last week, Pharmaniaga announced it has secured an additional order from the government for another six million doses. i. In your opinion, Pharmaniaga's common stock has categorised under which type of stock? (2 marks) ii. Covid-19 adversely affected the economy of many industries. However, there are industries that are able to survive and some even perform better. Explain TWO (2) advantages of investing in Pharmaniaga's common stock especially during this pandemic. (4 marks) d) Which project would you choose? Why? (2 marks) (Total: 20 marks) 3 Last week, Pharmaniaga announced it has secured an additional order from the government for another six million doses. i. In your opinion, Pharmaniaga's common stock has categorised under which type of stock? (2 marks) ii. Covid-19 adversely affected the economy of many industries. However, there are industries that are able to survive and some even perform better. Explain TWO (2) advantages of investing in Pharmaniaga's common stock especially during this pandemic. (4 marks) b. Kasih Berhad has just paid a dividend of RM 1.20 per share: The company's stock is currently selling at RM 14 per share. If the dividends are expected to grow at 5.8 percent constant rate and required return expected to be at 11 percent, compute the price of the stock 4 years from today. Would you buy Kasih Berhad share? (4 marks) C. Ally Berhad is going to pay an annual dividend of RM 3.20 a share on its share next year. This year, the company paid a dividend of RM 2.80 a share. The company follows a constant rate of growth dividend policy. What will one share of this common stock be worth seven years from now if the applicable discount rate is 10.85%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts