Question: answer each component PLEASE. if you are not, please leave it for another expert to answer PLEASE. thank you. Holt Enterprises recently paid a dividend,

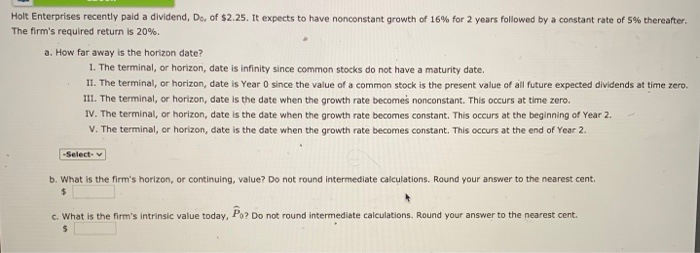

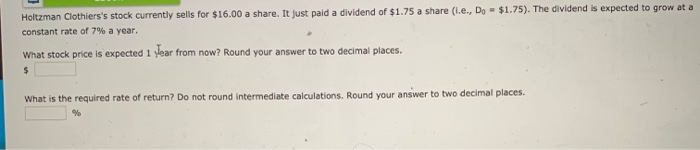

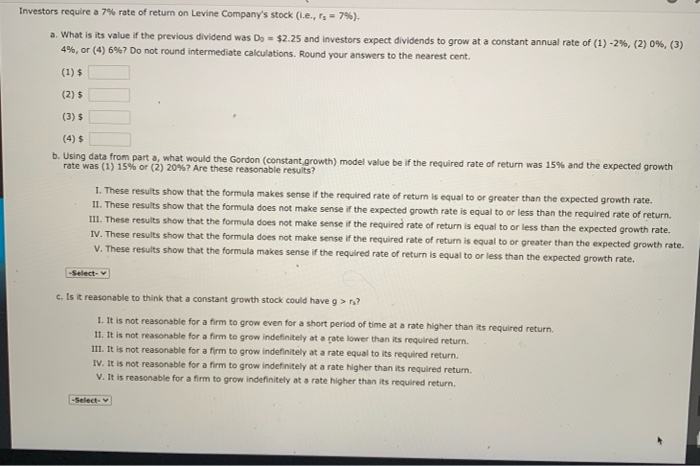

Holt Enterprises recently paid a dividend, Do, of $2.25. It expects to have nonconstant growth of 16% for 2 years followed by a constant rate of 5% thereafter, The firm's required return is 20%. a. How far away is the horizon date? 1. The terminal, or horizon, date is infinity since common stocks do not have a maturity date. II. The terminal, or horizon, date is Year O since the value of a common stock is the present value of all future expected dividends at time zero. III. The terminal, or horizon, date is the date when the growth rate becomes nonconstant. This occurs at time zero. IV. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the beginning of Year 2. V. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the end of Year 2. -Select b. What is the firm's horizon, or continuing, value? Do not round intermediate calculations. Round your answer to the nearest cent. c. What is the firm's intrinsic value today, Po? Do not round intermediate calculations. Round your answer to the nearest cent. S Holtzman Clothiers's stock currently sells for $16.00 a share. It just paid a dividend of $1.75 a share (I.e., Do = $1.75). The dividend is expected to grow at a constant rate of 7% a year. What stock price is expected 1 year from now? Round your answer to two decimal places. $ What is the required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. % Investors require a 7% rate of return on Levine Company's stock (l.e., Is = 7%). a. What is its value if the previous dividend was Do = $2.25 and investors expect dividends to grow at a constant annual rate of (1) -2%, (2) 0%, (3) 4%, or (4) 6%? Do not round intermediate calculations. Round your answers to the nearest cent. (1) $ (2) 5 (3) $ (4) 5 b. Using data from part a, what would the Gordon (constant growth) model value be if the required rate of return was 15% and the expected growth rate was (1) 15% or (2) 20%? Are these reasonable results? 1. These results show that the formula makes sense if the required rate of return is equal to or greater than the expected growth rate. 11. These results show that the formula does not make sense if the expected growth rate is equal to or less than the required rate of return. III. These results show that the formula does not make sense if the required rate of return is equal to or less than the expected growth rate. IV. These results show that the formula does not make sense if the required rate of return is equal to or greater than the expected growth rate. V. These results show that the formula makes sense if the required rate of return is equal to or less than the expected growth rate. -Select- c. Is it reasonable to think that a constant growth stock could have g > ? 1. It is not reasonable for a firm to grow even for a short period of time at a rate higher than its required return 11. It is not reasonable for a firm to grow indefinitely at a rate lower than its required return. III. It is not reasonable for a firm to grow indefinitely at a rate equal to its required return. IV. It is not reasonable for a firm to grow indefinitely at a rate higher than its required return. V. It is reasonable for a firm to grow indefinitely at a rate higher than its required return. -Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts