Question: answer each component PLEASE. if you are not, please leave it for another expert to answer PLEASE. thank you. An investor purchased the following five

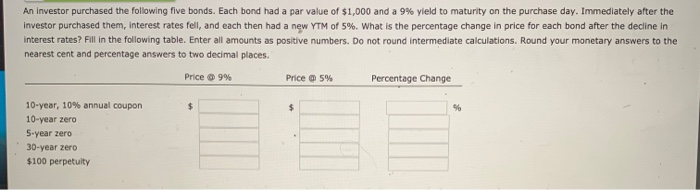

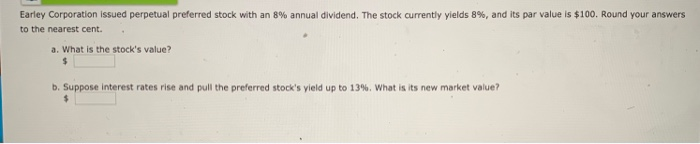

An investor purchased the following five bonds. Each bond had a par value of $1,000 and a 9% yield to maturity on the purchase day. Immediately after the investor purchased them, interest rates fell, and each then had a new YTM of 5%. What is the percentage change in price for each bond after the decline in interest rates? Fill in the following table. Enter all amounts as positive numbers. Do not round intermediate calculations. Round your monetary answers to the nearest cent and percentage answers to two decimal places. Price 9% Price 5% Percentage Change $ $ % 10-year, 10% annual coupon 10-year zero 5-year zero 30-year zero $100 perpetuity Earley Corporation issued perpetual preferred stock with an 8% annual dividend. The stock currently yields 8%, and its par value is $100. Round your answers to the nearest cent. a. What is the stock's value? b. Suppose interest rates rise and pull the preferred stock's yield up to 13%. What is its new market value? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts