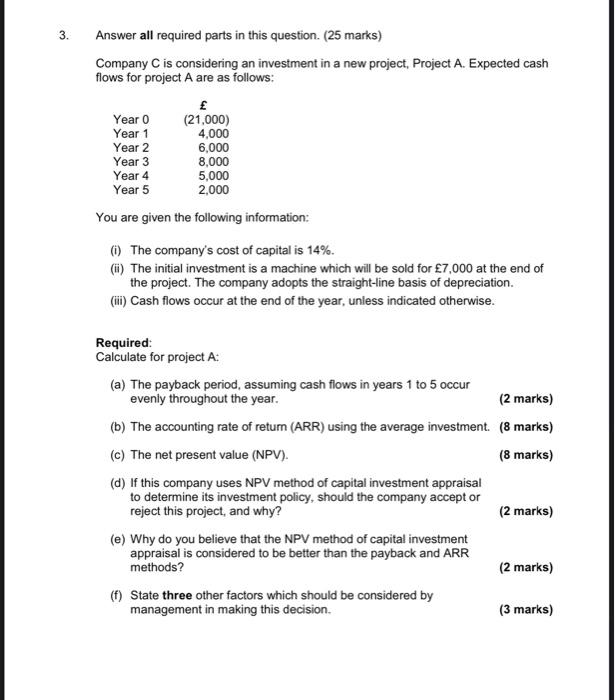

Question: answer & explain please Answer all required parts in this question. (25 marks) Company C is considering an investment in a new project, Project A.

Answer all required parts in this question. (25 marks) Company C is considering an investment in a new project, Project A. Expected cash flows for project A are as follows: You are given the following information: (i) The company's cost of capital is 14%. (ii) The initial investment is a machine which will be sold for 7,000 at the end of the project. The company adopts the straight-line basis of depreciation. (iii) Cash flows occur at the end of the year, unless indicated otherwise. Required: Calculate for project A: (a) The payback period, assuming cash flows in years 1 to 5 occur evenly throughout the year. (2 marks) (b) The accounting rate of retum (ARR) using the average investment. (8 marks) (c) The net present value (NPV). ( 8 marks) (d) If this company uses NPV method of capital investment appraisal to determine its investment policy, should the company accept or reject this project, and why? (2 marks) (e) Why do you believe that the NPV method of capital investment appraisal is considered to be better than the payback and ARR methods? (2 marks) (f) State three other factors which should be considered by management in making this decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts