Question: answer fast in 5 mins please Question Not yet answered Marked out of 20.00 Flag Question An exporter in Canada is expecting to receive pounds

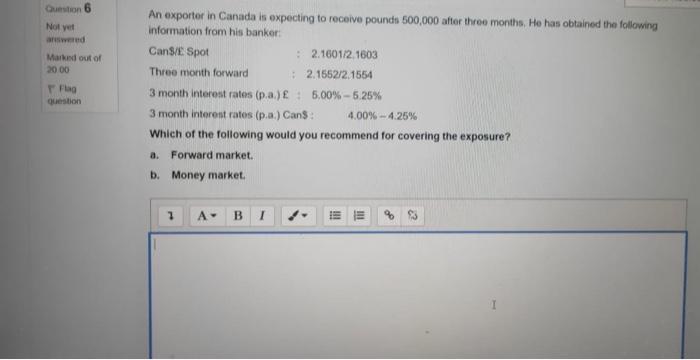

Question Not yet answered Marked out of 20.00 Flag Question An exporter in Canada is expecting to receive pounds 500,000 after three months. He has obtained the following information from his banker CanS/E Spot 2.160172.1603 Three month forward 2.1552/2.1554 3 month interest rates (p.a.) : 5.00% -5.25% 3 month interest rates (p.a.) Cans: 4.00% -4.25% Which of the following would you recommend for covering the exposure? a. Forward market. b. Money market 2 A B 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts