Question: ANSWER FAST PLEASE. ROUND YOUR ANSWER TO TWO DECIMAL PLACES. 13 bonds have a 12-year maturity, an 50% nominal coupon paid semiannually, and sell at

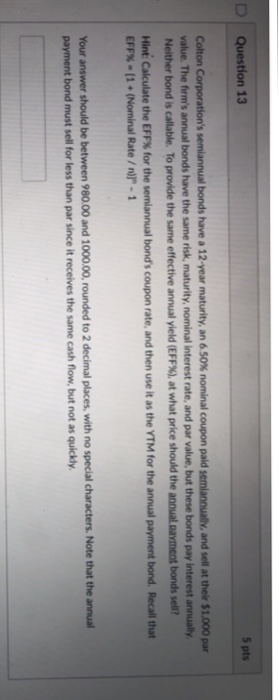

13 bonds have a 12-year maturity, an 50% nominal coupon paid semiannually, and sell at their $1,000 par value. The frm's annual bonds have the same risk, maturity, nominal interest rate, and par value, but these bonds pay interest annually Neither bond is callable. To provide the same effective annual yield (EFF%), at what price should the annual nment bonds sem? Hint: Calculate the EFF% for the semiannual bond's coupon rate, and then use it as the YTM for the annual payment bond. Recall that EFF% _ [1 + (Nominal Rate / nar-1 Your answer should be between 980.00 and 1000.00,rounded to 2 decimal places, with no special characters. Note that the annual payment bond must sell for less than par since it receives the same cash flow, but not as quickly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts