Question: answer fast please, will upvote. Question 8 (3 points) Jack made monthly contributions of $200 to his son's RESP for a total of 12 years.

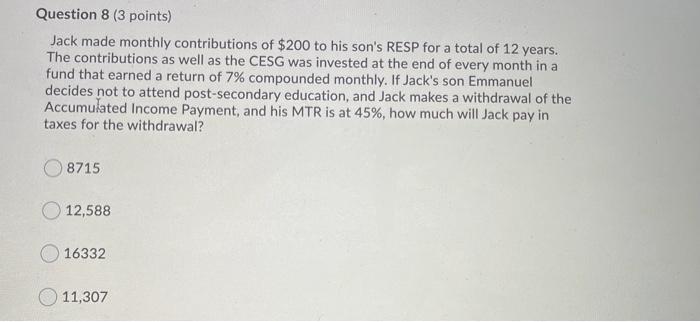

Question 8 (3 points) Jack made monthly contributions of $200 to his son's RESP for a total of 12 years. The contributions as well as the CESG was invested at the end of every month in a fund that earned a return of 7% compounded monthly. If Jack's son Emmanuel decides not to attend post-secondary education, and Jack makes a withdrawal of the Accumulated Income Payment, and his MTR is at 45%, how much will Jack pay in taxes for the withdrawal? 8715 12,588 16332 11,307

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts