Question: please answer fast, will upvote Question 14 (2 points) Farah has been making contributions to an RESP on behalf of her son, Jake, for the

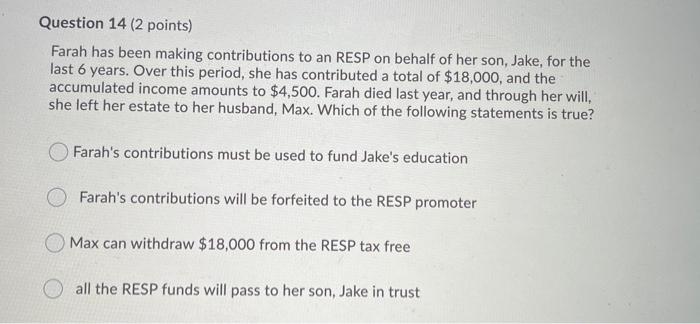

Question 14 (2 points) Farah has been making contributions to an RESP on behalf of her son, Jake, for the last 6 years. Over this period, she has contributed a total of $18,000, and the accumulated income amounts to $4,500. Farah died last year, and through her will, she left her estate to her husband, Max. Which of the following statements is true? Farah's contributions must be used to fund Jake's education Farah's contributions will be forfeited to the RESP promoter Max can withdraw $18,000 from the RESP tax free all the RESP funds will pass to her son, Jake in trust

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts