Question: Answer: FIFO LIFO weighted Average Ending Inventory Answer: FIFO LIFO Difference Ending Inventory The Shirt Shop had the following transactions for T-shirts for Year 1,

Answer:

| FIFO | LIFO | weighted Average | |

| Ending Inventory |

Answer:

| FIFO | LIFO | Difference | |

| Ending Inventory |

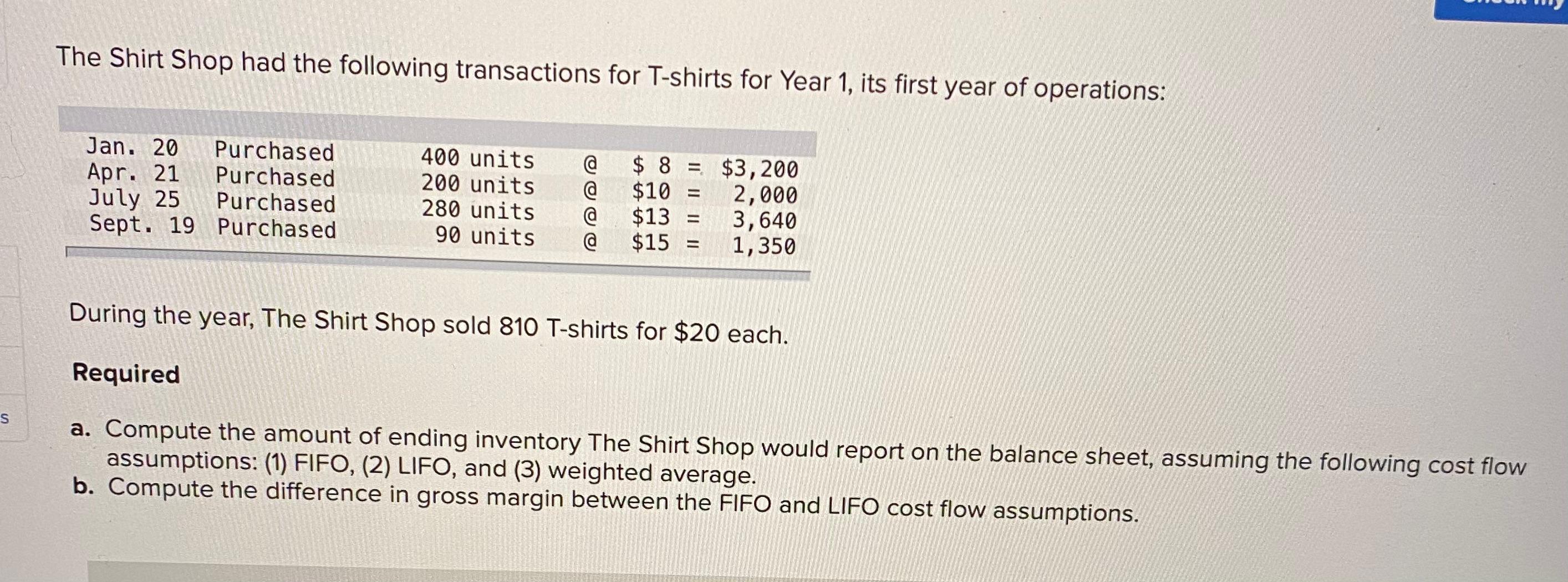

The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations: Jan. 20 Purchased Apr. 21 Purchased July 25 Purchased Sept. 19 Purchased 400 units 200 units 280 units 90 units @ @ @ a $ 8 = $3,200 $10 = 2,000 $13 3,640 $15 1,350 During the year, The Shirt Shop sold 810 T-shirts for $20 each. Required s a. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. b. Compute the difference in gross margin between the FIFO and LIFO cost flow assumptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts