Question: answer for b and c day (30 June) latest by 6.00 pm. The management for a nuclear research laboratory is contemplating leasing a diagnostic scanner

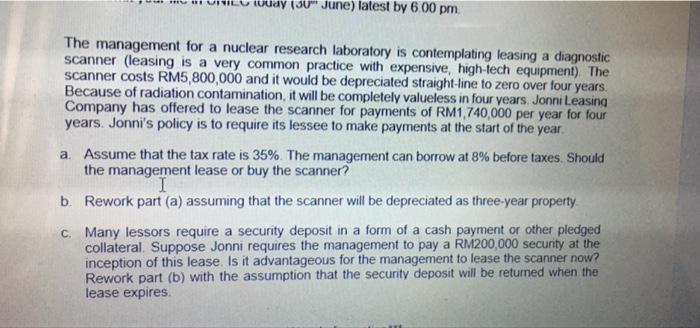

day (30 June) latest by 6.00 pm. The management for a nuclear research laboratory is contemplating leasing a diagnostic scanner (leasing is a very common practice with expensive, high-tech equipment). The scanner costs RM5,800,000 and it would be depreciated straight-line to zero over four years. Because of radiation contamination, it will be completely valueless in four years. Jonni Leasing Company has offered to lease the scanner for payments of RM1,740,000 per year for four years. Jonni's policy is to require its lessee to make payments at the start of the year. a. Assume that the tax rate is 35%. The management can borrow at 8% before taxes. Should the management lease or buy the scanner? I b. Rework part (a) assuming that the scanner will be depreciated as three-year property. c. Many lessors require a security deposit in a form of a cash payment or other pledged collateral. Suppose Jonni requires the management to pay a RM200,000 security at the inception of this lease. Is it advantageous for the management to lease the scanner now? Rework part (b) with the assumption that the security deposit will be returned when the lease expires

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts