Question: answer for question a , b and c pls A derivative is a financial security with a value that is reliant upon, or derived from,

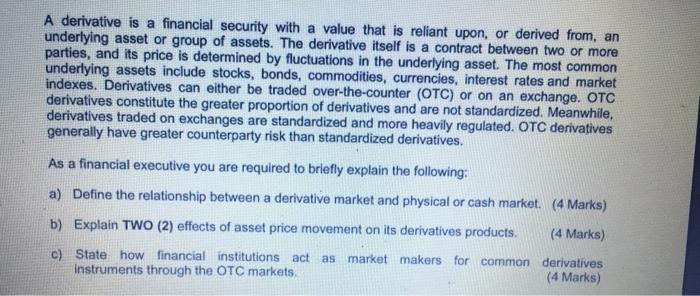

A derivative is a financial security with a value that is reliant upon, or derived from, an underlying asset or group of assets. The derivative itself is a contract between two or more parties, and its price is determined by fluctuations in the underlying asset. The most common underlying assets include stocks, bonds, commodities, currencies, interest rates and market indexes. Derivatives can either be traded over-the-counter (OTC) or on an exchange. OTC derivatives constitute the greater proportion of derivatives and are not standardized. Meanwhile, derivatives traded on exchanges are standardized and more heavily regulated. OTC derivatives generally have greater counterparty risk than standardized derivatives. As a financial executive you are required to briefly explain the following: a) Define the relationship between a derivative market and physical or cash market. (4 Marks) b) Explain TWO (2) effects of asset price movement on its derivatives products. (4 Marks) c) State how financial institutions act as market makers for common derivatives instruments through the OTC markets. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts