Question: Answer for the question is given below: PLEASE ANSWER 4,5, and 6 (Thanks in advance) 1:-) breakeven unit=total fixed cost/contribution per unit Fixed cost=80000 contribution

Answer for the question is given below: PLEASE ANSWER 4,5, and 6 (Thanks in advance)

1:-)

breakeven unit=total fixed cost/contribution per unit

Fixed cost=80000

contribution per unit=selling price-DM-DL-var OH

contribution per unit=44-16-10-5=13

breakeven unit=80000/13= 6153.8units

breakeven sales=6153.8*44=270767.2

2:-)

margin of safety in units=budgeted sales unit - breakeven sales units

margin of safety in units=6800-6153=647 units

margin of safety in sales= budgeted sales-breakeven sales

margin of safety in sales=(6800*44)-270767=299200-270767=28433

margin of safety in percentage=((budgeted sales-breakeven sales)/budgeted sales)*100

margin of safety in percentage=((299200-270767)/299200)*100=10%

3:)

operating leverage

sales (44*6800)

DM (16*6800)

DL (10*6800)

var OH (5*6800)

contribution

fixed cost

operating leverage

contribution=299200-108800-68000-34000=88400

opearing leverage=88400-80000=8400

PLEASE ANSWER 4,5, and 6 (Thanks in advance)

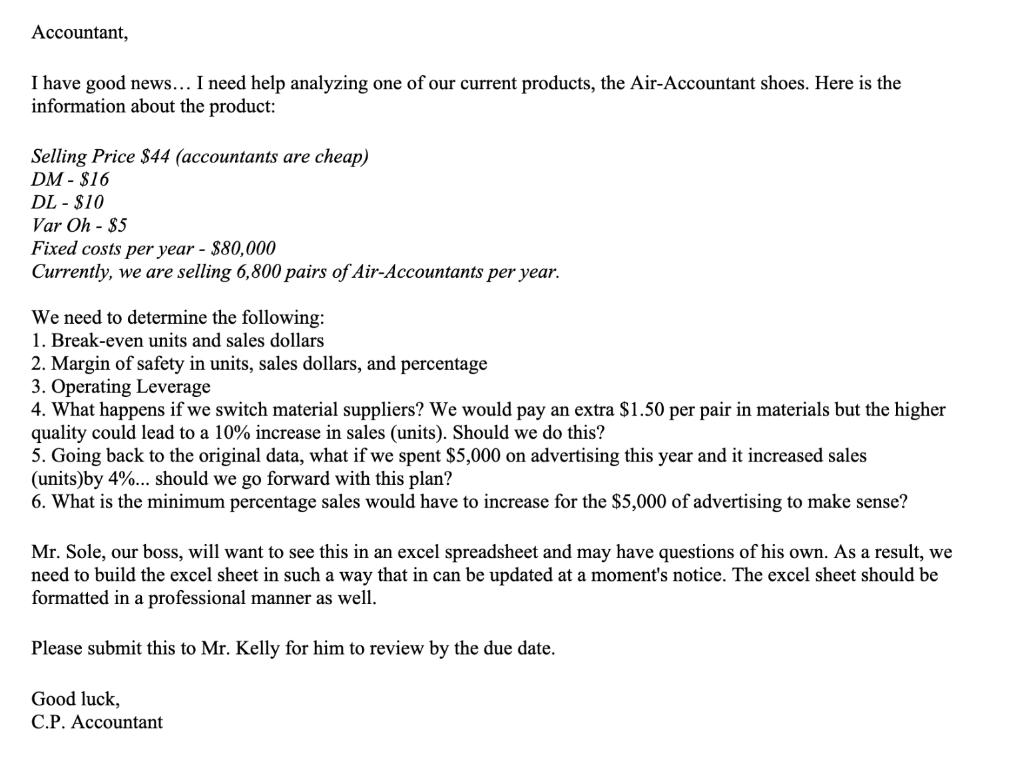

Accountant, I have good news... I need help analyzing one of our current products, the Air-Accountant shoes. Here is the information about the product: Selling Price $44 (accountants are cheap) DM$16 DL$10 Var Oh- $5 Fixed costs per year $80,000 Currently, we are selling 6,800 pairs of Air-Accountants per year. We need to determine the following: 1. Break-even units and sales dollars 2. Margin of safety in units, sales dollars, and percentage 3. Operating Leverage 4. What happens if we switch material suppliers? We would pay an extra $1.50 per pair in materials but the higher quality could lead to a 10% increase in sales (units). Should we do this? 5. Going back to the original data, what if we spent $5,000 on advertising this year and it increased sales (units)by 4%... should we go forward with this plan? 6. What is the minimum percentage sales would have to increase for the $5,000 of advertising to make sense? Mr. Sole, our boss, will want to see this in an excel spreadsheet and may have questions of his own. As a result, we need to build the excel sheet in such a way that in can be updated at a moment's notice. The excel sheet should be formatted in a professional manner as well. Please submit this to Mr. Kelly for him to review by the due date. Good luck, C.P. Accountant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts