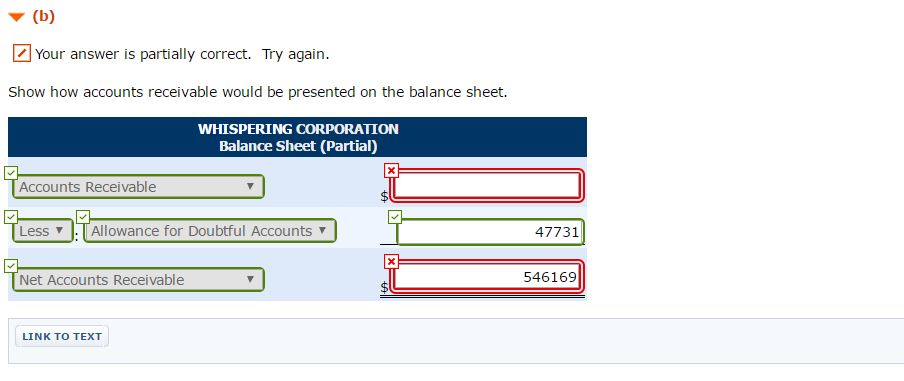

Question: Answer for the wrong entries and 3. What is the dollar effect of the year-end bad debt adjustment on the before-tax income? Thank you Problem

Answer for the wrong entries and

3. What is the dollar effect of the year-end bad debt adjustment on the before-tax income?

Thank you

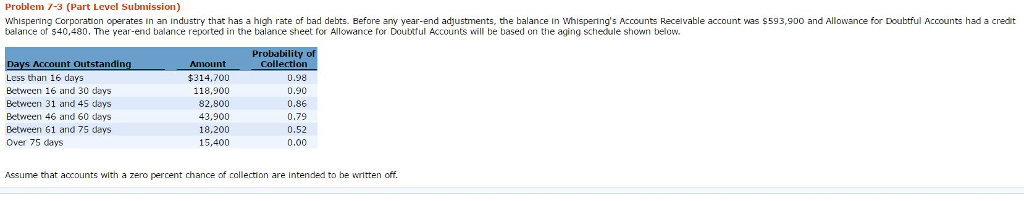

Problem 1-3 (Part Level Submission) Whispering Corporation operates In an Industry that has a high rate of bad debts. Before any year-end adjustments, the balance In Whisperlng's Accounts Receivable account was S593,900 and Allowance for Doubtful Accounts had a credit balance of 540,480. The year-end balance reported in the balance sheet ror Allowance for Doubtful Accounts will be based on the aging schedule shown below. Probability of Less than 16 days $314,700 0.98 Between 16 and 30 days 118,900 0.90 82,800 Between 31 and 4S days 0.86 Between 46 and 60 days 43,900 0,79 Between 61 and 75 days 8,200 0,52 over 75 days 19,400 0,00 Assume that accounts with a zero percent chance of collection are intended to be written off

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts